From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surge Anticipated Despite Renewable Energy Growth and LNG Oversupply Concerns

Asia’s steel market outlook remains very positive, despite shifts in the energy landscape. The increasing adoption of renewable energy, detailed in “Renewables overtook coal for powergen in 1H: Ember” and “Global renewable power capacity to double by 2030: IEA,” signals a long-term shift in demand drivers. While the expansion of LNG projects, as highlighted in “Opinion: Foot on the gas,” raises potential concerns about oversupply, no direct relationship with current steel plant activity levels can be established based on the data provided. The “IEA-Bericht: Energiewende macht weltweit Fortschritte – reicht das für die Klimaziele?” shows the significant role of China in the renewable energy transition with potential impact on the energy mix of steel production. Biofuels and LNG for marine fuels may shift the landscape, as indicated by “Varied biofuels, LNG key for net-zero: Marine Fuels 360,”. The global energy transition’s progress is underscored by “Energy transition ‘rolling on’ despite headwinds: DNV“.

Measured Activity Overview

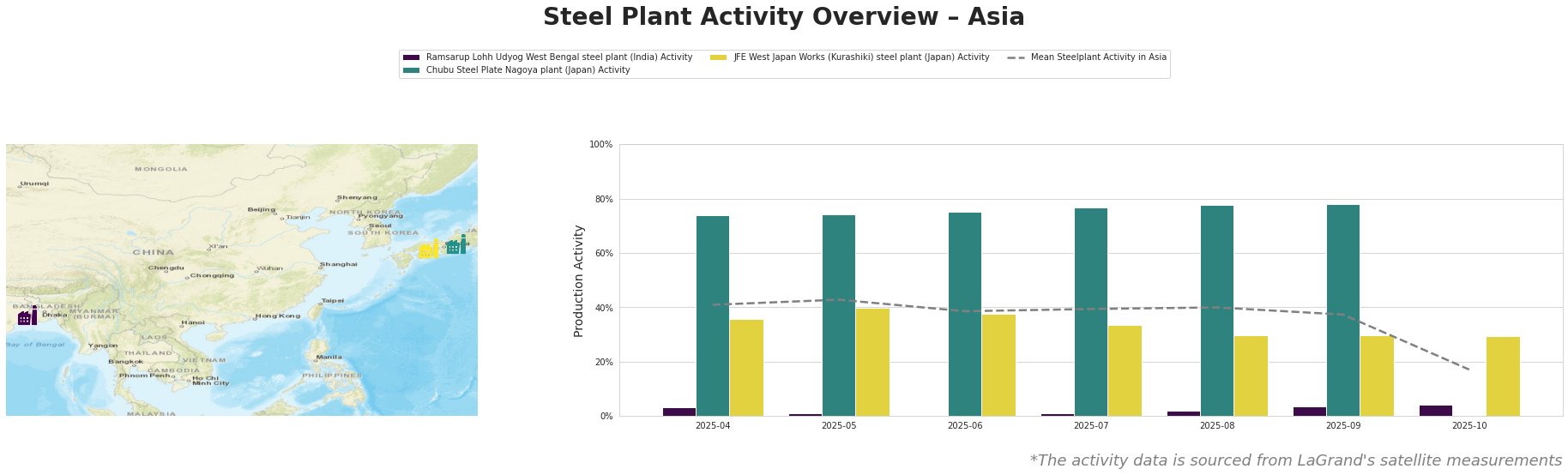

Overall, average steel plant activity in Asia experienced a significant drop in October 2025, falling to 17.0% from a range of 37.0% to 43.0% in the preceding months.

Ramsarup Lohh Udyog West Bengal steel plant showed consistently low activity levels, ranging from 0.0% to 3.0% between April and September 2025, with a slight increase to 4.0% in October. This plant, utilizing both BF and DRI processes with a 182 ttpa DRI capacity, focuses on finished rolled and semi-finished products like billets and wires for the energy sector. The low activity may suggest operational issues or shifts in regional demand, but no direct connection to the provided news articles can be established.

Chubu Steel Plate Nagoya plant maintained a high and stable activity level between April and September 2025, ranging from 74.0% to 78.0%. This EAF-based plant with a 700 ttpa capacity produces plates for the automotive, building, and transport sectors. The lack of activity data for October prevents any assessment of recent changes, and no direct connection to the provided news articles can be established.

JFE West Japan Works (Kurashiki) steel plant exhibited a gradual decrease in activity from 36.0% in April 2025 to 30.0% in September 2025, followed by a further slight decrease to 29.0% in October 2025. This integrated BF-BOF plant, with a substantial 10,000 ttpa crude steel capacity, produces a wide range of products, including sheets, plates, and pipes, for diverse sectors. The observed decrease might reflect broader market adjustments or plant-specific maintenance, but no direct link to the named news articles is evident.

Evaluated Market Implications

The significant drop in the mean steel plant activity across Asia in October 2025, combined with the decreasing activity at JFE West Japan Works (Kurashiki), indicates a potential near-term supply disruption. However, without clear insight into the causes, procurement decisions become challenging.

Recommended Procurement Actions:

-

Steel Buyers: Given the drop in overall activity, especially at JFE West Japan Works (Kurashiki), buyers should immediately contact their suppliers to verify lead times and potential delivery delays. Diversification of supply sources should be considered, particularly for products sourced from the JFE plant, to mitigate risks associated with potential disruptions.

-

Market Analysts: Further investigation is warranted to understand the reasons behind the activity decrease in October 2025. Focus should be given to identifying whether supply chain disruptions, domestic policy changes, or seasonal demand variations are responsible. Further, investigate the reason behind the October data gap from Chubu Steel Plate Nagoya plant. This data will support more accurate forecasts and risk assessments.