From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineGreen Steel Surge: Solar Furnaces & Hydrogen Fueling Optimistic European Outlook

Europe’s steel market exhibits a very positive sentiment driven by technological advancements in green steel production. The implementation of innovative, decarbonized steel production methods, exemplified by news articles like “Panatere inaugurates world’s first solar furnaces to produce recycled steel in Switzerland” and “ArcelorMittal Olaberria launches a pilot project to use green hydrogen,” signal a shift toward sustainable practices. These articles are linked to observed activity data through their potential to influence production levels, but currently no direct impact can be explicitly established.

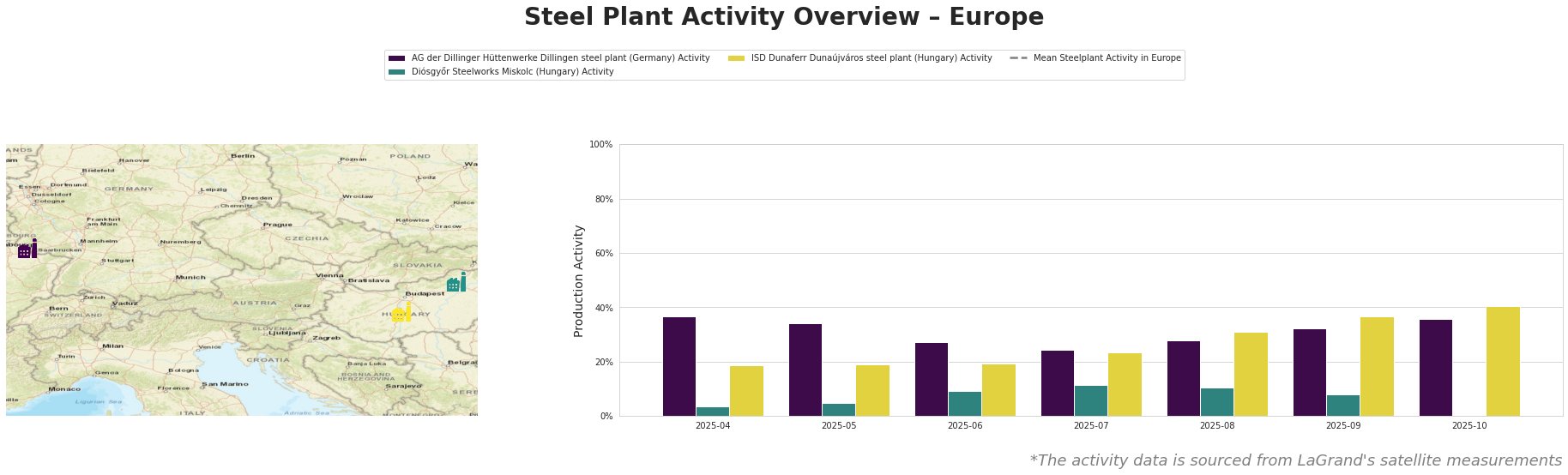

Across Europe, the average steel plant activity saw fluctuations throughout the period, peaking in May and July before declining significantly in October. AG der Dillinger Hüttenwerke’s activity decreased from April to July before recovering, while ISD Dunaferr showed a steady increase over the observed months, reaching a high of 40% in October. Diósgyőr Steelworks showed consistently low activity, peaking at 12% in July.

AG der Dillinger Hüttenwerke Dillingen steel plant, an integrated BF-BOF plant in Germany producing primarily semi-finished and finished rolled products, experienced activity fluctuations. The activity dipped from 37% in April to 24% in July, recovering to 36% in October. No direct connection to the provided news articles can be established for these fluctuations.

Diósgyőr Steelworks Miskolc, a Hungarian EAF-based plant producing semi-finished and finished rolled products, shows very low activity levels. The plant’s activity gradually increased from 3% in April to 12% in July, followed by a decline to 8% in September. Satellite data for October is unavailable. ResponsibleSteelCertification is a notable characteristic. This increase can not be linked to any of the provided news articles.

ISD Dunaferr Dunaújváros steel plant, another Hungarian integrated BF-BOF plant, showed a steady increase in activity from 19% in April to 40% in October. Similar to AG der Dillinger Hüttenwerke, no direct connection to the provided news articles can be established.

The news articles highlight technological advancements in decarbonizing steel production. The project at ArcelorMittal Olaberria with green hydrogen could, if scaled, reduce reliance on traditional carbon-intensive methods. Similarly, Panatere’s solar furnaces may alleviate some dependence on imported steel.

Evaluated Market Implications:

Given the increasing activity at ISD Dunaferr and the implementation of green technologies highlighted in the news, potential supply disruptions are not explicitly indicated by the data. Procurement Action: Steel buyers should closely monitor the progress and scalability of green steel initiatives like Panatere’s solar furnaces and ArcelorMittal’s hydrogen project. While these projects currently have limited production capacity (e.g., Panatere’s 1,000 tons/year by 2028), successful scaling could diversify supply options and potentially reduce long-term reliance on traditional steel production methods, thus buffering against potential future supply chain vulnerabilities related to carbon regulations or resource scarcity. Buyers should engage with suppliers exploring these technologies to understand their timelines and potential impact on future pricing and availability.