From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndonesian Steel Market Faces Headwinds: EU Tariffs, WTO Disputes, and Fluctuating Plant Activity Signal Caution

Indonesia’s steel sector faces continued challenges driven by international trade disputes and fluctuating domestic production. Recent news highlights ongoing tensions with the EU regarding tariffs, as evidenced by “Indonesia has called on the EU to lift tariffs on its stainless steel products” and “WTO recommends EU bring measures on Indonesian stainless CR flats into conformity.” These disputes, while potentially leading to future tariff adjustments, currently contribute to market uncertainty, although no immediate impact on the observed plant activity can be explicitly established.

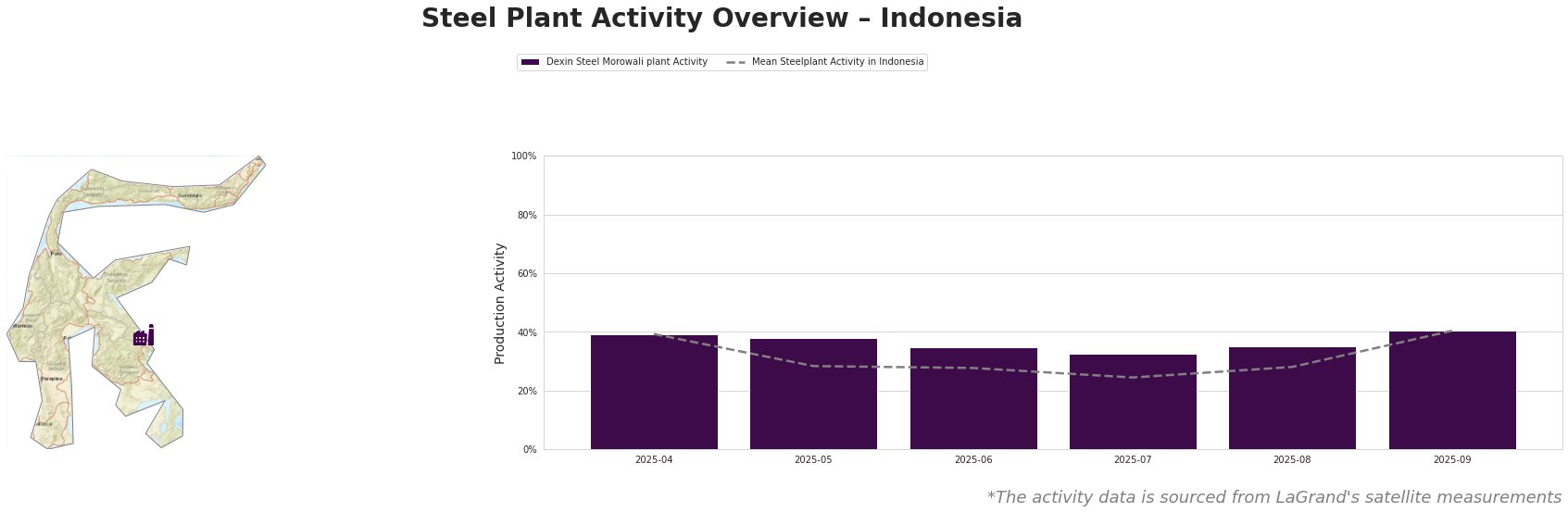

Observed plant activity, represented as a percentage of all-time highs, reveals a mixed trend. The following table details the recent activity:

The average steel plant activity across Indonesia saw a decline from April (39%) to July (24%), followed by a recovery to 40% in September.

Dexin Steel Morowali plant

The Dexin Steel Morowali plant, a 3.5 million tonne per annum (tpa) BOF-based integrated steel plant located in Central Sulawesi, primarily produces finished rolled and semi-finished products like wire rod, slab, bar, and billet, targeting the building and infrastructure as well as automotive sectors. Dexin Steel Morowali activity closely mirrored the mean activity level in Indonesia. The plant experienced a decrease from 39% in April to 33% in July, before climbing back to 40% in September. This pattern, however, shows no direct correlation with the trade dispute news and may be driven by other domestic factors. Given the plant’s BOF-based production and reliance on imported iron ore and met coal, potential domestic supply chain issues or fluctuations in raw material prices could be contributing factors, though no direct connection to the provided news articles can be established.

Evaluated Market Implications

The ongoing trade disputes between Indonesia and the EU, as highlighted in “Indonesia has called on the EU to lift tariffs on its stainless steel products,” create uncertainty for Indonesian stainless steel exports. The EU’s initiation of an expiry review on hot-rolled stainless steel sheet imports from Indonesia, China, and Taiwan, as reported in “EU initiates expiry review on HR stainless sheet imports from three countries“, adds further complexity. Given these trade headwinds, coupled with the fluctuating, yet recently improving, production levels at key plants like Dexin Steel Morowali, the steel market in Indonesia is likely to remain volatile.

- Recommended Procurement Actions: Steel buyers should closely monitor the outcomes of the EU trade disputes, particularly the expiry review mentioned in “EU initiates expiry review on HR stainless steel sheet imports from three countries,” as these could impact the availability and pricing of stainless steel from Indonesia. Buyers should consider diversifying their supply sources to mitigate potential disruptions and negotiate flexible contracts that account for potential tariff changes.