From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Strengthens Despite Ukrainian Export Challenges: German Plants Show Increased Activity

Europe’s steel market shows signs of resilience despite headwinds in Ukraine. “Ferrexpo increased output by 0.9% y/y in January-September,” “Ukraine produced 4.8 million tons of rolled steel in January-September,” and “Ukraine reduced iron ore exports by 4.4% y/y in January-September” highlight the mixed performance of the Ukrainian steel industry. The news of increased Ferrexpo output coupled with overall increases in Ukraine’s rolled steel production might suggest increased activity; however, satellite data of Donetsksteel Metallurgical Plant activity levels do not show direct correlation, exhibiting persistently low activity over the past several months.

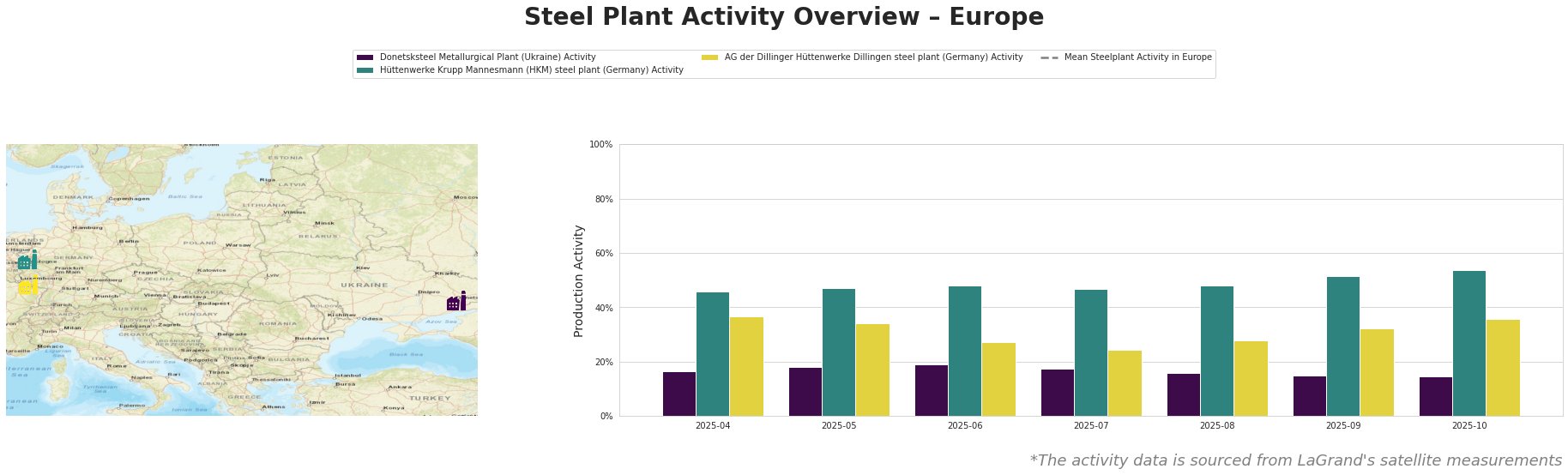

The table illustrates fluctuating average steel plant activity in Europe. The activity at Donetsksteel Metallurgical Plant in Ukraine remains consistently low, between 15% and 19% of its all-time high, which could be caused by the production challenges named in the “Ukraine produced 4.8 million tons of rolled steel in January-September” news article. In contrast, Hüttenwerke Krupp Mannesmann (HKM) in Germany has seen a steady increase, reaching 54% in October 2025. AG der Dillinger Hüttenwerke in Germany shows more volatile behavior, dropping to a low of 24% in July, but recovering to 36% in October.

Donetsksteel Metallurgical Plant, a Ukrainian integrated steel plant with a capacity of 1.5 million tons of pig iron via BF, has shown stable and persistently low activity levels between April and October 2025, ranging from 15% to 19% of its historical peak. This consistent underperformance does not appear to directly correlate with the Ukrainian news articles indicating increases in overall production, perhaps reflecting localized challenges or a shift in production focus within Ukraine.

Hüttenwerke Krupp Mannesmann (HKM), a major German integrated steel plant with a 6 million ton crude steel capacity via BOF, exhibits a consistent upward trend in activity. Starting at 46% in April 2025, activity increased to 54% by October 2025. This increase contrasts with the challenges faced by Ukrainian producers, suggesting a strengthening position for HKM within the European market. No direct connection could be established with the provided news articles.

AG der Dillinger Hüttenwerke, another significant German integrated steel plant with a 2.76 million ton crude steel capacity via BOF, displays fluctuating activity levels. From a high of 37% in April, activity dropped to 24% in July before recovering to 36% by October 2025. This volatility, without direct correlation to the provided news articles, may reflect maintenance schedules, shifts in product mix, or localized market conditions.

The consistently low activity at Donetsksteel, combined with the increase in production at the German HKM plant, suggests a potential shift in supply dynamics within the European market. Steel buyers should closely monitor the activity of HKM and consider securing contracts to mitigate potential supply disruptions from Ukraine. Given the volatility observed at AG der Dillinger Hüttenwerke, diversification of suppliers within Germany is also advisable to ensure stable procurement. Buyers should closely watch for further announcements about export restrictions or infrastructure problems in Ukraine, potentially impacting the steelmaking process.