From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel: Imports Fall Amid Rising Domestic Output, Plant Activity Varies

In Asia, specifically India, steel imports have decreased even as domestic production rises. According to the news article “India’s steel imports down 36% in September, remains net importer,” steel imports fell by 36.3% in September. Satellite observations show diverging activity trends across Indian steel plants, although no direct link between these trends and the import/export balance is established through the provided news articles.

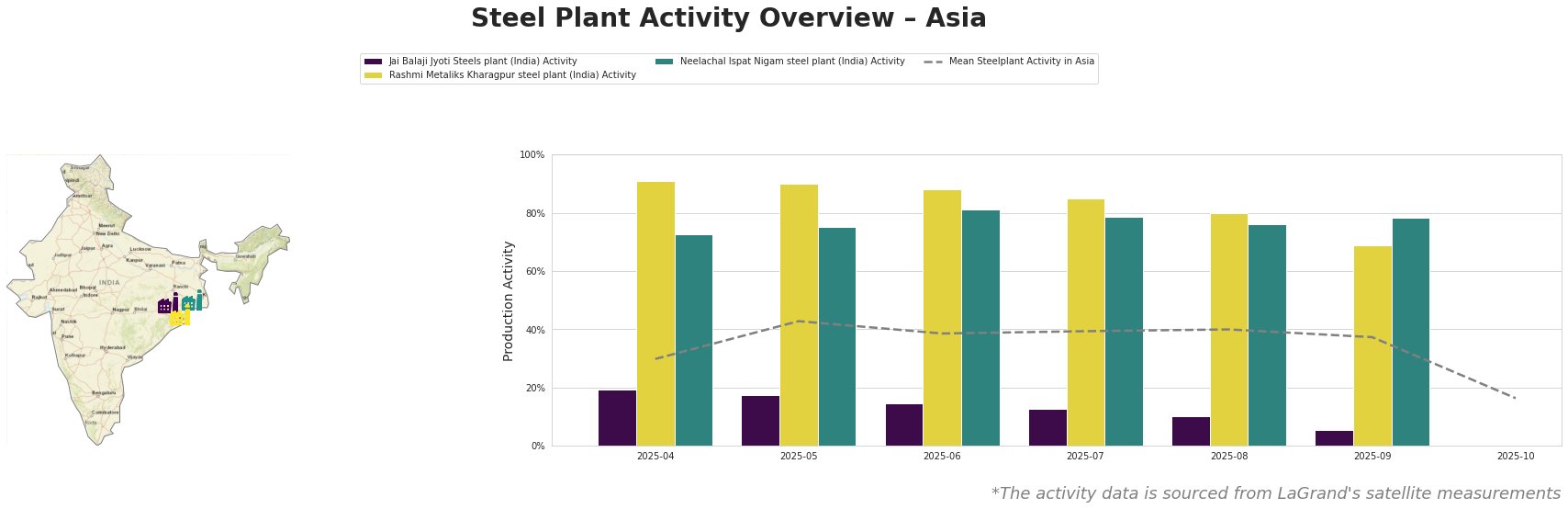

The mean steel plant activity in Asia peaked in May at 43.0% and has since declined to 16.0% by October 31st. The Jai Balaji Jyoti Steels plant has experienced a significant activity decline from 19.0% in April to 5.0% in September. In contrast, the Rashmi Metaliks Kharagpur steel plant has seen high activity levels, peaking at 91.0% in April and decreasing to 69.0% in September. The Neelachal Ispat Nigam steel plant has maintained a relatively stable activity level, ranging from 73.0% to 81.0%. Notably, the Jai Balaji Jyoti Steels plant operates well below the average Asian activity levels, while Rashmi Metaliks and Neelachal Ispat Nigam operate significantly above. The reason for the sharp decline in overall activity in October is unclear. No direct connection can be established between observed plant activity levels and the news article “India’s NMDC Limited sees iron ore output rise 23% in September“.

Jai Balaji Jyoti Steels, located in Odisha, is an integrated DRI-EAF based plant with a crude steel capacity of 92 ttpa. Satellite observations show a consistent decline in activity throughout the observed period, reaching 5.0% in September, a significant drop from 19.0% in April. This downtrend does not appear to be directly correlated with any of the provided news articles, as there is no mention of issues at this specific plant.

Rashmi Metaliks Kharagpur, situated in West Bengal, operates as an integrated BF and DRI plant with a crude steel capacity of 1500 ttpa. Satellite data indicates consistently high activity, though a decline is observed from 91.0% in April to 69.0% in September. This decline cannot be directly linked to any of the provided news articles.

Neelachal Ispat Nigam, located in Odisha, is an integrated BF-BOF plant producing crude and semi-finished steel products with a crude steel capacity of 1100 ttpa. Its activity levels remained relatively stable throughout the period, ranging from 73.0% to 81.0%. This stability cannot be directly linked to any of the provided news articles.

The “India’s steel imports down 36% in September, remains net importer” article indicates increased domestic production. Given the activity decline observed at Jai Balaji Jyoti Steels alongside high but slightly decreasing activity at Rashmi Metaliks, steel buyers should carefully monitor the output of smaller regional players. Although the overall Indian steel production is up, disruptions at specific plants like Jai Balaji Jyoti Steels could create localized supply constraints. Procurement professionals should diversify their sourcing and confirm delivery timelines to mitigate potential risks arising from uneven plant performance. The manganese ore price increase, as indicated in “India’s MOIL Limited hikes prices for all manganese ore grades for Oct delivery” should be factored into budgeting. While the article “India’s fuel demand rises in September” indicates a healthy economy, and thus a healthy steel demand, procurement professionals should be aware of potentially rising transportation costs that will impact purchase prices.