From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market: Climate Concerns and Plant Activity Shifts Signal Procurement Challenges

In Europe, climate policy debates are intersecting with observed steel plant activity levels, potentially impacting supply. News articles, including „Autogipfel“: Umweltminister pocht auf Verbrenner-Aus – Klingbeil kündigt neue Anreize für E-Autos an and Meine WELT – Meine Meinung: „Warum müssen wir Klimapolitik in anderen Ländern bezahlen, wenn es bei uns nicht reicht?“, highlight ongoing discussions on climate goals and funding priorities, although a direct connection to specific plant activity levels cannot be established at this time.

Monthly Activity Overview

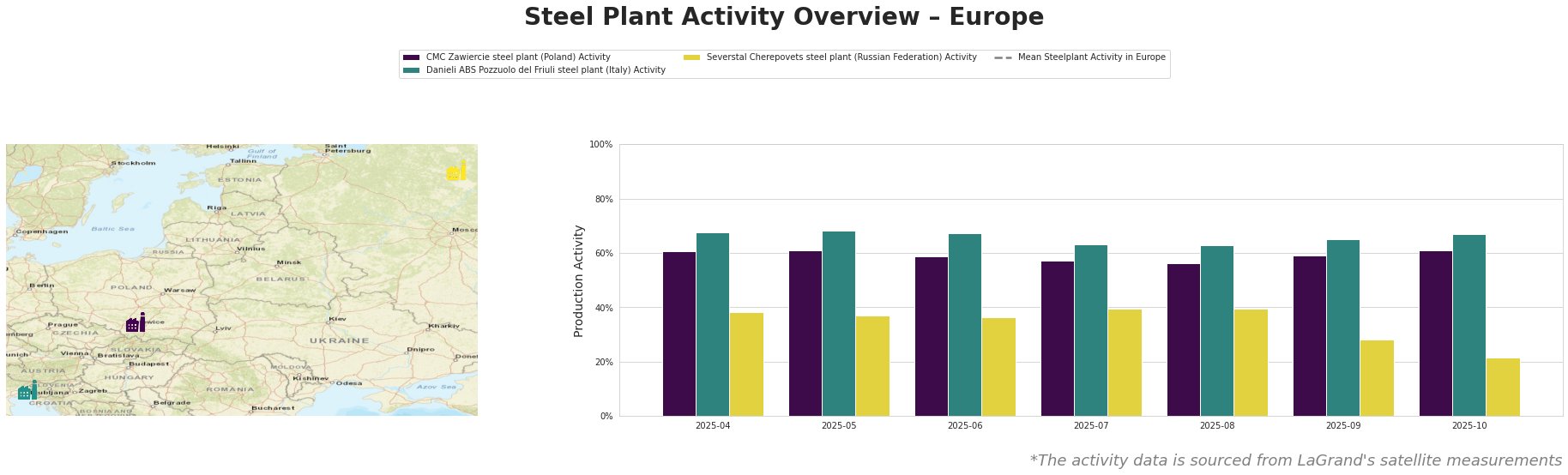

The mean steel plant activity in Europe has fluctuated significantly, peaking in May and August 2025 and then declining sharply in October. CMC Zawiercie steel plant in Poland has shown a relatively stable activity level, hovering around 60%, while Danieli ABS Pozzuolo del Friuli steel plant in Italy experienced a dip in activity during July and August, before returning to similar levels, with the highest activity levels in April and May. Severstal Cherepovets steel plant in the Russian Federation, exhibits the most significant decline, decreasing from 40% activity in July/August to 22% in October. The news articles provided do not offer explicit linkages to explain observed shifts.

Plant Information

CMC Zawiercie, a Polish steel plant with a 1.7 million tonne crude steel capacity based on EAF technology, has shown consistent activity around 60% for the months reported. This plant focuses on supplying various sectors including automotive, building, and energy. No direct connection between the observed stable activity and provided news articles can be established.

Danieli ABS Pozzuolo del Friuli, an Italian EAF-based steel plant with 1.1 million tonnes of crude steel capacity, experienced a temporary reduction in activity during July and August, dropping to 63%. It produces a range of products from crude to finished rolled steel. No connection can be drawn between this temporary dip and the provided news articles.

Severstal Cherepovets, a large integrated steel plant in Russia with a 12 million tonne crude steel capacity using both BOF and EAF technologies, shows a marked decrease in activity, falling from 40% in July/August to 22% in October. No direct relationship between news articles and a potential activity shift can be established

Evaluated Market Implications

The significant decline in activity at Severstal Cherepovets warrants attention. The reason for this drop remains unclear based on available news.

- Potential Supply Disruptions: The observed activity reduction at Severstal Cherepovets, without a clearly established reason, introduces uncertainty.

- Recommended Procurement Actions:

- Steel Buyers:Closely monitor supply chains originating from or routed through Severstal Cherepovets. Diversify suppliers to mitigate potential disruptions. Request clarity from Severstal regarding production outlook and potential impacts on existing contracts.

- Market Analysts: Investigate the underlying factors for the production decrease at Severstal Cherepovets. Analyze potential ripple effects on the European steel market, considering import/export dynamics and alternative sourcing options.