From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineJindal Steel Deal Boosts Indian Steel Sector: Plant Activity Stable Despite Market Shifts

The Indian steel market is showing resilience amidst potential shifts in the European landscape. The news articles, “Kretinsky to sell Thyssenkrupp Steel Europe stake, opening path for Jindal deal,” “Czech billionaire Kretinsky sells 20% stake in Thyssenkrupp Steel,” and “Kretinsky to sell stake in Thyssenkrupp Steel Europe, paving way for deal with Jindal,” signal Jindal Steel International’s potential expansion into Europe. While these developments do not show an immediate and direct influence on the satellite-observed activity levels of Indian steel plants, the stable activity suggests a strong domestic demand mitigating any impact from these international developments.

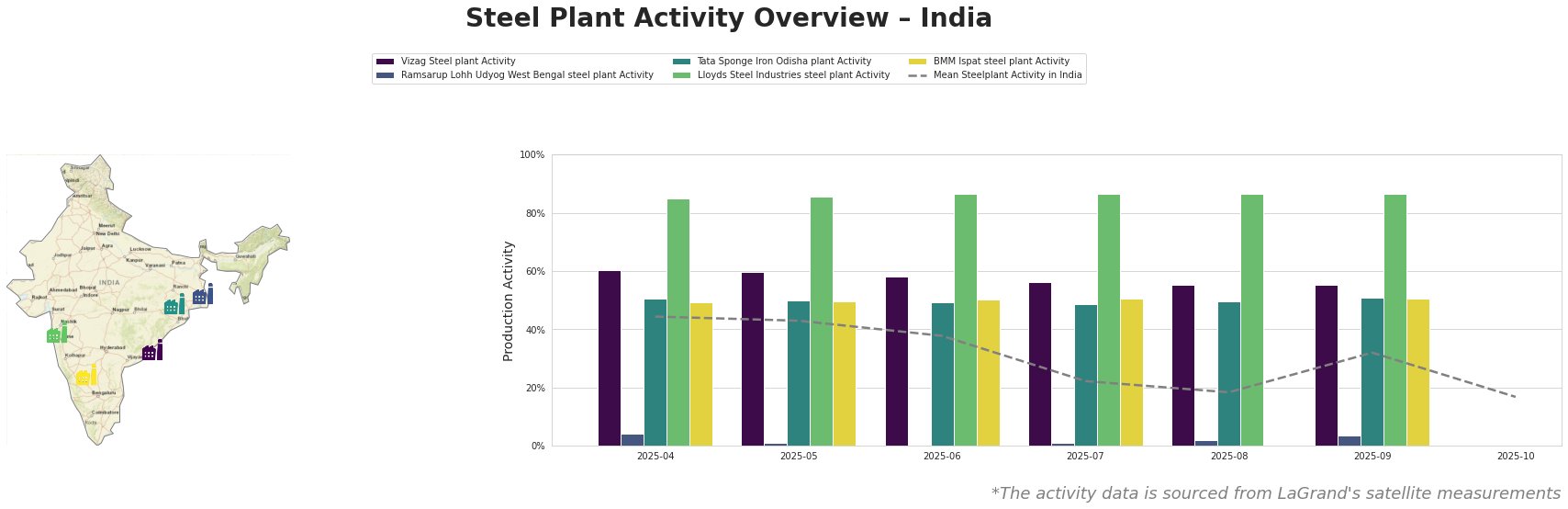

The mean steel plant activity in India shows a general decline from April (44%) to October (17%). However, individual plant activity varies significantly. Vizag Steel Plant consistently operates above the mean, while Ramsarup Lohh Udyog in West Bengal consistently operates far below the mean. Lloyds Steel Industries steel plant Activity operated at almost double the mean value. Tata Sponge Iron Odisha plant Activity showed a stable production around the mean, while BMM Ispat steel plant Activity also operated around the mean value. There is no direct relationship between the reported news articles regarding Jindal’s potential acquisition and any observed change in activity at these specific plants.

Vizag Steel Plant, located in Andhra Pradesh, is an integrated steel plant with a crude steel capacity of 7.3 million tonnes per annum (MTPA), utilizing BF-BOF technology. Its activity remained relatively stable at a high level, ranging from 60% in April-May to 55% in September, consistently above the national average. The steady production suggests robust domestic demand for its products, including rebars and wire rods, primarily used in building and infrastructure. No direct connection can be established between its high consistent production and the Jindal news.

Ramsarup Lohh Udyog’s West Bengal plant, an integrated plant utilizing both BF and DRI processes, shows a very low activity level, consistently below 4% throughout the observed period. This suggests potential operational challenges or a strategic slowdown unrelated to the Jindal Steel developments. The plant focuses on semi-finished and finished rolled products like billets and wires for the energy sector. No direct link to the news articles can be established, indicating other factors are impacting the plant’s output.

Tata Sponge Iron’s Odisha plant, focused on DRI production with a capacity of 400,000 tonnes per annum, maintained a stable activity level around 50-51% from April to September. This indicates steady demand for its DRI products. Since this plant only produces DRI, its activity might be less directly influenced by the news concerning finished steel producers. No direct correlation can be established.

Lloyds Steel Industries, located in Maharashtra and focused on EAF-based steelmaking with a crude steel capacity of 641,000 tonnes per annum, operates at very high activity levels, consistently around 85-87%. This strong performance suggests high demand for its slabs, cold rolled coils, and sheets used in the energy and machinery sectors. This consistently high activity, nearly double the mean, does not appear to be influenced by the Jindal developments, suggesting a strong and stable market for its specific product lines.

BMM Ispat, based in Karnataka, is an integrated steel plant with DRI, BOF, and EAF processes and a crude steel capacity of 2.2 MTPA. Its activity remained relatively stable, fluctuating around the mean, indicating a balanced production and demand scenario. It produces semi-finished products like bars and rebars for the building and infrastructure sectors. No direct link between the Jindal Steel news and BMM Ispat’s stable activity can be established.

The observed trends indicate that while Jindal Steel’s potential European expansion is a significant development covered in “Kretinsky to sell Thyssenkrupp Steel Europe stake, opening path for Jindal deal,” “Czech billionaire Kretinsky sells 20% stake in Thyssenkrupp Steel,” and “Kretinsky to sell stake in Thyssenkrupp Steel Europe, paving way for deal with Jindal,” it has not yet directly impacted the domestic operations of the observed Indian steel plants.

Evaluated Market Implications:

Given the stable yet declining average plant activity in India alongside Jindal Steel’s potential European acquisition, steel buyers should:

- Monitor Lloyds Steel Industries’ output closely: Its consistently high activity indicates strong regional demand for its specific products (slabs, CRC, sheets), potentially making it a reliable supplier amidst broader market fluctuations. Procurement professionals should secure contracts to lock in supply.

- Diversify sourcing: While Vizag Steel Plant shows stable production, the overall decline in mean activity suggests a potential tightening of supply in the coming months. Buyers should explore alternative suppliers, particularly those focused on DRI production like Tata Sponge Iron, to mitigate risks.

- Closely monitor domestic prices: The potential shift in global steel dynamics resulting from Jindal’s expansion may indirectly influence domestic pricing, even without directly impacting plant activity. Procurement strategies should include price escalation clauses and hedging mechanisms where feasible.

These recommendations are based on the observed plant activity and the potential strategic shift signaled by Jindal Steel’s interest in Thyssenkrupp Steel Europe, rather than any direct disruption in supply within the Indian market.