From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges: Green Steel Investments and Capacity Expansions Fuel Positive Outlook

Asia’s steel market exhibits a very positive sentiment, driven by technological advancements and capacity expansions focused on high-value and green steel production. This is reflected in news such as “ANDRITZ to Supply Silicon Steel Processing Plant to ArcelorMittal/China Oriental Group,” highlighting investments in new energy magnetic materials (NEMM) and “China’s Shanxi Jingang New Materials Technology orders ESP line from Primetals,” showcasing the expansion of thin-slab casting capabilities. While the news highlights investment activities in the region, a direct relationship to the satellite-observed changes in activity levels of the selected plants cannot be explicitly established based on the provided information.

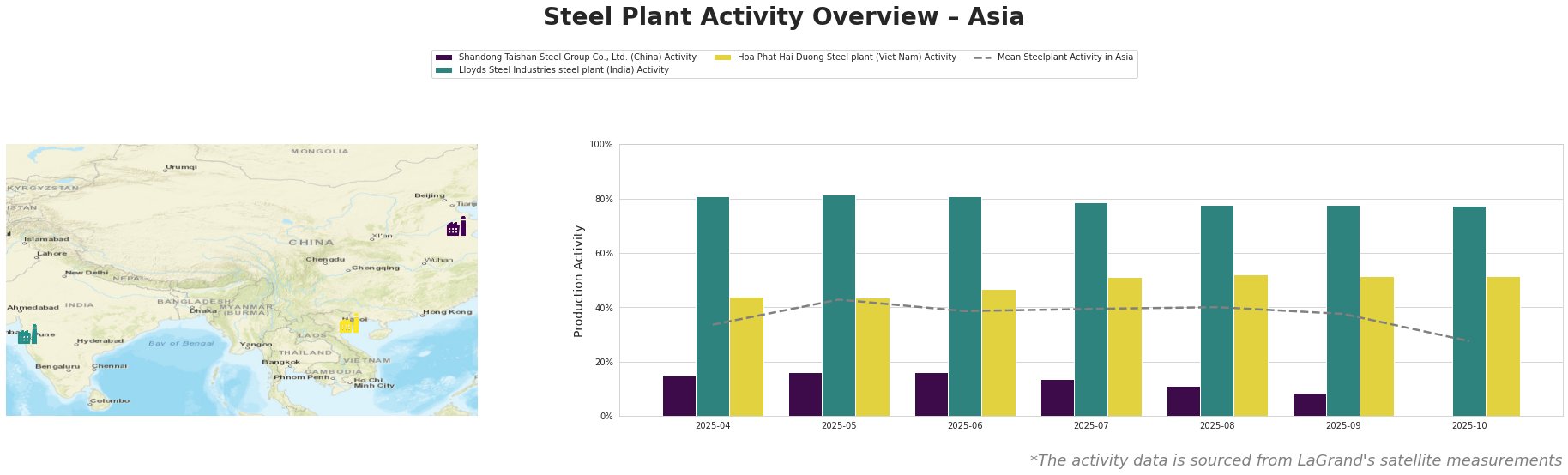

The mean steel plant activity across Asia peaked in May at 43% and showed a continuous decline towards October (28%). Shandong Taishan Steel Group Co., Ltd. consistently operated below the Asian average, experiencing a notable decline from 15% in April to 8% in September. Activity data is missing for October. Lloyds Steel Industries steel plant in India consistently maintained high activity levels, fluctuating between 78% and 82%, significantly above the regional average. Hoa Phat Hai Duong Steel plant in Vietnam showed a steady activity level increase from April (44%) to August (52%), followed by a slight decline and stabilization at around 51%.

Shandong Taishan Steel Group Co., Ltd.

Shandong Taishan Steel Group Co., Ltd., located in Shandong, China, is an integrated steel plant with a crude steel capacity of 5,000 thousand tonnes per annum (ttpa). Its main process is integrated BF, featuring BF, BOF, and EAF equipment, with a focus on finished rolled products like hot and cold-rolled coil and stainless steel. The plant holds a ResponsibleSteel certification. Satellite observations reveal a consistent decline in activity from 15% in April to 8% in September, with data missing for October, which is below the mean activity in Asia. No direct connection can be established between this observed decline and the provided news articles regarding silicon steel or ESP line investments.

Lloyds Steel Industries steel plant

Lloyds Steel Industries steel plant, situated in Maharashtra, India, operates with an electric arc furnace (EAF) process and a crude steel capacity of 641 ttpa and DRI based Iron making capacity of 270 ttpa. The plant produces semi-finished and finished rolled products, including slabs, cold-rolled coils, and sheets, targeting end-user sectors such as energy and tools/machinery. It also holds a ResponsibleSteel certification. Observed activity at Lloyds Steel Industries has remained consistently high, fluctuating between 78% and 82% from April to October, significantly above the regional average. No direct connection can be established between these consistently high activity levels and the provided news articles.

Hoa Phat Hai Duong Steel plant

Hoa Phat Hai Duong Steel plant in Vietnam utilizes an integrated BF process with a crude steel capacity of 2,500 ttpa and an Iron capacity of 1700 ttpa and BOF based steelmaking capacity. It focuses on finished rolled products like construction steel, hot-rolled coil, and pipes. The plant holds a ResponsibleSteel certification. Satellite data indicates a rise in activity from 44% in April to a peak of 52% in August, followed by a slight decline and stabilization at 51% in September and October. No direct connection can be established between these observed activity changes and the provided news articles.

The news regarding green steel investments and capacity expansions, such as those by ArcelorMittal/China Oriental Group and Shanxi Jingang, signal a shift towards higher-value steel products. Procurement professionals should anticipate a potential shift in pricing for specialized steel grades like silicon steel and ultra-low carbon steel. Given the consistent decline in activity at Shandong Taishan Steel, steel buyers should diversify their supply chains to mitigate potential supply disruptions related to commodity steel grades in the Chinese market. Focus on suppliers outside of the Shandong region may provide more stable supply options. The SSAB’s “SSAB Zero steel meets IEA carbon thresholds” announcement, even though manufactured in the US, signals a future trend. Procurement teams should proactively assess the feasibility of incorporating green steel into their supply chains, aligning with potential future environmental regulations and customer demand.