From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina’s Steel Export Surge Offsets Production Cuts, Pressuring Asian Markets

Asia’s steel market faces increasing pressure from surging Chinese exports, even amidst indications of production adjustments within China. This is coupled with broader challenges in the global long steel market as highlighted in “IREPAS chairman: Global longs market faces ongoing challenges of competition and tariff uncertainty“. While the news articles “IREPAS Meeting: 2025 set to be record year for China’s steel exports” and “Alexander Gordienko: 2025 set to be record year for China’s steel exports” directly support the expectation of increased exports, we observe a complex interplay with production trends reflected in plant activity data. The observed plant activity data shows that several plants adjusted production output to the news.

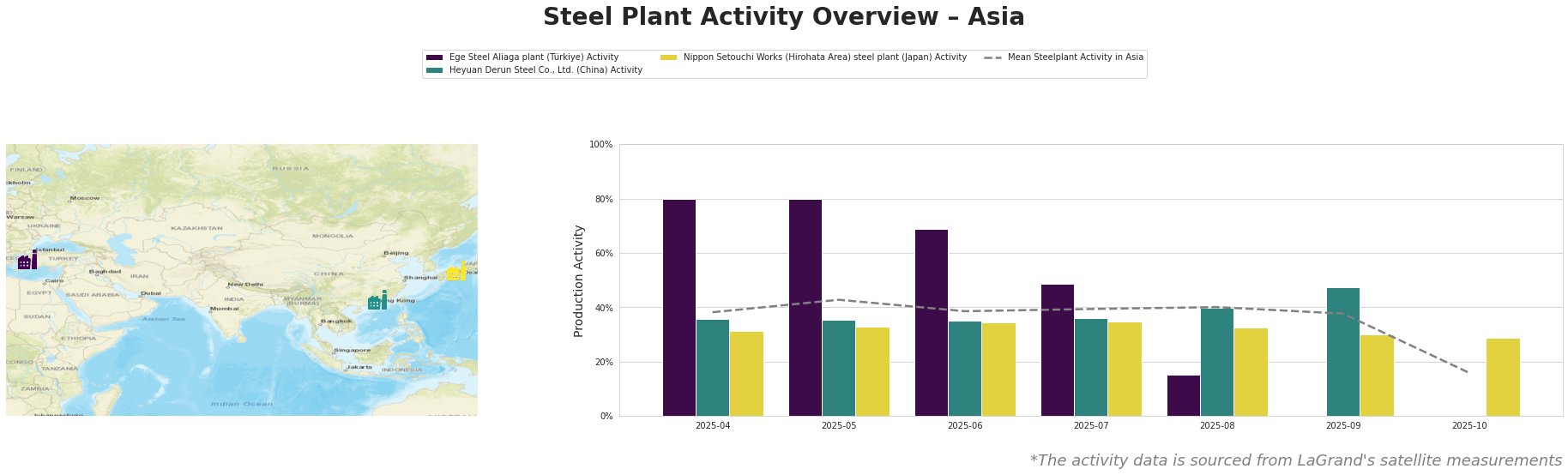

The average steel plant activity in Asia shows a fluctuating trend, peaking in May at 43% and then declining to 16% by the end of October. This drop in October is significant.

Ege Steel Aliaga, a Turkish EAF-based plant producing 2 million tonnes of crude steel annually, primarily rebar and wire rod, demonstrates a sharp decline in activity from 80% in April-May to 0% in September. The continued downtrend and complete halt in October could indicate significant operational challenges, potentially linked to the issues faced by Turkish steelmakers as mentioned in “IREPAS chairman: Global longs market faces ongoing challenges of competition and tariff uncertainty“, which cites unprofitability hindering global competitiveness, although a direct causal relationship cannot be definitively established based solely on the provided information.

Heyuan Derun Steel Co., Ltd., a Chinese EAF-based plant with a capacity of 1.2 million tonnes producing primarily rebar, exhibited relatively stable activity between April and July, around 35-36%. A notable increase is observed in August and September, reaching 40% and 48% respectively. This increase coincides with reports in “IREPAS Meeting: 2025 set to be record year for China’s steel exports” and “Alexander Gordienko: 2025 set to be record year for China’s steel exports” projecting a record year for Chinese steel exports due to stagnant domestic demand, and may reflect the plant increasing production for export markets.

Nippon Setouchi Works, a Japanese BOF-based plant producing 2.816 million tonnes of crude steel annually, primarily sheets, shows a consistently low activity level, fluctuating between 29% and 35% from April to October. The overall low utilization and slight decline towards October suggest the plant isn’t benefiting substantially from the forecast export increases and could be facing regional demand softness as highlighted in “IREPAS Meeting: 2025 set to be record year for China’s steel exports“, although a direct link cannot be definitively established.

Evaluated Market Implications:

-

Potential Supply Disruptions: The sharp decline and complete halt in production at Ege Steel Aliaga may lead to supply disruptions, particularly for rebar and wire rod in regions traditionally served by Turkish exports.

-

Procurement Actions for Steel Buyers and Analysts:

- Monitor Turkish steel export prices closely, anticipating potential price increases due to reduced supply from Ege Steel Aliaga. Consider diversifying sourcing to mitigate risks.

- Leverage the increased Chinese export capacity by securing favorable contracts, particularly for rebar and semi-finished steel. Base procurement decisions on updated, detailed global supply projections. Due to high export, monitor domestic China pricing and policy shifts.

- Carefully evaluate the sustainability commitments of China’s production. Focus on responsible sourced steel to safeguard against potential long-term reputational and regulatory risks.

- Given the low activity level at Nippon Setouchi Works and the projected shift in Chinese demand from construction to manufacturing (“Baosteel at IREPAS: Long-term demand outlook solid despite short-term disruptions“), explore opportunities for sourcing flat steel products from Japan, potentially at competitive prices.