From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMixed Signals: European Steel Production Rises Amidst Global Competition and Regional Challenges

Europe’s steel sector presents a mixed picture, with production increases in some regions offset by broader EU declines and global competitive pressures. According to “Spain increased steel production by 4.4% y/y in January-August” and “Poland increased steel production by 12% y/y in August,” some countries are showing robust growth, while “ADMIB: Metals account for 11% of total Turkey’s exports in August 2025” highlights export dynamics. The Ukrainian steel sector has also seen positive developments as reported in “Ukraine’s Zaporizhstal records 9.6% rise in crude steel output in Jan-Sept 2025“. Whether and how these developments relate to activity at specific European steel plants, as tracked by satellite observation, remains largely unclear from the provided data, as some crucial regions are outside the European Union.

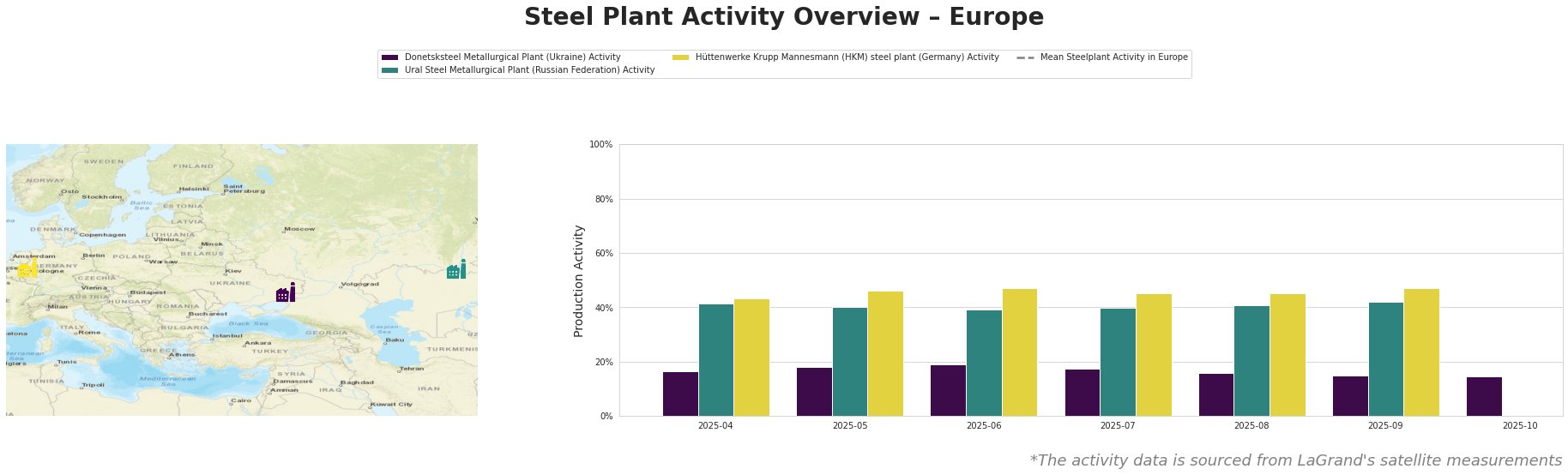

The provided data indicates fluctuating average steel plant activity across Europe. The mean activity varies over the months, without a clear trend.

Donetsksteel Metallurgical Plant, an integrated steel plant in Ukraine specializing in pig iron, showed relatively stable activity levels ranging from 15% to 19% during April-September 2025, with a slight peak in June. Its relatively consistent activity, despite being located in a region affected by conflict, does not directly correlate with the reported production increases at Zaporizhstal in “Ukraine’s Zaporizhstal records 9.6% rise in crude steel output in Jan-Sept 2025“. Activity dropped to 15% in September, the lowest value measured in the period.

Ural Steel Metallurgical Plant, an integrated plant in Russia producing crude, semi-finished, and finished rolled products, shows stable activity, fluctuating between 39% and 42% from April to September 2025. No direct link between these activity levels and the provided news articles could be established.

Hüttenwerke Krupp Mannesmann (HKM), a German integrated steel plant producing slabs, round bars, and rolled products, exhibits the highest activity levels among the observed plants, ranging from 43% to 47%. Activity peaked in June and September at 47%. No direct link between these activity levels and the provided news articles could be established.

The news item “Spain increased steel production by 4.4% y/y in January-August” does not seem to have a clear reflection on the measured activity of HKM in Germany. Similarly, the information found in “Poland increased steel production by 12% y/y in August” is not clearly reflected in any activity increases measured at HKM.

Despite increased exports from Turkey (“ADMIB: Metals account for 11% of total Turkey’s exports in August 2025“), and increased steel production in Poland and Spain, no direct evidence is given to show any impact on plant activity levels for Germany.

Given the mixed regional performance and competitive pressures, steel buyers should closely monitor import trends, particularly from Turkey and potentially Ukraine, to leverage competitive pricing. For steel buyers relying on the Donetsksteel Metallurgical Plant, continuously monitor geopolitical developments and logistics to mitigate potential supply chain disruptions due to the consistently low activity levels. Since steelworkers’ unions in Poland plan protests as reported in “Poland increased steel production by 12% y/y in August,” monitor the outcome of the union action as it could potentially impact steel production.