From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Resilient Despite Iran Sanctions; China Production Remains Strong

Asia’s steel market demonstrates resilience despite renewed EU sanctions on Iran, with Chinese production holding firm. The reimposition of restrictions targeting Iran’s steel sector, as reported in “EU bans steel trade with Iran” and “The EU has reinstated sanctions against Iran, banning trade in steel and metals,” aim to curtail Iranian metal exports. While these sanctions are expected to impact Iranian steel trade with the EU, their overall effect on the Asian market appears limited due to China’s continued demand. No direct correlation between the EU sanctions and observed activity at Chinese steel plants could be established based on the provided news and satellite data.

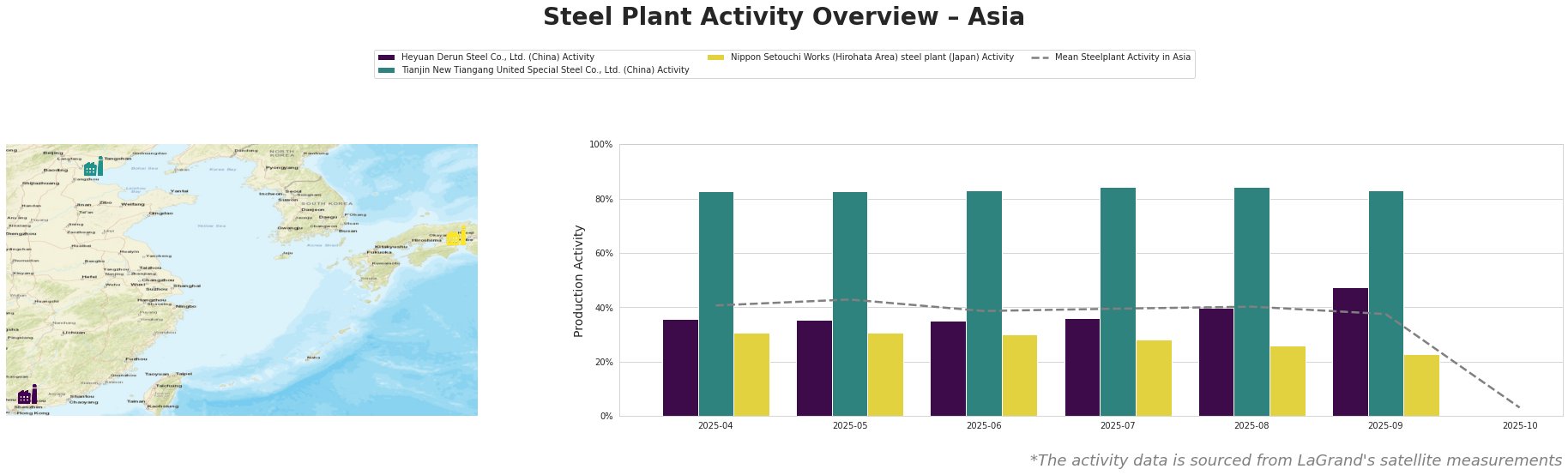

Observed plant activity data reveals distinct trends. The mean steel plant activity in Asia fluctuated between 38% and 43% from April to September 2025, before dropping sharply to 3% in October, a shift which cannot be linked to any of the provided news articles. Tianjin New Tiangang United Special Steel Co., Ltd. maintained a consistently high activity level, hovering around 83-84%, significantly exceeding the Asian average. Heyuan Derun Steel Co., Ltd. exhibited relatively stable activity until September, when it jumped to 48% activity. Nippon Setouchi Works (Hirohata Area) experienced a gradual decline from 31% in April to 23% in September.

Heyuan Derun Steel Co., Ltd., located in Guangdong, China, operates primarily with electric arc furnaces (EAF), boasting a crude steel capacity of 1.2 million tonnes per year. The observed rise in activity to 48% in September, from 40% in August, does not appear directly linked to the EU sanctions on Iran, as the plant focuses on hot rolled rebar and billet production, primarily for domestic consumption.

Tianjin New Tiangang United Special Steel Co., Ltd., situated in Tianjin, China, is an integrated steel plant with a blast furnace (BF) and basic oxygen furnace (BOF) process, producing 4.5 million tonnes of crude steel annually. Its consistently high activity level (83-84%) suggests stable demand for its angle steel and continuous casting billet products. There’s no evidence to connect this activity with the EU sanctions outlined in “EU bans steel trade with Iran” or “The EU has reinstated sanctions against Iran, banning trade in steel and metals.”

Nippon Setouchi Works (Hirohata Area) in Japan, possesses a crude steel capacity of 2.816 million tonnes. The plant’s gradual decline in activity from April (31%) to September (23%) could indicate weakening demand for its sheet products. This decline happens independently of the EU Sanctions on Iran.

The EU sanctions on Iran, highlighted in “EU bans steel trade with Iran” and “The EU has reinstated sanctions against Iran, banning trade in steel and metals,” are unlikely to cause significant disruptions in the broader Asian steel market, given China’s robust domestic production and continued steel demand. However, steel buyers should closely monitor Iranian steel export flows and potential rerouting of materials.

- Procurement Action: Steel buyers focusing on billet should explore alternative supply chains outside of Iran and the EU to secure supply, considering the potential for redirected trade flows.

- Market Analysis Action: Analysts should track the impact of “Iran sanctions snapback unlikely to hit oil flows” on Iran’s overall financial stability, as any economic downturn could affect domestic steel demand and subsequently influence export strategies, despite sanctions.