From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Braces for Uncertainty Amid US Shutdown: Plant Activity Slows

The Asian steel market faces increased uncertainty due to the US government shutdown and its impact on global economic data. While a direct causal link cannot be established, recent satellite-observed decreases in Asian steel plant activity coincide with the disruption of crucial US economic data releases, potentially affecting demand forecasts. Specifically, the shutdown, as reported in “US government shutdown delays construction data,” “Fed shutdown disrupts most USDA data releases,” and “US gov shutdown lowers shroud on jobs, inflation data,” has halted the publication of key indicators related to construction, agriculture, and employment, complicating market analysis.

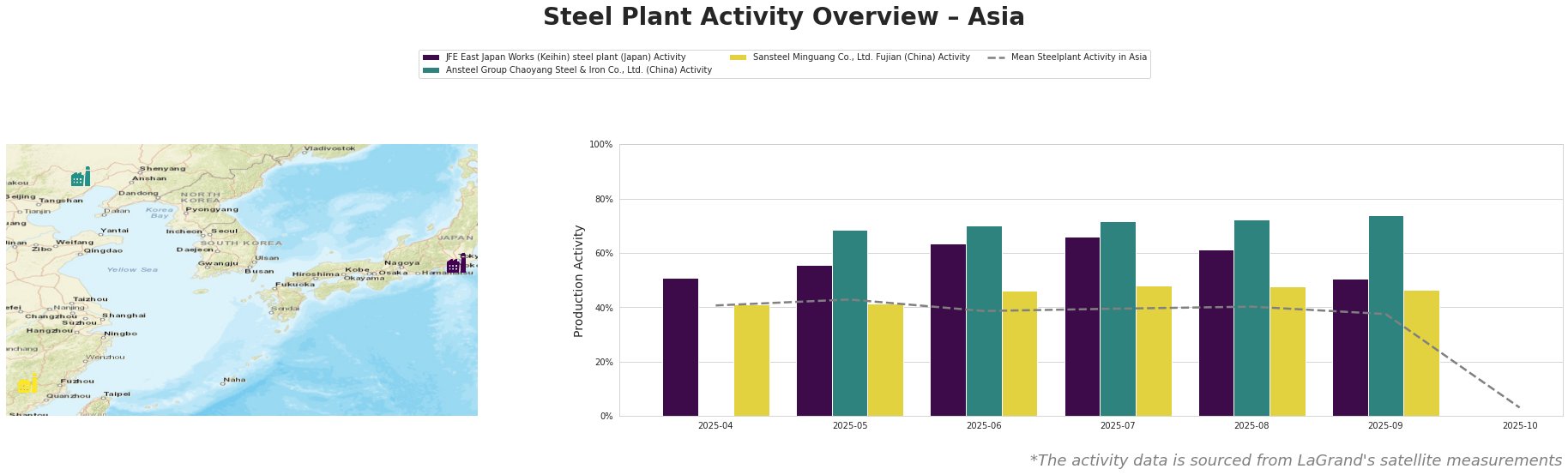

The mean steel plant activity across Asia decreased from 41.0% in April to a significantly low 3.0% in October. JFE East Japan Works (Keihin) steel plant activity peaked at 66.0% in July before dropping to 51.0% by September. Ansteel Group Chaoyang Steel & Iron Co., Ltd. activity steadily increased from May to September, reaching a high of 74.0%. Sansteel Minguang Co., Ltd. Fujian activity remained relatively stable between 41.0% and 48.0% from April to September. The drastic drop in overall and individual activity for October warrants careful observation.

JFE East Japan Works (Keihin) steel plant, an integrated BF-BOF steelmaker with a crude steel capacity of 4.075 million tonnes per annum, experienced a decline in activity from 66.0% in July to 51.0% in September. While the plant has ResponsibleSteelCertification, there is no explicitly established direct link between its activity decline and the US government shutdown news. Of particular note is the previously planned shutdown of BF and BOF by FY2023.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., boasting a crude steel capacity of 2.1 million tonnes per annum through its BF-BOF process, shows increasing activity, reaching 74.0% in September. Despite this increase, no direct link can be established between this activity and the US government shutdown. The lack of publicly available data related to specific export activities or reliance on US-impacted sectors prevents any definitive conclusion.

Sansteel Minguang Co., Ltd. Fujian, an integrated steel plant with a crude steel capacity of 6.8 million tonnes per annum that is produced via the BF-BOF route. It also has ResponsibleSteelCertification. There has been a small amount of fluctuation in observed activity, with no clear trend, or direct connection to US government shutdown.

Given the uncertainty created by the US government shutdown and the simultaneous drop in overall Asian steel plant activity, steel buyers are advised to carefully monitor inventory levels and consider diversifying their sourcing options to mitigate potential supply chain disruptions. The delay in US construction data, as highlighted in “US government shutdown delays construction data,” makes it difficult to accurately forecast demand in key steel-consuming sectors. Should activity in October persist at the 3% level, Asian buyers heavily reliant on the specific steel production from JFE East Japan Works (Keihin) steel plant are advised to secure alternative supplies, given that the news articles highlight potential impacts on demand-side forecasts, and, for example, the halt of the USDA export sales reports.