From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIran Steel Market Resilient Despite EU Sanctions: Production Remains Stable, But Monitor Supply Chains

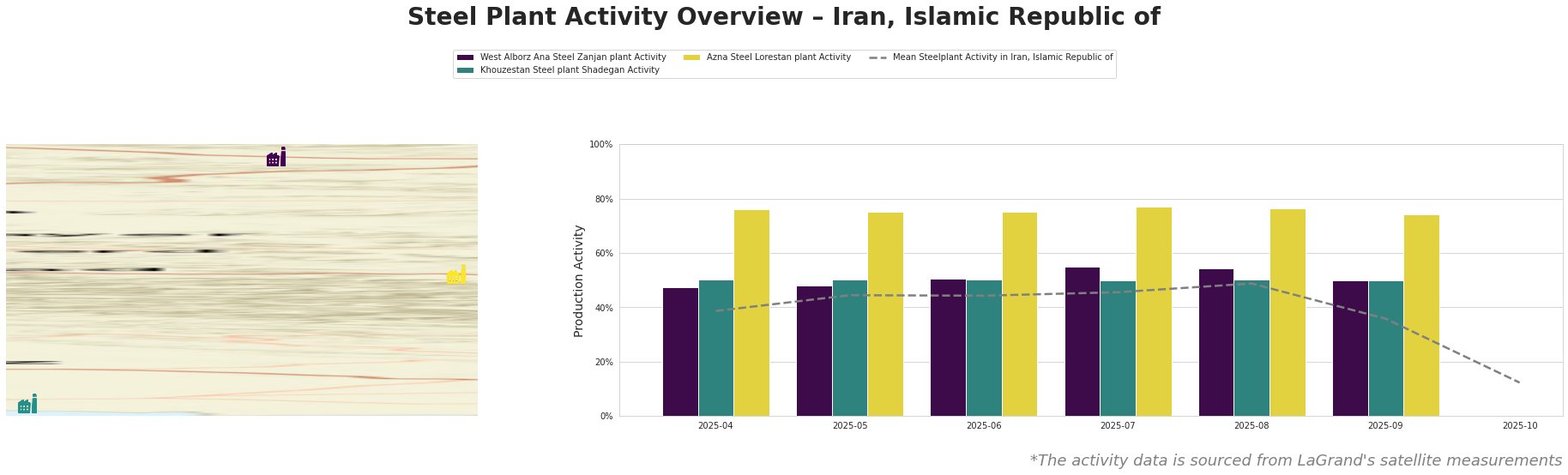

Recent EU sanctions targeting steel trade with Iran are unlikely to immediately disrupt domestic steel production, though potential long-term impacts on exports and material availability necessitate careful monitoring. Activity levels at key Iranian steel plants remained relatively stable through September 2025, even as new sanctions loomed, but data reveals a considerable overall activity decrease for October. The EU’s actions, outlined in “EU bans steel trade with Iran” and “The EU has reinstated sanctions against Iran, banning trade in steel and metals“, prohibit the import and export of steel and related materials between the EU and Iran. These new developments however have shown no direct correlation in activity levels until late october, where considerable activity level decreases have been observed. The article “Iran sanctions snapback unlikely to hit oil flows” highlights the potential for broader economic pressure on Iran, which could indirectly affect the steel sector.

Overall activity levels across the observed plants averaged between 39% and 49% from April to August 2025, dropping to 36% in September, and then plummeted to 12% in October. The Azna Steel Lorestan plant consistently operated at the highest activity level (74-77%), significantly above the mean. Khouzestan Steel plant Shadegan remained stable at 50% throughout the observed period.

The West Alborz Ana Steel Zanjan plant, a DRI-EAF based producer with a crude steel capacity of 1.5 million tons per annum (ttpa), showed fluctuating activity. Its activity peaked at 55% in July 2025, before decreasing in the following months, and considerably falling to 50% in September. Despite EU sanctions, no direct and immediate drop in activity at the Zanjan plant correlating with the news of “EU bans steel trade with Iran” can be established until the sharp drop observed in October’s mean.

Khouzestan Steel plant Shadegan, with a larger 3.6 million ttpa crude steel capacity using DRI-EAF technology, maintained a steady 50% activity level from April to September 2025. Given its high domestic production capacity and focus on semi-finished products, the recent sanctions against Iran have no direct correlation and immediate effect on the production output of Khouzestan Steel plant Shadegan during this period.

Azna Steel Lorestan plant, an EAF-based producer with a 1.2 million ttpa crude steel capacity, exhibited the highest activity levels, ranging from 74% to 77%. However, its activity decreased to 74% in September. As with the other plants, there is no discernible immediate connection between the “EU bans steel trade with Iran” news release and production from April to September.

The reimposition of EU sanctions, while potentially impacting Iran’s steel exports, does not appear to have immediately disrupted domestic production at these key plants based on activity data through September 2025. However, the sharp decrease of overall activity in October requires further investigation. Steel buyers and market analysts should:

- Closely monitor October activity data for individual plants to assess the immediate impact of the sanctions. The observed sharp drop in the mean activity may point to broader effects than initially anticipated.

- Assess potential supply chain vulnerabilities related to EU-sourced inputs. While the plants primarily use DRI-EAF technology, any reliance on EU-origin equipment, parts, or technical assistance could be affected.

- Factor potential disruptions from broader economic pressure resulting from sanctions, as highlighted in “Iran sanctions snapback unlikely to hit oil flows“. This could affect access to financing, insurance, and shipping.

- Engage in contingency planning to diversify sourcing and mitigate potential disruptions to steel supply, particularly for semi-finished products.