From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: EU Tariffs Looming, Chinese Plant Activity Remains Strong, Procurement Strategies Evolving

Asia’s steel market remains robust despite potential headwinds from EU trade policy. Activity levels at key Chinese plants, specifically Ansteel Group Chaoyang Steel & Iron Co., Ltd. and Xinjiang Yili Iron and Steel Co., Ltd., indicate continued strength, even as the EU considers tariffs on Chinese steel as reported in “The EU may impose tariffs of 25-50% on Chinese steel – Handelsblatt“, “EU plans tariffs of 25%-50% on Chinese steel and related products, Handelsblatt reports“, “The EU plans to impose duties of 25-50% on Chinese steel and related products, according to Handelsblatt.“, “EU plans 25-50% tariffs on Chinese steel to protect domestic industry“, and “The EU plans to reduce steel import quotas and increase tariffs“. While these articles highlight the potential for reduced Chinese steel exports to Europe, no immediate impact is yet observed in the satellite-observed production activity.

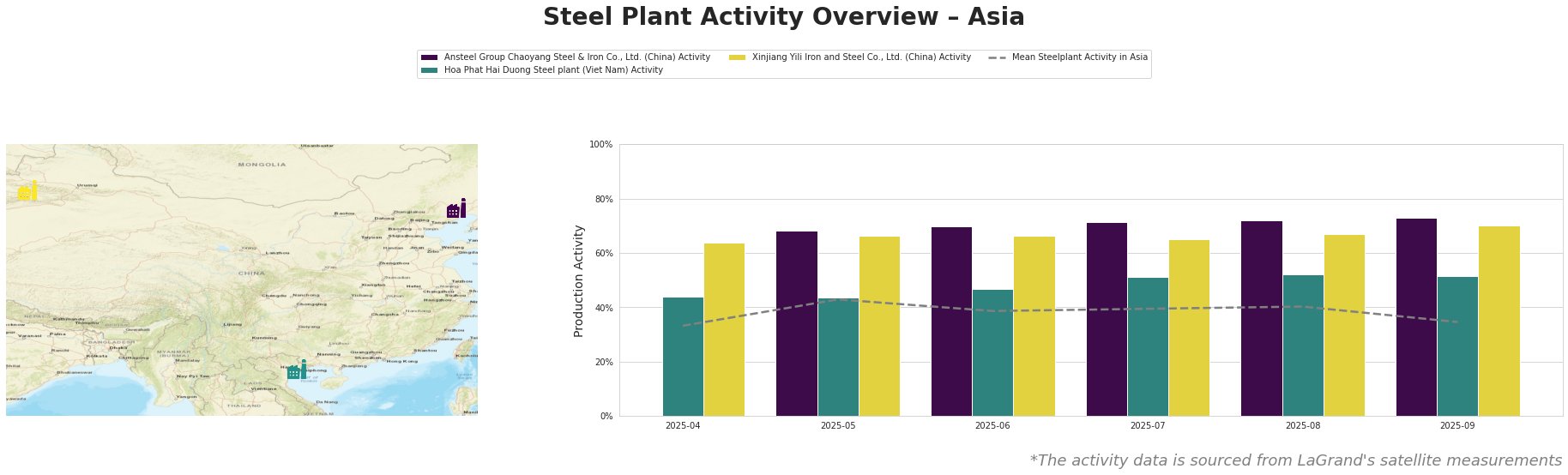

The mean steel plant activity in Asia fluctuated, reaching a high of 43.0% in May and declining to 35.0% in September. In contrast, Ansteel Group Chaoyang Steel & Iron Co., Ltd. showed a consistent upward trend, reaching 73.0% in September, substantially above the Asian average. Hoa Phat Hai Duong Steel plant activity remained relatively stable between 44% and 52% across the observed period. Xinjiang Yili Iron and Steel Co., Ltd. also maintained high activity, peaking at 70% in September.

Ansteel Group Chaoyang Steel & Iron Co., Ltd., a BOF-based integrated steel plant in Liaoning with a crude steel capacity of 2.1 million tonnes, has shown a consistent increase in activity from May (68.0%) to September (73.0%). This sustained high activity occurs despite the EU’s announcement of potential tariffs on Chinese steel. No explicit connection between the EU’s tariff plans and the plant’s activity can be established based on the available data. The plant primarily produces steel plate and steel pipe, suggesting it may be less directly impacted by tariffs focused on specific steel product categories initially.

Hoa Phat Hai Duong Steel plant in Vietnam, another integrated steel producer with a 2.5 million tonne crude steel capacity focused on construction steel and hot-rolled coil, exhibited relatively stable activity. The activity level remained between 44.0% and 52.0% during the observed period. The news articles primarily focus on Chinese steel, and no direct correlation between the EU tariff discussions and the activity at this Vietnamese plant can be established.

Xinjiang Yili Iron and Steel Co., Ltd., an integrated steel plant in Xinjiang with a 1 million tonne crude steel capacity producing hot-rolled round bars and wire rods, shows similarly high and stable activity. Activity increased from 64% in April to 70% in September, maintaining high production levels in spite of announcements regarding potential EU tariffs, for which no explicit connection to activity could be observed.

The observed consistent, above-average production at Ansteel Group Chaoyang Steel & Iron Co., Ltd. and Xinjiang Yili Iron and Steel Co., Ltd. suggests that these producers have not yet curtailed production in anticipation of EU tariffs. Given the EU’s plans to reduce steel import quotas as indicated in “The EU plans to reduce steel import quotas and increase tariffs“, steel buyers should proactively:

- Diversify sourcing: Explore alternative sources of steel outside of China, particularly from regions less likely to be affected by EU tariffs, to mitigate potential supply disruptions.

- Negotiate contracts: Secure firm contracts with suppliers, especially those in China, that include clauses protecting against potential tariff-related price increases and quota limitations.

- Monitor trade policy: Closely monitor EU trade policy developments and their impact on specific steel product categories to anticipate potential disruptions and adjust procurement strategies accordingly.

Despite the looming EU tariffs, the sustained high production levels at key Chinese steel plants, as evidenced by satellite data, indicate continued supply. However, the evolving trade landscape necessitates proactive risk management and diversification of sourcing strategies for steel buyers.