From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Production Cuts Impact Japan Exports, Rebar Prices Stable

China’s steel production cuts and declining Japanese exports are key factors shaping the Asian steel market. Satellite data reveals distinct plant-level activity variations. These trends, coupled with a decrease in US rebar imports as reported in “US rebar imports down 51.8 percent in July 2025“, have specific implications for steel buyers. While “China reduced steel production by 2.8% in 8 months” and “Japan’s steel exports down 4.2 percent in January-August 2025” indicate overall production and export declines, we cannot establish a direct link to the observed plant-level activity changes from satellite data.

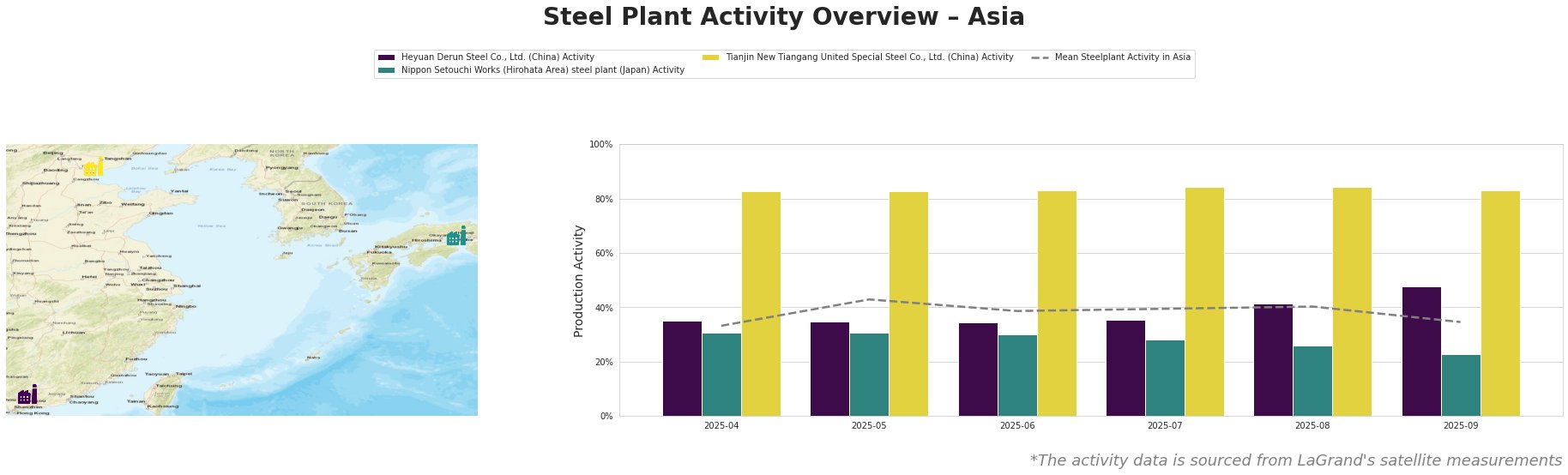

The mean steel plant activity in Asia fluctuated, peaking at 43% in May and then decreasing to 35% in September. Heyuan Derun Steel, a Chinese EAF-based rebar producer, showed increasing activity, rising from 35% in July to 48% in September. Nippon Setouchi Works, a Japanese BOF-based sheet producer, exhibited a steady decline, dropping from 31% in April/May to 23% in September, significantly below the Asian average. Tianjin New Tiangang United Special Steel, a Chinese integrated BF/BOF-based producer of angle steel and billet, maintained a consistently high activity level around 83-84% throughout the period, significantly above the Asian mean. While “China reduced steel production by 2.8% in 8 months” we can not relate this to satellite data from Tianjin New Tiangang United Special Steel showing consistently high activity. Similarly, “Japan’s steel exports down 4.2 percent in January-August 2025” highlights broader export declines, but no direct connection to the observed activity drop at Nippon Setouchi Works can be explicitly established from the provided articles.

Heyuan Derun Steel Co., Ltd., a Guangdong-based steel plant with a 1.2 million tonne EAF capacity focusing on hot rolled rebar and billet, increased its activity from 35% in July to 48% in September. This rise contradicts the overall Chinese production cut reported in “China reduced steel production by 2.8% in 8 months”, potentially signaling regional demand variations or a shift in production focus towards rebar.

Nippon Setouchi Works (Hirohata Area) is a Kansai-based steel plant utilizing BOF technology with a crude steel capacity of 2.816 million tonnes, specializing in sheet production. Its activity steadily declined from 31% in April/May to 23% in September. This decrease potentially reflects reduced demand for sheets in key export markets. “Japan’s steel exports down 4.2 percent in January-August 2025” broadly indicates export weaknesses, but a direct causal link to the Hirohata Area activity drop cannot be definitively established with the provided information.

Tianjin New Tiangang United Special Steel Co., Ltd., located in Tianjin, operates an integrated BF/BOF process with a substantial crude steel capacity of 4.5 million tonnes, producing angle steel and continuous casting billet. Its consistently high activity (around 83-84%) suggests robust domestic demand for its products, irrespective of the broader production cuts mentioned in “China reduced steel production by 2.8% in 8 months”.

The contrasting activity levels and production trends, highlight specific regional factors influencing steel production. Given the increasing activity at Heyuan Derun Steel and the overall decrease in US rebar imports as per “US rebar imports down 51.8 percent in July 2025”, steel buyers should anticipate stable rebar prices in Asia, but monitor for potential increases due to domestic demand within China. Steel buyers relying on Japanese sheet exports should prepare for potential supply constraints and explore alternative sources due to the activity decline at Nippon Setouchi Works (Hirohata Area) as well as “Japan’s steel exports down 4.2 percent in January-August 2025”.