From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Price Declines Amid Weak Demand; Plant Activity Mixed

Europe’s steel market faces headwinds as evidenced by recent price declines and sluggish post-holiday restarts. The core issue is weak demand, with several news articles pointing to downward price pressures, particularly in the long products segment. Specifically, “European rebar, wire rod prices on downward track” and “The European long products market is mostly stable, and prices for Italian rebar are declining.” highlight this trend. While these price drops are occurring, it is not possible to directly link them to any sudden changes in activity levels at the observed steel plants based on the satellite data.

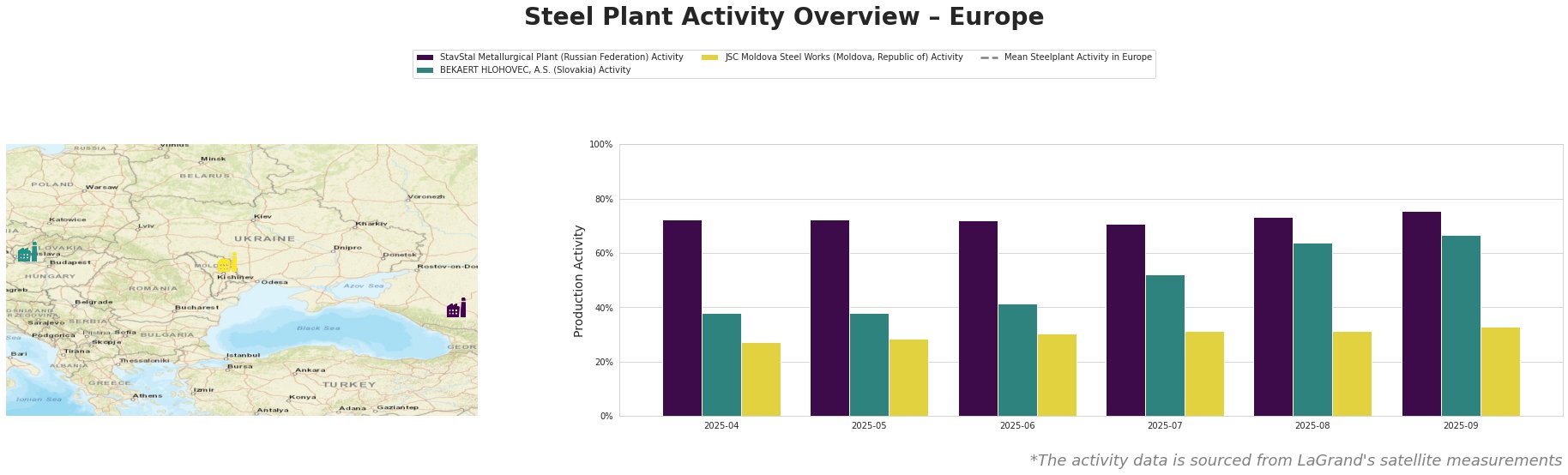

Mean steel plant activity in Europe exhibits volatility with peak months in May, July and August.

StavStal Metallurgical Plant, a Russian facility with a 500ktpa EAF capacity focused on rebar and wire rod, shows a consistently high activity level, increasing from 72% in April to 75% in September. No direct connection between this observed steady production and the “European rebar, wire rod prices on downward track” is explicitly evident within the available news.

BEKAERT HLOHOVEC, A.S., a Slovakian wire rod producer serving the automotive and construction sectors, shows increasing activity levels from 38% in April to 67% in September. This increased production at this plant may put pressure on the wire rod market. Considering the news article “European rebar, wire rod prices on downward track”, there might be an indirect connection to decreasing wire rod prices, however a direct link cannot be explicitly established.

JSC Moldova Steel Works, operating a 1000ktpa EAF-based plant producing rebar and wire rod, has experienced a more gradual activity increase, from 27% in April to 33% in September. There is no directly available news to explicitly relate the activities of this plant to.

Evaluated Market Implications:

The satellite data reveals diverging production trends across European steel plants, with some ramping up activity while market sentiment turns increasingly negative. While “European rebar, wire rod prices on downward track,” indicates downward pressure in long steel products, these cannot be directly linked to sudden, demonstrable drops in overall European steel production.

Recommended Procurement Actions:

- Steel Buyers: Given the news that “European rebar, wire rod prices on downward track” and “Prices for European rebar and wire rod are decreasing,” procurement professionals focused on these long products in Europe should actively negotiate with suppliers to capitalize on the downward price trends. The fact that “Italian rebar prices decline” shows there is a significant opportunity to push for lower prices.

- Market Analysts: Closely monitor the activity levels of BEKAERT HLOHOVEC, A.S. As activity levels are consistently rising and may contribute to price drops in the wire rod market. Further market analysis should explore any possible connection between this activity and price developments.