From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market: Rebar Price Dip Amid Stable Activity, Signals Procurement Opportunities

Italy’s steel market presents a mixed picture. While the overall European long products market remains stable, “European longs market mostly stable, Italian rebar prices decline“ reports a decrease in Italian rebar prices by €10-20/mt, potentially bottoming out. These price declines cannot be directly linked to immediate, observable drops in plant activity, but the article suggests a slight demand recovery in response to lower prices, a pattern which will likely continue. This observation of declining prices and the potential recovery of demand is an ongoing development that must be noted. In tandem, “Italian plate hikes fail amid sluggish post-holiday restart“ notes subdued demand hindering price increases for heavy plate, despite producers’ intentions, and delivery times stable at around three weeks. This article does not indicate or correlate with major activity level changes but provides context for the overall market sentiment. “Price increases in Italy have failed amid a sluggish recovery after the holidays“ offers similar conclusions, reinforcing the trend of price stagnation despite producers’ intentions.

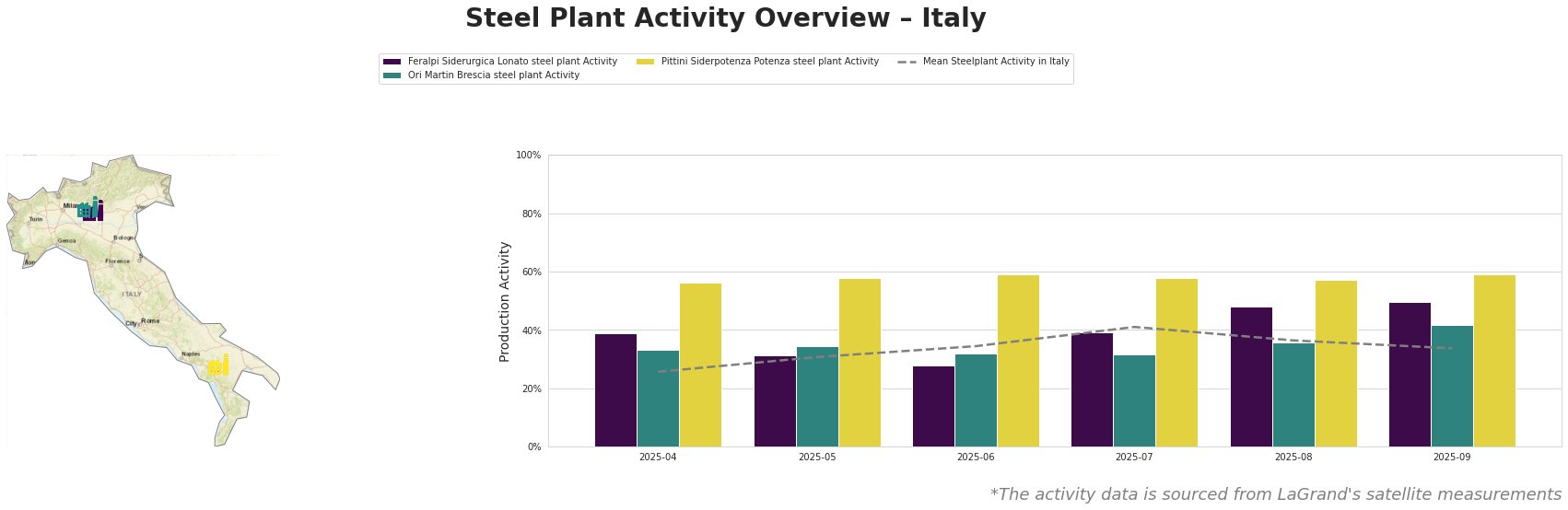

Overall, the mean steel plant activity in Italy has seen fluctuation. From April to September 2025, it rose from 26.0 to a peak of 41.0 in July, before decreasing again to 34.0 in September. Note the mean activity value obscures individual plant behaviors that are uncorrelated (explained individually below).

Feralpi Siderurgica Lonato steel plant, an EAF-based producer in the Province of Brescia with a capacity of 1.1 million tonnes of crude steel, primarily focuses on rebar, billets, mesh, and wire rod. The plant’s activity shows a considerable rise from 28.0 in June to 50.0 in September. This increase does not directly correlate with any specific information contained in the provided news articles; no direct connection can be established.

Ori Martin Brescia steel plant, another EAF-based producer in the Province of Brescia, has a capacity of 650,000 tonnes of crude steel. Its product range includes billets, rolled products, wire, and wire rod, targeting sectors like automotive, building and infrastructure, energy, and machinery. The activity level rose from 32.0 in June to 42.0 in September. As with Feralpi, no explicit link to the provided news articles can be established based on satellite data.

Pittini Siderpotenza Potenza steel plant, located in the Province of Potenza, operates an EAF with a capacity of 700,000 tonnes of crude steel and specializes in rebar for the building and infrastructure sectors. Its activity has been relatively stable around the high 50’s, with a high of 59.0 in June and September. There is no direct correlation between its stable, high activity and the market news provided.

Given the reported decline in Italian rebar prices alongside stable plant activity at Pittini and increased activity at Feralpi and Ori Martin, the following procurement actions are recommended:

- Rebar Buyers: Capitalize on the current price decline in the Italian rebar market, as mentioned in “European longs market mostly stable, Italian rebar prices decline.” While a demand recovery is anticipated, proactive negotiation with suppliers may secure favorable terms, particularly from producers such as Pittini Siderpotenza, which has maintained stable, high activity levels.

- Plate Buyers: Given the difficulty producers are experiencing with price hikes, as highlighted in “Italian plate hikes fail amid sluggish post-holiday restart,” consider negotiating for stable prices, especially for S275 and S355 grades. Be aware of the three-week lead times and factor them into procurement planning.