From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Ukraine Export Decline Offset by Domestic Demand; Dillinger Hüttenwerke Activity Fluctuations

Europe’s steel market presents a mixed picture with Ukrainian export declines offset by increased domestic demand, while German steel production shows fluctuating activity. According to “Ukraine’s total steel exports down 13 percent in January-August 2025,” exports have decreased significantly, yet domestic sales have risen. Separately, “Steel production in Ukraine decreased by 6.1% YoY in August,” indicating continued volatility in Ukrainian output. No direct link between the Ukrainian news articles and satellite-observed activity changes at specific European steel plants can be established with the available data.

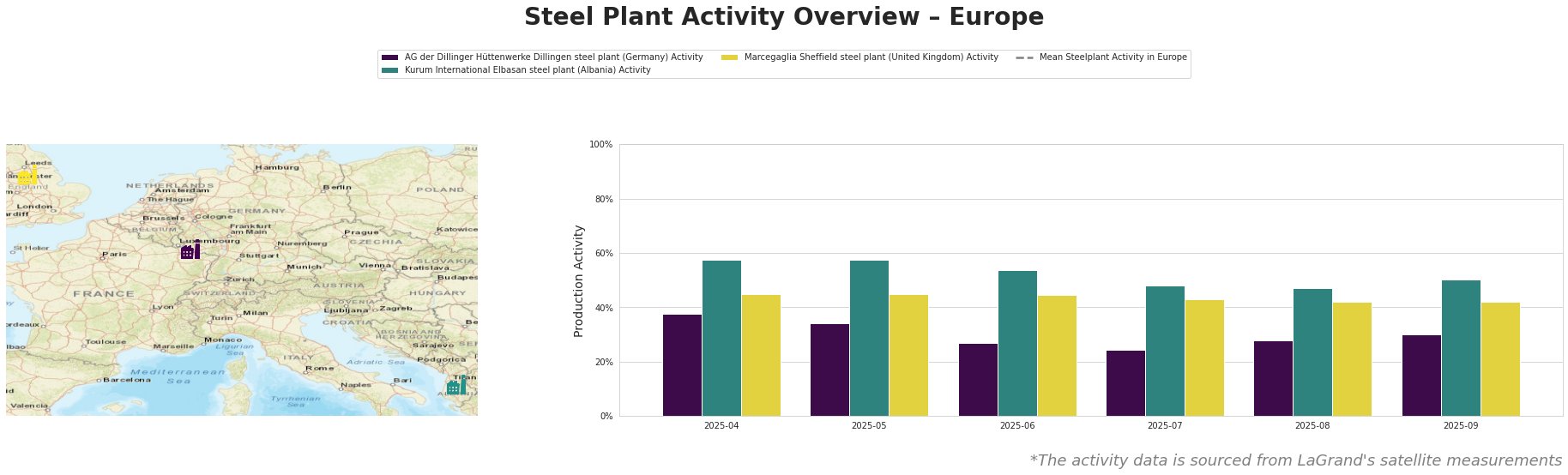

Observed activity levels across the measured European steel plants indicate fluctuations. The “Mean Steelplant Activity in Europe” varies, with peaks in May, July, and August. AG der Dillinger Hüttenwerke shows a decline from April (38%) to July (24%), followed by a slight recovery to 30% in September. Kurum International Elbasan steel plant exhibits a steady decline from April (58%) to August (47%), with a slight increase to 50% in September. Marcegaglia Sheffield steel plant shows a slight decrease from April (45%) to September (42%).

AG der Dillinger Hüttenwerke, a major integrated steel plant in Germany with a crude steel capacity of 2.76 million tonnes via the BOF process, produces high-quality heavy-plate products for diverse sectors. The plant’s activity dropped from 38% in April to a low of 24% in July, subsequently recovering to 30% by September. No direct connection between this activity fluctuation and any of the provided news articles can be established.

Kurum International Elbasan steel plant in Albania, an EAF-based producer with a 700,000-tonne crude steel capacity, mainly manufactures iron and steel billets. Its activity declined steadily from 58% in April to 47% in August before a minor rebound to 50% in September. No direct connection between this trend and the provided news articles can be established.

Marcegaglia Sheffield, a UK-based EAF steel plant, produces slabs, blooms, billets, and ingots with a 500,000-tonne capacity. Its activity shows a slight decrease from 45% in April to 42% in September. No direct relationship between this marginal decline and any of the provided news articles is apparent.

Evaluated Market Implications:

The 13% decrease in Ukrainian steel exports reported in “Ukraine’s total steel exports down 13 percent in January-August 2025,” coupled with increased domestic consumption, suggests a potential shift in regional steel flows within Europe.

* Supply Disruption Potential: Reduced Ukrainian export volumes may lead to tighter supply conditions, particularly for flat steel products where exports decreased by 1%.

* Recommended Procurement Actions: Steel buyers who have relied on Ukrainian steel supply must secure alternative sources, prioritizing long steel, where Ukrainian exports are increasing. Buyers should also closely monitor the activity of other European plants to ensure stable supply. Given the observed fluctuations at Dillinger Hüttenwerke, buyers should diversify suppliers for heavy plate products.