From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China’s Green Investments Buoy Sentiment Despite Emission Concerns

Asia’s steel market shows positive sentiment amid China’s climate goals, though concerns about emissions persist. Recent news articles including “China could reduce emissions by 1.6 billion tons by 2030 – research” highlight potential emission cuts via green investments, but are tempered by articles such as “Xi Jinpings Klimaziele für China sind zu zaghaft“, raising concerns about the ambition of China’s climate targets. The impact of these factors on steel production is indirectly observed through satellite data, however, no direct relationship between plant activity and these news items could be established.

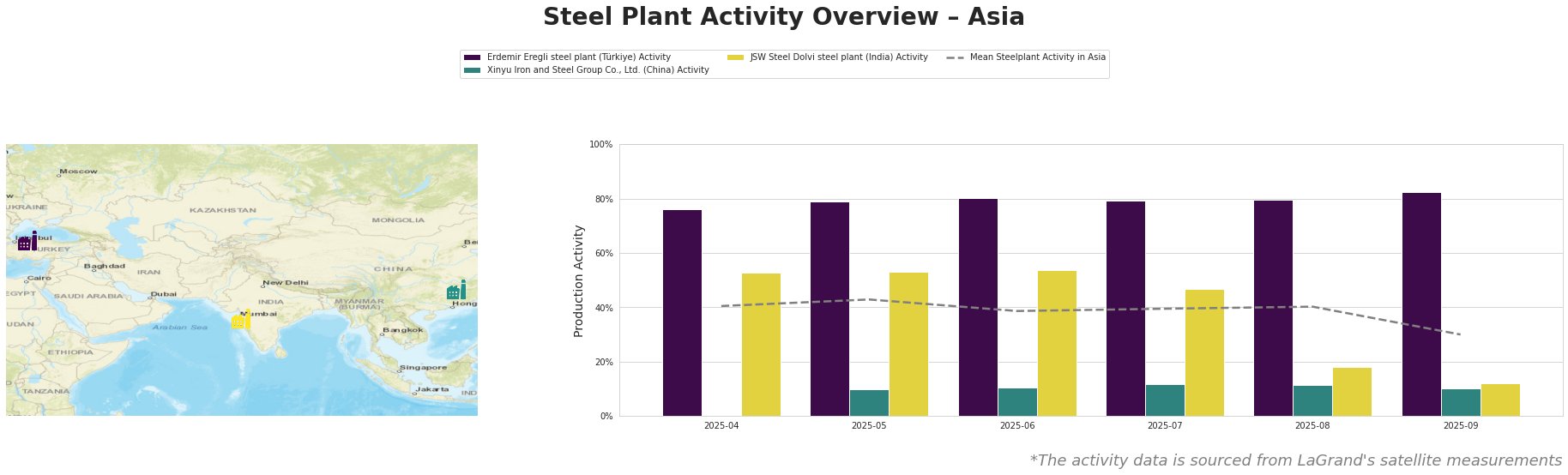

The mean steel plant activity in Asia has fluctuated, peaking at 43% in May 2025, then declining to 30% by September 2025.

Erdemir Eregli, an integrated (BF) steel plant located in Türkiye with a crude steel capacity of 4000 ttpa and significant BOF capacity, has shown consistently high activity, ranging from 76% to 82% over the observed period, and remains above the Asian average. The plant focuses on semi-finished and finished rolled products, serving sectors like automotive and building. No direct connection between the plant activity data and the news articles could be established.

Xinyu Iron and Steel Group Co., Ltd., a large integrated (BF) steel plant located in Jiangxi, China, with a crude steel capacity of 10000 ttpa, has demonstrated consistently low activity. The plant’s activity fluctuated between 10% and 12% between May and September 2025, significantly below the Asian average. The company mainly produces finished rolled products for the energy, building, and transport sectors. While the article “China could reduce emissions by 1.6 billion tons by 2030 – research” mentions limiting steel production as a key initiative, a direct link between this statement and Xinyu’s observed low activity level could not be conclusively established from the available data.

JSW Steel Dolvi, an integrated (BF and DRI) steel plant in Maharashtra, India, with a crude steel capacity of 5000 ttpa, has shown a significant activity drop from 53% in May to 12% in September 2025. JSW Steel Dolvi produces a range of products, including wire rods, bars, and specialty steel, serving sectors such as energy, building, and automotive. No direct connection between the sharp decrease in plant activity and the provided news articles could be established.

A potential supply disruption is indicated by the sharp activity drop at the JSW Steel Dolvi plant in India. Given this significant decline in activity, steel buyers who rely on JSW Steel Dolvi should proactively engage with the supplier to understand the reasons behind the production cut and explore alternative sourcing options to mitigate potential delays or shortages. Simultaneously, analysts should closely monitor JSW Steel Dolvi’s activities to identify any future impacts on steel price. Furthermore, it is suggested that buyers closely follow local Indian steel news and regulations for any insights.