From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Green Investments Signal Production Shifts Despite Climate Goal Concerns

China’s steel sector is undergoing changes driven by environmental targets and investments, as reflected in recent satellite-observed activity. Observed production trends cannot be tied conclusively to the announcements in “China could reduce emissions by 1.6 billion tons by 2030 – research,” which highlights potential emissions reductions through green investments, and to the arguments in “Xi Jinpings Klimaziele für China sind zu zaghaft“, “Xi Jinping vor den UN: Chinas doppelbödige Klimaziele“, and “Was von Chinas Klimazielen zu halten ist” articles critiquing the ambition and impact of China’s climate goals. While these articles suggest potential impacts on industrial production, direct links between specific plant activities and the policy discussions are difficult to ascertain.

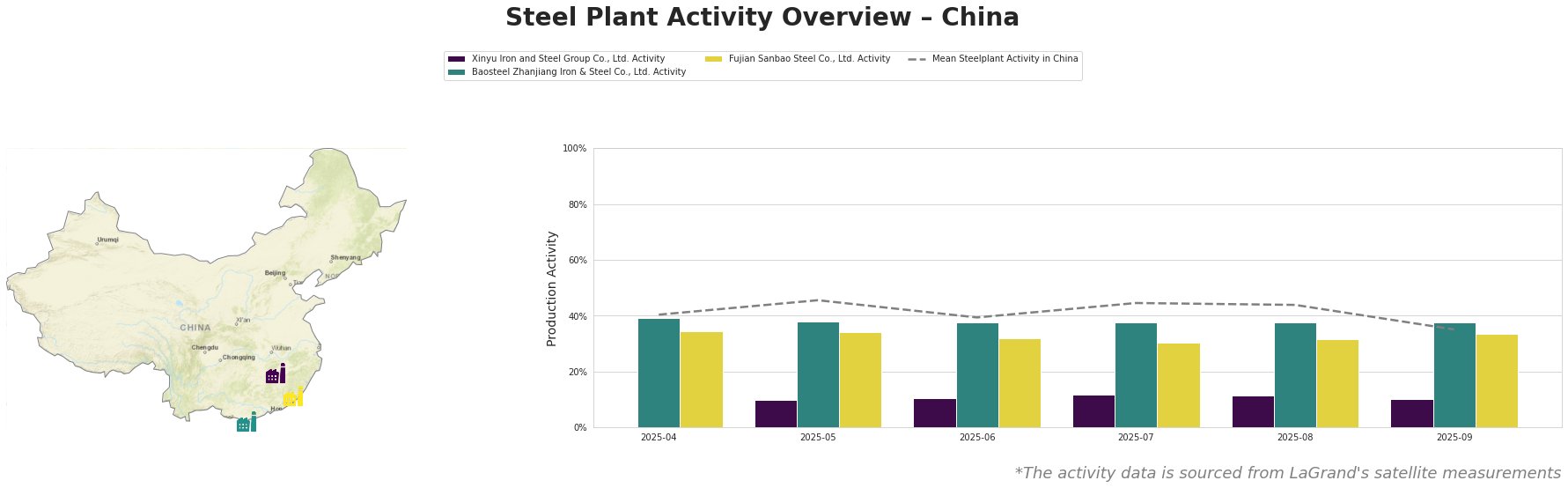

The mean steel plant activity in China fluctuated, peaking at 46.0% in May and then dropping to 35.0% in September. Xinyu Iron and Steel Group Co., Ltd. consistently operated at significantly lower activity levels compared to the national mean, ranging from 10.0% to 12.0%. Baosteel Zhanjiang Iron & Steel Co., Ltd. maintained a stable activity level of 38.0% throughout the observed period. Fujian Sanbao Steel Co., Ltd. showed a slight decrease from 34.0% in April and May to 30.0% in July, before recovering to 33.0% in September.

Xinyu Iron and Steel Group Co., Ltd., located in Jiangxi, has a crude steel capacity of 10,000 ttpa, primarily utilizing basic oxygen furnace (BOF) technology and a smaller electric arc furnace (EAF). Satellite data indicates consistently low activity (10.0%-12.0%), substantially below the national average, suggesting potential production curtailments. While “China could reduce emissions by 1.6 billion tons by 2030 – research” mentions limiting steel production as a key initiative, no direct causal link can be confirmed between the reported policy goals and the observed activity levels at Xinyu Iron and Steel.

Baosteel Zhanjiang Iron & Steel Co., Ltd., based in Guangdong, boasts a crude steel capacity of 12,528 ttpa, relying on BOF technology and hydrogen-based shaft furnace with a capacity of 1 million tonnes. The plant demonstrates consistent satellite-observed activity at 38.0%, indicating stable production levels. Although this plant also features a Hydrogen based shaft furnace, the articles critiquing China’s climate goals do not allow any conclusions related to production activities.

Fujian Sanbao Steel Co., Ltd., situated in Fujian, has a crude steel capacity of 4,620 ttpa, using both BOF and EAF technologies. Activity levels fluctuated, initially at 34.0% and then declining to 30.0% before a slight recovery. Since all three plants have ResponsibleSteelCertification, this may indicate that there are greater external pressures on the plants to adhere to environmentally conscious production methods.

Given the low activity levels at Xinyu Iron and Steel, potential buyers relying on this plant for medium, thick, and extra thick plates should secure alternative suppliers. The stable production at Baosteel Zhanjiang Iron & Steel suggests a reliable source for hot rolled plates, cold rolled sheets, and hot-dip galvanized plates. Because of the relatively stable production at Fujian Sanbao Steel, current supply relationships should not need to be altered, but potential buyers should remain cognizant of price fluctuations.