From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market Faces Production Cuts Amidst German Decline, Italy Shows Mixed Signals

In Europe, the steel market sentiment remains negative as German steel production continues to decline, contrasting with mixed signals from Italy. The observed trends potentially lead to supply disruptions and require immediate attention from steel procurement professionals. The decline can be explicitly linked to the news article “Germany reduced steel production by 10.5% y/y in August” and “German crude steel output down 11.9 percent in January-August 2025“. The news article “Italian crude steel production up 7.3 percent in August 2025” indicates a production increase; however, the news article “Italy reduced steel production to an annual low in August” states that Italian steel production reached an annual low in August 2025. No explicit links can be established between these news articles and the satellite-observed activity data.

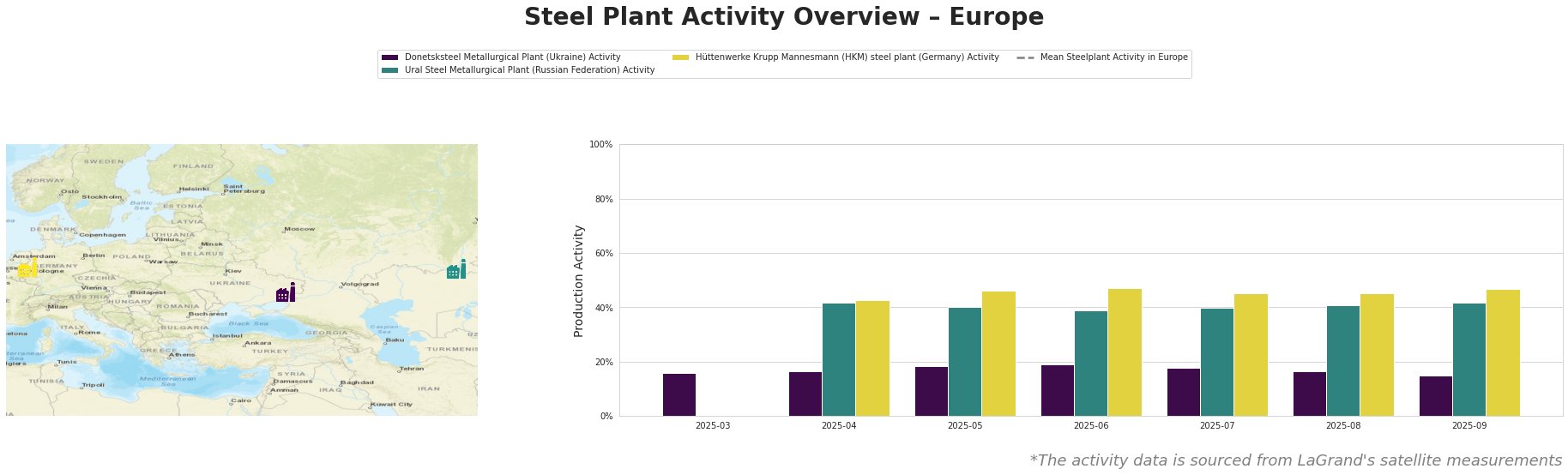

The mean steel plant activity in Europe shows considerable fluctuations over the observed period, with high values in March, May, July, and August, and drops in April, June, and September. Donetsksteel Metallurgical Plant shows relatively stable activity, fluctuating between 15% and 19%. Ural Steel Metallurgical Plant’s activity ranges between 39% and 42%, showing a minor upward trend, while Hüttenwerke Krupp Mannesmann (HKM) steel plant maintains consistent activity, ranging from 43% to 47%. Overall, Ural Steel Metallurgical Plant and Hüttenwerke Krupp Mannesmann (HKM) steel plant show activity levels significantly above the Donetsksteel Metallurgical Plant. No direct connections could be established between the observed monthly activity fluctuations and the named news articles.

Donetsksteel Metallurgical Plant, located in Donetsk and operating using integrated (BF) processes and EAF technology, displays a slight decrease in activity, from 19% in June 2025 to 15% in September 2025. It specializes in pig iron production. This decline cannot be directly linked to the provided news articles.

Ural Steel Metallurgical Plant, situated in the Orenburg region and also operating an integrated (BF) process and EAF technology, saw relatively stable activity ranging between 39% and 42% during the observed period, with a slight increase towards the end. Ural Steel produces crude, semi-finished, and finished rolled steel products, including pig iron and flat products, serving the building, infrastructure, and transport sectors. This stable trend occurs while the article “Germany reduced steel production by 10.5% y/y in August” and “German crude steel output down 11.9 percent in January-August 2025” reports on Germany’s decline, suggesting regional divergence in steel production trends.

Hüttenwerke Krupp Mannesmann (HKM) steel plant in Germany, also operating an integrated (BF) process and BOF technology, experienced relatively stable activity between 43% and 47% during the observed period, peaking in June and September 2025. HKM produces crude, semi-finished, and finished rolled steel products. The HKM plant has a crude steel capacity of 6000 ttpa. Given the overall German decline in steel production reported in “Germany reduced steel production by 10.5% y/y in August” and “German crude steel output down 11.9 percent in January-August 2025“, the relatively stable observed activity at HKM warrants closer scrutiny to assess its potential impact on regional supply dynamics.

The observed decline in German steel production, coupled with mixed signals from Italy, creates potential supply disruptions within the European market. Specifically, the German decline reported in “Germany reduced steel production by 10.5% y/y in August” and “German crude steel output down 11.9 percent in January-August 2025“, warrants the following actions for steel buyers and analysts:

- Diversify Sourcing: Given the German decline, steel buyers should actively diversify their sourcing strategies to mitigate risks associated with potential supply shortages from German producers. Consider increasing procurement from alternative sources within Europe and globally.

- Monitor HKM Activity: Closely monitor the activity of Hüttenwerke Krupp Mannesmann (HKM) steel plant. While German steel production is declining overall, the activity at this plant warrants close observation to ascertain whether it can mitigate overall supply concerns.

- Prioritize Long-Term Contracts: Secure long-term contracts with steel suppliers outside of Germany to ensure a stable supply chain.

- Factor in Transport Costs: Consider logistical implications and transport costs when evaluating alternative sourcing options to maintain cost-effectiveness.