From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia Steel Market: Green Incentives and CBAM Impact Drive Tata Steel Stability Amidst Arjas Downturn

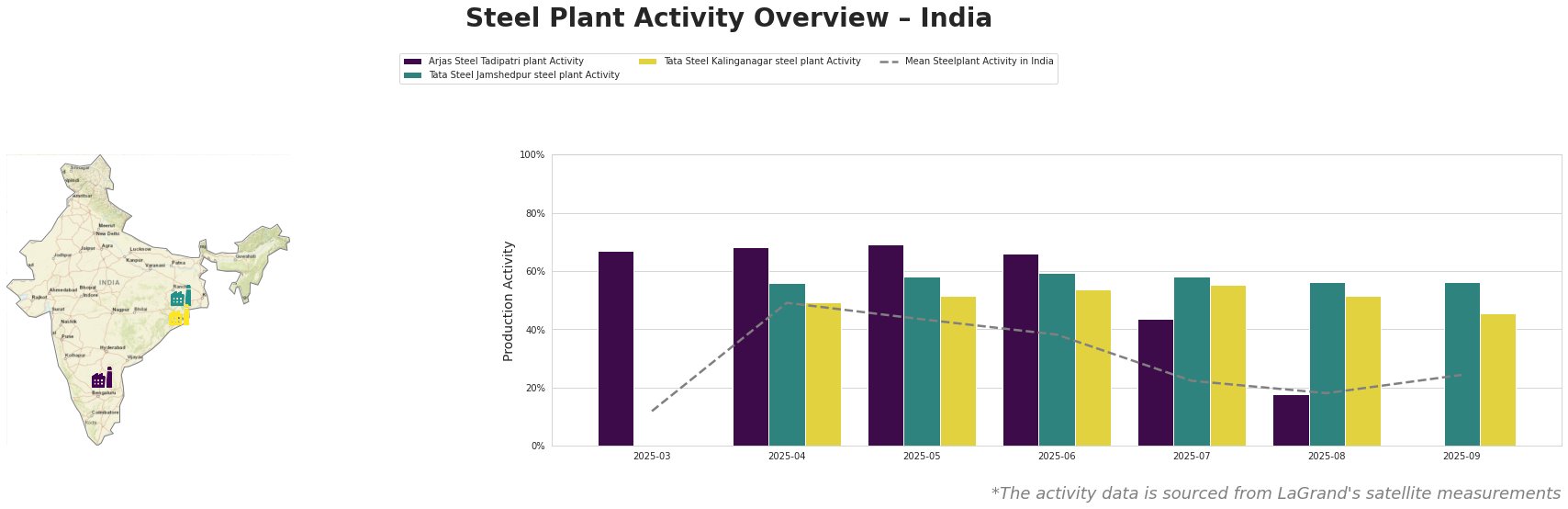

India’s steel sector is navigating the challenges and opportunities presented by CBAM and green steel initiatives. Steel plant activity levels show diverging trends across the country. Activity levels at Arjas Steel Tadipatri saw a significant drop, however, a link to the news article “CBAM will affect steel exports from India much more than US tariffs – minister” cannot be directly established from the provided information. Activity at Tata Steel plants has remained relatively stable.

Here’s a summary of India’s observed steel plant activity:

The mean steel plant activity in India fluctuated between 12% and 49% from March to April, then generally declined to 18% in August, before increasing again to 24% in September. Arjas Steel Tadipatri plant activity started high (67%-69% from March to May), then declined steadily and drastically to 0% in September. In contrast, Tata Steel Jamshedpur shows a stable activity in the range of 56%-59%. The Tata Steel Kalinganagar plant shows more variation, with values between 45% and 55%.

Arjas Steel Tadipatri plant

Arjas Steel Tadipatri, located in Andhra Pradesh, is an integrated steel plant with a crude steel capacity of 325 ttpa utilizing BF-BOF technology. While certified for ISO 14001 and ISO 50001, its reliance on blast furnace technology makes it particularly vulnerable to CBAM, as highlighted in “CBAM will affect steel exports from India much more than US tariffs – minister”. The plant’s activity experienced a sharp decline, dropping from 67% in March to 0% in September, significantly underperforming the national mean. This significant drop could potentially be linked to the Indian government’s strategy to focus on secondary steel mills and its impact on steel production. Although no direct connection can be made, it is conceivable that plant management are reevaluating their production strategy in light of the upcoming incentives and CBAM challenges.

Tata Steel Jamshedpur steel plant

Tata Steel’s Jamshedpur plant in Jharkhand, boasting a crude steel capacity of 10,000 ttpa using BF-BOF methods, demonstrates consistent activity, hovering around 56%-59% throughout the observed period. The plant uses captive iron ore mines. Despite its integrated BF-BOF process potentially leading to higher emissions, as discussed in “CBAM will affect steel exports from India much more than US tariffs – minister”, no immediate activity reduction is observed. No direct link can be established between the news articles and plant activity.

Tata Steel Kalinganagar steel plant

The Tata Steel Kalinganagar plant in Odisha, with a 3,000 ttpa crude steel capacity via BF-BOF process, shows a more variable activity pattern, ranging from 45% to 55%. Despite being ResponsibleSteel certified, this plant also utilizes BF-BOF technology, and as such, is exposed to CBAM as highlighted in “CBAM will affect steel exports from India much more than US tariffs – minister”. No direct activity impact is evident from the news provided.

Evaluated Market Implications

The observed decline in activity at Arjas Steel Tadipatri, coupled with India’s focus on green steel initiatives, suggests potential shifts in regional steel supply. The focus on secondary steel mills outlined in “India to direct 80 percent of green steel incentives to secondary mills” could lead to some disruption in the supply of long products from integrated BF-BOF mills.

Procurement Actions:

- Steel Buyers focused on bars, squares, profiles, and rounds: Closely monitor the Arjas Steel Tadipatri plant’s future production announcements and diversify supplier base to mitigate potential disruptions.

- Steel Analysts: Track the impact of the ₹5,000 crore ($602 million) green steel scheme on secondary steel producers and assess how it affects the competitive landscape, especially regarding supply of finished and semi-finished long products. Track the progress of the Indian government’s green steel certification, considering that, as reported in the news article “CBAM will affect steel exports from India much more than US tariffs – minister”, 39 manufacturers have already applied by July 2025.

- Steel Buyers in Europe: Monitor the progress of Jindal Steel’s bid to buy Thyssenkrupp Steel Europe, as described in the article “Jindal Steel submits offer to acquire Thyssenkrupp steel business in Germany”, along with information contained in “Jindal’s bid to buy TK Steel Europe highlights CBAM, which offers 2 billion euros in green investments.“ If the acquisition is successful, it will indicate that supplies from Jindal will be CBAM-compliant in the future.