From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: China Production Cuts Offset by Rebar Surge; Nagarnar Plant Ramps Up

Asia’s steel market presents a mixed outlook. While overall Chinese steel production is down, rebar output has increased, potentially impacting regional supply dynamics. The “China cut steel production to a 9-month low in August” and “China’s crude steel output below 80 million mt again in August, down 2.8% in Jan-Aug 2025” articles directly correlate with satellite-observed activity, reflecting production limits and weakening demand. However, the article “China’s rebar output up 0.3 percent in January-August 2025” indicates a contrasting trend. These articles highlight domestic pressures and hint at increased exports into the region, which are confirmed by the “China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025” news.

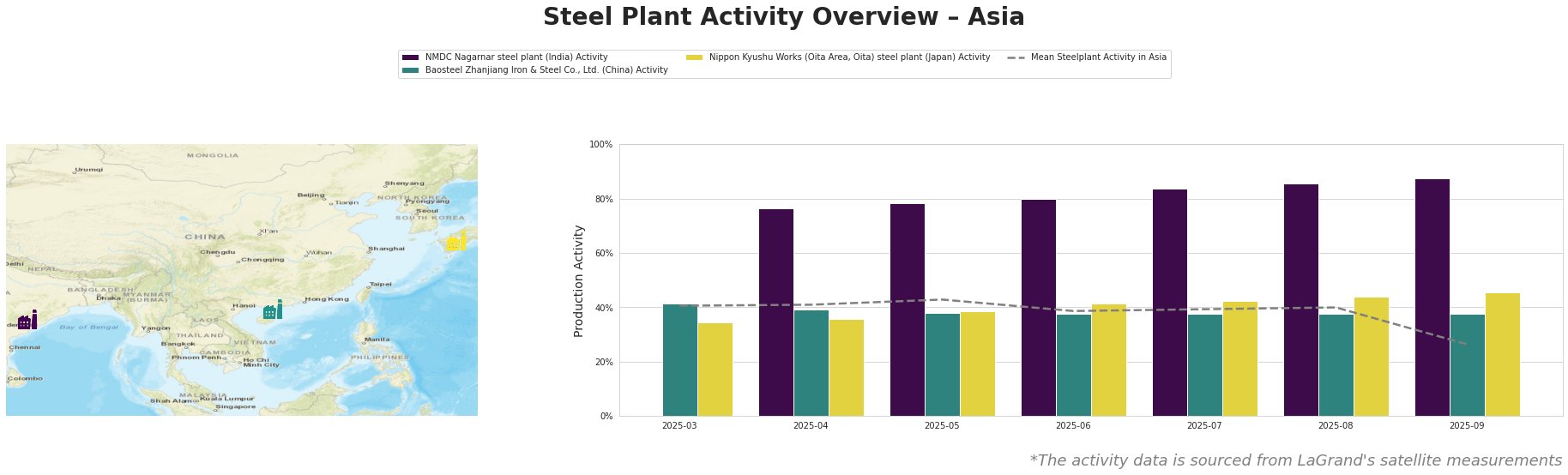

The mean steel plant activity in Asia fluctuated between 39% and 43% from April to August, before experiencing a significant drop to 26% in September. NMDC Nagarnar steel plant exhibits a consistently rising activity level from 76% in April to a high of 88% in September, significantly exceeding the mean activity. Baosteel Zhanjiang Iron & Steel Co., Ltd. shows stable activity around 38-42%, while Nippon Kyushu Works steadily increases from 35% in March to 45% in September. The drop in overall mean activity in September has no direct connection to the given news articles.

NMDC Nagarnar steel plant in Chhattisgarh, India, an integrated BF-BOF plant with a 3 million tonne crude steel capacity focused on hot rolled coils, sheets, and plates for automotive and infrastructure sectors, displays a significant and consistent activity increase from 76% in April to 88% in September. This indicates a ramp-up in production. There is no direct connection to the provided news articles.

Baosteel Zhanjiang Iron & Steel Co., Ltd., located in Guangdong, China, is a major integrated steel producer with a 12.5 million tonne crude steel capacity. Its activity remained stable at around 38% from May to September. This stability somewhat contrasts with the broader production cuts reported in “China cut steel production to a 9-month low in August” and “China’s crude steel output below 80 million mt again in August, down 2.8% in Jan-Aug 2025,” suggesting that this plant may be operating at a more consistent level despite the overall downturn.

Nippon Kyushu Works (Oita Area, Oita) steel plant in Kyūshū, Japan, with a 10 million tonne crude steel capacity and a focus on hot rolled steel sheets and steel plates, showed a steady increase in activity from 35% in March to 45% in September. This indicates a gradual increase in production. There is no direct connection to the provided news articles.

Evaluated Market Implications:

The decrease in overall Chinese steel production, documented in “China cut steel production to a 9-month low in August”, alongside the slight drop in sheet/plate exports (“China’s steel sheet/plate exports down significantly in Aug, almost stable in Jan-Aug 2025”), implies potential supply constraints for these products in the Asian market in the short term. However, the concurrent increase in rebar production (“China’s rebar output up 0.3 percent in January-August 2025”) suggests a potential oversupply of rebar, possibly leading to increased exports and price competition in that segment.

Recommended Procurement Actions:

- Steel Buyers focused on Sheet and Plate: Given the production cuts in China as well as decreased exports to the US (“US iron and steel scrap exports down 0.7 percent in July 2025” and “US steel exports up 0.8 percent in July 2025“), prioritize securing contracts with steel plants outside of mainland China, such as NMDC Nagarnar steel plant (India) and Nippon Kyushu Works (Oita Area, Oita) steel plant, which show increased activities.

- Steel Buyers focused on Rebar: Given the increased rebar production in China, anticipate downward pressure on rebar prices in the region and consider negotiating more favorable terms with suppliers. Closely monitor Chinese rebar export volumes for opportunities to diversify sourcing.

- Market Analysts: Closely monitor NMDC Nagarnar steel plant’s hot rolled coil, sheet, and plate production for opportunities. Also, track the effects of increased Chinese rebar output on global prices, as well as the increased activity in the Nippon Kyushu steel plant.