From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Jindal’s Expansion & Oman DRI Boost Signal Positive Outlook Despite Activity Dip

Asia’s steel market shows a generally positive outlook, driven by expansion plans and investments in green steel production. “Jindal Steel has ordered a second direct reduction plant for its project in Oman“ signals increasing DRI capacity that could impact regional supply dynamics. However, recent activity level fluctuations require careful monitoring, with no explicit connection to the named news articles.

The positive sentiment is further fueled by “India’s Jindal bids for ThyssenKrupp Steel Europe“ and “Jindal Steel prepared to continue thyssenkrupp’s green transformation“, highlighting Jindal’s ambitions to become a major player in low-emission steel production. While these European developments do not directly impact current Asian steel plant activity, they indicate Jindal’s overall expansion strategy and potential future influence on the Asian market. There is no direct correlation established between these news articles and the observed steel plant activity data.

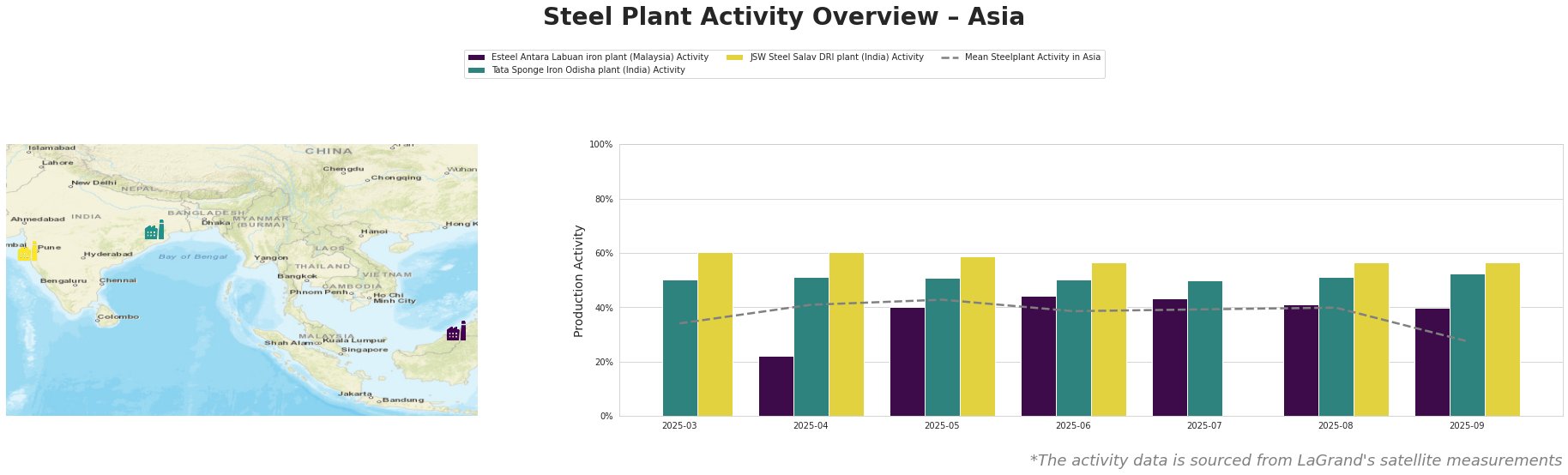

The mean steel plant activity in Asia shows a decrease to 28% in September from a high of 43% in May. Esteel Antara Labuan iron plant in Malaysia, a DRI facility with a 900ktpa capacity, shows an activity level of 40% in September. The Tata Sponge Iron Odisha plant in India, a 400ktpa DRI plant, shows increased activity of 53% in September. The JSW Steel Salav DRI plant, with a 1000ktpa DRI capacity, exhibited stable activity at 57% in September. This activity data has no explicit relationship to the provided news.

Esteel Antara Labuan iron plant (Malaysia), a 900ktpa DRI facility producing HBI, demonstrated fluctuating activity, peaking at 44% in June before settling at 40% in September. There is no direct link to the named news articles that can explain this trend. Tata Sponge Iron Odisha plant (India), with a 400ktpa DRI capacity, experienced a slight increase in activity to 53% in September. This facility uses waste heat for power generation. There is no connection to the news articles. JSW Steel Salav DRI plant (India), a 1000ktpa DRI/HBI producer, maintained a relatively stable activity level around 57% in recent months. There is no news article that explicitly explains this activity.

The order of a second DRI plant in Oman, detailed in “Jindal Steel has ordered a second direct reduction plant for its project in Oman,” suggests a future increase in DRI supply to the Asian market. This could potentially put downward pressure on DRI prices, especially if Jindal Steel successfully acquires ThyssenKrupp, as it indicates a larger, more integrated global supply chain. Given the increased activity level at the Tata Sponge Iron Odisha plant and the stable level at JSW Steel Salav DRI plant, steel buyers should secure DRI supply agreements in the short-term, but carefully monitor DRI price developments as the Oman project progresses towards completion. These actions could help mitigate short-term supply concerns and take advantage of potential price decreases in the future.