From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineIndia’s Trade Deal Momentum Fuels Optimism in Asian Steel Market: Plant Activity Mixed

India’s proactive trade negotiation strategy, evidenced by the news articles “India, EU Move Closer To FTA Conclusion, Next Round In October,” “US Negotiators In India To Revive Trade Deal Talks Amid Trump Tariff Overhang,” “Trade Talks ‘Positive’, Says US Embassy After Chief Negotiator Lynch Meets Indian Counterparts,” “India, Eurasian Economic Commission To Start Trade Talks Early November,” “Trade Agreements With US And EU Next Big Steps For India’s Growth, Says Arvind Panagariya,” and “India, New Zealand To Hold Next Round Of Trade Talks In October,” signals a positive outlook for regional steel demand. However, satellite-observed steel plant activity across Asia shows a mixed picture, with no direct link to the above-mentioned news articles at this time.

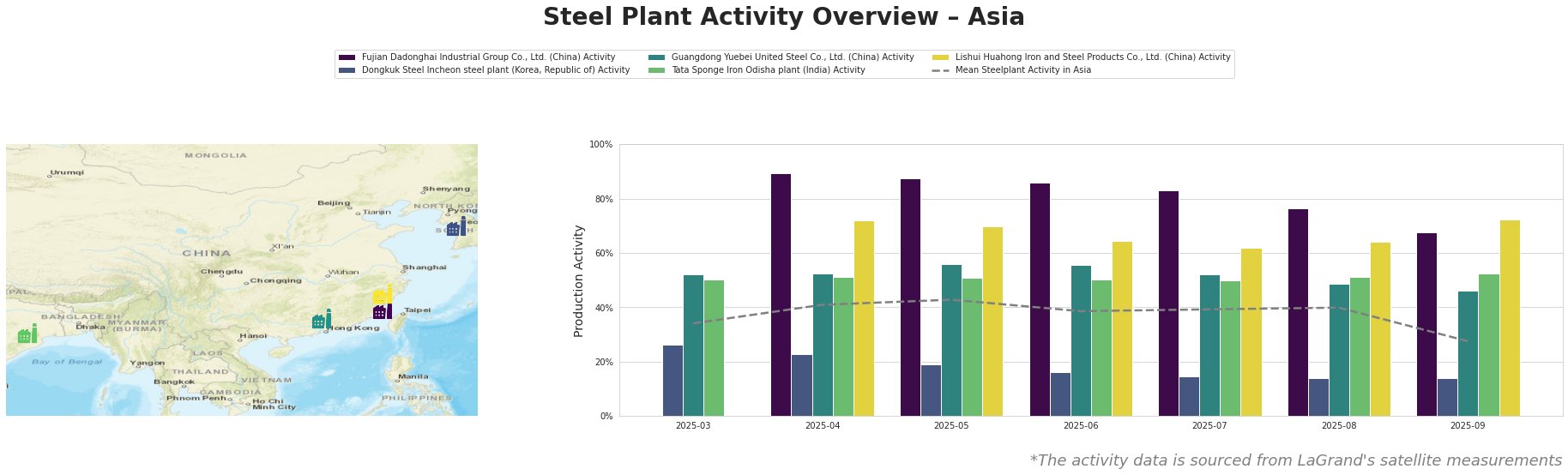

The mean steel plant activity in Asia dropped significantly in September to 28%, after hovering around 40% in previous months.

Fujian Dadonghai Industrial Group Co., Ltd., a Chinese integrated BF steel producer with a 2.2 million tonne crude steel capacity specializing in rebar production, saw a consistent decline in activity from a high of 90% in April to 68% in September. This represents a 22% activity decrease, but no direct relationship to the provided news articles could be established.

Dongkuk Steel Incheon steel plant, a South Korean EAF-based rebar producer with a 2.2 million tonne capacity, experienced a consistent decline in activity, stabilizing at 14% since July. This is significantly below the regional average. No direct link to the news on trade deals can be established.

Guangdong Yuebei United Steel Co., Ltd., another Chinese steel plant with integrated BF and EAF production, and a crude steel capacity of 2 million tons, produces rebar for building and infrastructure. The plant’s activity levels decreased from 56% in June to 46% in September. This is a moderate decrease compared to other plants in the region. There is no clear connection to the cited news articles.

Tata Sponge Iron Odisha plant, an Indian DRI-based iron producer with a 400,000-tonne capacity, maintained a relatively stable activity level around 50%, with a slight increase to 53% in September. This stability contrasts with the volatility seen in other plants. No direct relationship to the provided news articles is evident.

Lishui Huahong Iron and Steel Products Co., Ltd., a Chinese EAF-based rebar producer, experienced fluctuating activity. While it showed a decrease from April to July, it peaked again in September at 72%. No direct link to news on trade agreements could be found.

The observed decrease in activity at Fujian Dadonghai and Guangdong Yuebei, alongside the consistently low levels at Dongkuk Steel, suggests a potential contraction in steel supply, particularly for rebar. Given the positive momentum in India’s trade negotiations, this could create opportunities for Indian steel producers, as highlighted by “Trade Agreements With US And EU Next Big Steps For India’s Growth, Says Arvind Panagariya“.

Recommended Procurement Actions:

- Steel Buyers: Closely monitor rebar prices, especially in regions served by Fujian Dadonghai, Guangdong Yuebei, and Dongkuk Steel Incheon. Consider diversifying suppliers and exploring opportunities with Indian steel producers.

- Market Analysts: Track the impact of India’s trade deals on steel demand and prices, specifically focusing on rebar, given the potential supply constraints indicated by the satellite data.