From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEgypt’s Steel Safeguards & Libyan Plant Downtime: Africa Steel Market Update

Egypt’s imposition of safeguard duties impacts the flat and billet steel markets, while satellite data reveals a recent activity drop at Libya’s Misrata plant. The implementation of these duties is directly related to the news articles “Egypt protects domestic flat steel industry with 13.6% safeguard duty,” “Egypt has imposed a temporary duty on imports of hot-rolled steel at 13.6%,” “Egypt Imposes Temporary Safeguard Duties of 13.6% on Hot-Rolled Steel Imports,” and “Egypt’s provisional safeguard duty for import billet shocks the market as supplies are to drop significantly.” However, these news items provide no direct explanation for observed changes at the Libyan Iron and Steel Misrata plant.

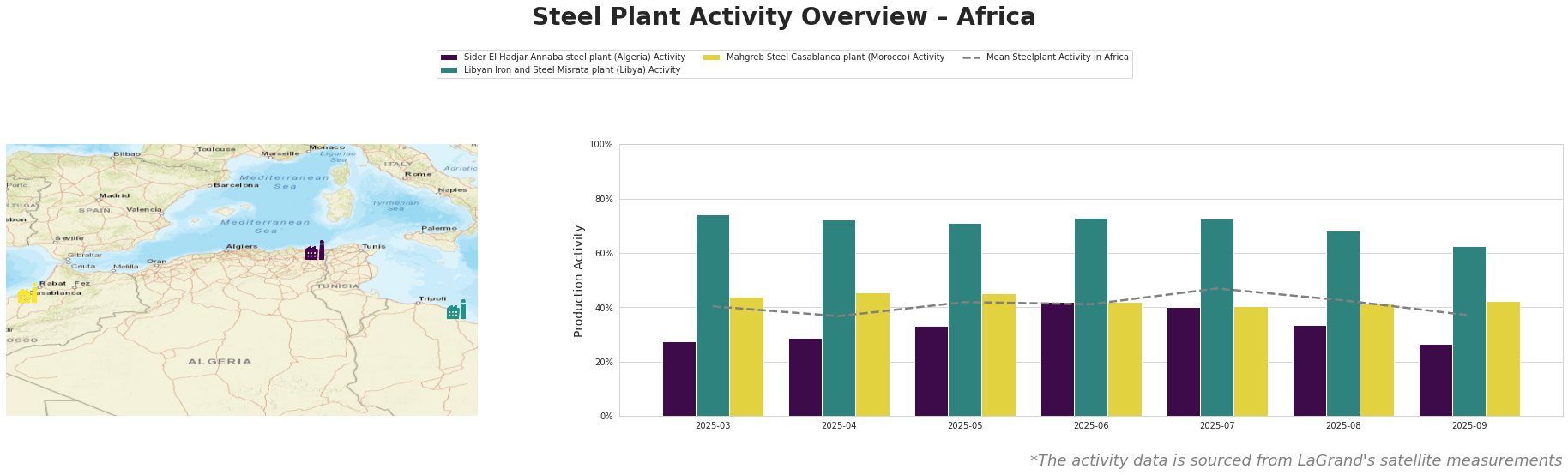

Observed steel plant activity across selected African plants is detailed below:

The Mean Steelplant Activity in Africa shows fluctuations, peaking in July at 47.0% and dropping to 37.0% in September. Sider El Hadjar Annaba steel plant (Algeria) activity peaked in June at 42.0% and declined to 27.0% in September, consistently below the mean. Libyan Iron and Steel Misrata plant (Libya) showed the highest activity levels, with a peak between March and July (71.0% – 74.0%), but experienced a notable drop to 63.0% in September. Mahgreb Steel Casablanca plant (Morocco) has remained relatively stable between 40.0% – 46.0%, but has been below average for the region.

Sider El Hadjar Annaba, Algeria, is an integrated steel plant using BF and EAF technologies with a crude steel capacity of 1.8 million tonnes per annum (ttpa), producing semi-finished and finished rolled products, including hot-rolled coils, sheets, and rebar. The plant’s activity was consistently below the regional average and experienced a significant drop to 27.0% in September. No direct relationship could be established between this activity drop and any of the provided news articles.

Libyan Iron and Steel Misrata, Libya, an integrated steel plant utilizing DRI and EAF technologies with a crude steel capacity of 1.75 million ttpa, produces a range of products from HBI to long and flat steel products. Activity at the Misrata plant was consistently high relative to the regional average but dropped to 63.0% in September. This decline in activity does not align directly with any of the provided news articles.

Mahgreb Steel Casablanca, Morocco, operates an EAF-based plant with a crude steel capacity of 1 million ttpa, focusing on flat steel products such as hot-rolled, cold-rolled, and galvanized steel, targeting the automotive, construction, and energy sectors. The plant’s activity remained relatively stable and near the regional average throughout the period. No direct link could be established between the plant’s performance and the provided news articles.

Egypt’s new safeguard duties, as reported in “Egypt protects domestic flat steel industry with 13.6% safeguard duty,” “Egypt has imposed a temporary duty on imports of hot-rolled steel at 13.6%,” “Egypt Imposes Temporary Safeguard Duties of 13.6% on Hot-Rolled Steel Imports,” and “Egypt’s provisional safeguard duty for import billet shocks the market as supplies are to drop significantly,” are anticipated to curtail imports, especially from Russia and Donbass, Ukraine, directly impacting billet supplies. The safeguard on HRC will raise prices, potentially closing the market for HRC imports. The drop in activity observed at the Libyan Iron and Steel Misrata plant in September might indicate a potential supply issue of HBI in the region, but no direct connection between the Egyptian safeguards and Misrata plant production can be established.

Evaluated Market Implications:

The Egyptian safeguard duties are likely to cause supply disruptions, particularly in HRC and billet imports. Given the increased costs of imported HRC due to the new duty, steel buyers dependent on these imports should secure alternative supplies and consider domestic sources. For billet buyers, the duties may lead to reduced availability, particularly from traditional suppliers like Russia. They should proactively diversify their supply base and assess the impact on rebar prices. Buyers who were sourcing HRC from Russia and China will need to find alternative sources, which may require adjusting to higher prices or exploring new trade relationships. Given the uncertainty, steel market analysts should closely monitor price fluctuations in Egypt and neighboring countries to understand the full market impact of the safeguard duties.