From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Demand Concerns Amid CBAM Uncertainty, Plant Activity Fluctuations

Europe’s steel market is exhibiting a pessimistic outlook, as evidenced by the “European longs market stable to lower amid pessimistic mood,” coupled with concerns over the Carbon Border Adjustment Mechanism (CBAM), highlighted in the “UK Metals Expo: Concerns remain over CBAM understanding” and “UK Metals Expo: Concerns remain about understanding CBAM” news articles. While a direct causal link between these news events and satellite-observed plant activity cannot be definitively established, the market sentiment paints a picture of potential challenges for steel producers and consumers.

Monthly Plant Activity:

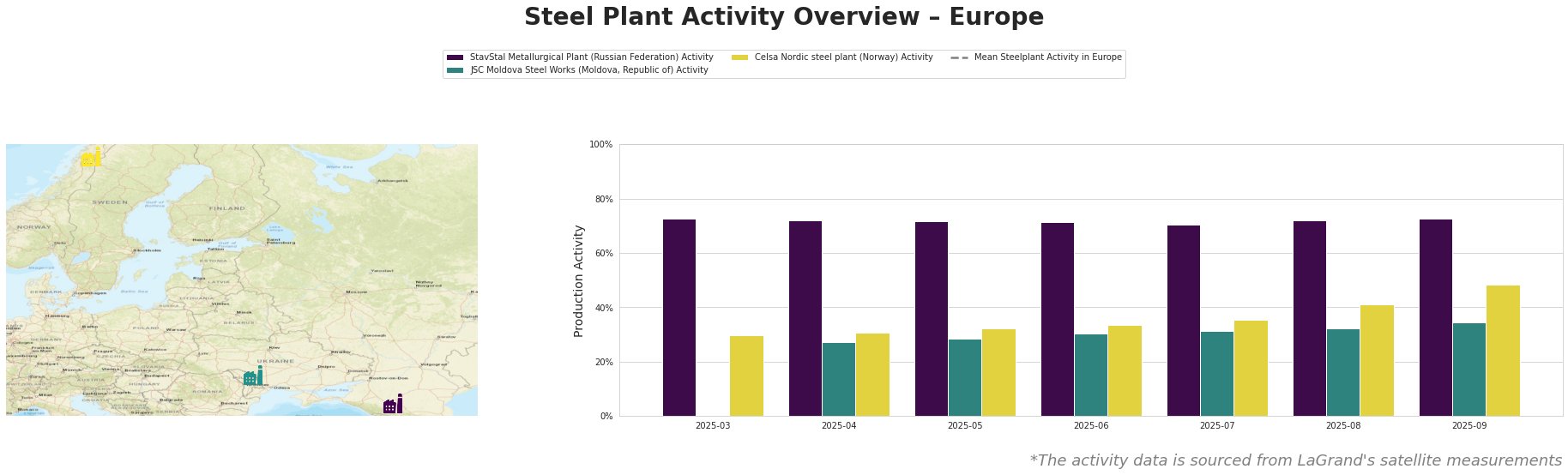

Overall, the mean steel plant activity in Europe shows considerable fluctuation throughout the period, with a notable drop in September 2025.

StavStal Metallurgical Plant, a Russian Federation-based EAF steel plant with a capacity of 500 ttpa producing rebar and wire rod, has maintained relatively stable activity levels, fluctuating between 70% and 73% over the observed period. There’s no direct connection between this stable activity and the mentioned news articles.

JSC Moldova Steel Works, an EAF-based plant in Transnistria with a 1000 ttpa capacity focusing on wire rod, rebar, and billet production, has seen a gradual increase in activity, from 27% in April to 34% in September. This upward trend doesn’t directly correlate with the negative sentiment expressed in the cited news articles.

Celsa Nordic steel plant in Norway, also an EAF-based producer with a capacity of 700 ttpa producing billet, rebar, and wire rod, has shown a more pronounced increase in activity, rising from 30% in March to 48% in September. This increase could be a localized response to specific regional demand, but no direct link to the news articles can be established.

Evaluated Market Implications:

The “European longs market stable to lower amid pessimistic mood,” combined with CBAM concerns raised at the UK Metals Expo (“UK Metals Expo: Concerns remain over CBAM understanding” and “UK Metals Expo: Concerns remain about understanding CBAM”), suggests potential downward pressure on European steel prices, particularly for long products. The lack of clarity surrounding CBAM’s implementation could further dampen demand as importers grapple with uncertain financial liabilities.

Procurement Actions:

- Steel Buyers: Given the downward pressure on prices indicated by the “European longs market stable to lower amid pessimistic mood” and uncertainty surrounding CBAM, steel buyers should consider negotiating shorter-term contracts to capitalize on potential price declines. Focus on suppliers with clear CBAM compliance strategies to mitigate potential cost increases related to carbon emissions.

- Market Analysts: Closely monitor CBAM implementation details and their impact on import costs. Track the correlation between CBAM-related announcements and European steel prices. Pay close attention to Q4 2025 activity levels across European EAF producers to understand how the lower average production activity translates to actual steel availability.