From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Exports Shift as Turkish Imports Surge: European Market Impact

Europe’s steel market faces evolving dynamics, driven by shifts in Ukrainian exports and rising Turkish imports. According to “The import of semi-finished products to Ukraine increased to almost 47 thousand tons,” Ukraine is experiencing a significant decrease in semi-finished carbon steel exports coupled with increased imports. This coincides with data from “Turkish steel exports to Ukraine grew by 36.1% y/y in January-August” highlighting Turkey’s growing influence in the Ukrainian market. Satellite data suggests a potential decoupling, showing varying plant activity levels that are not clearly correlated with these specific trade dynamics.

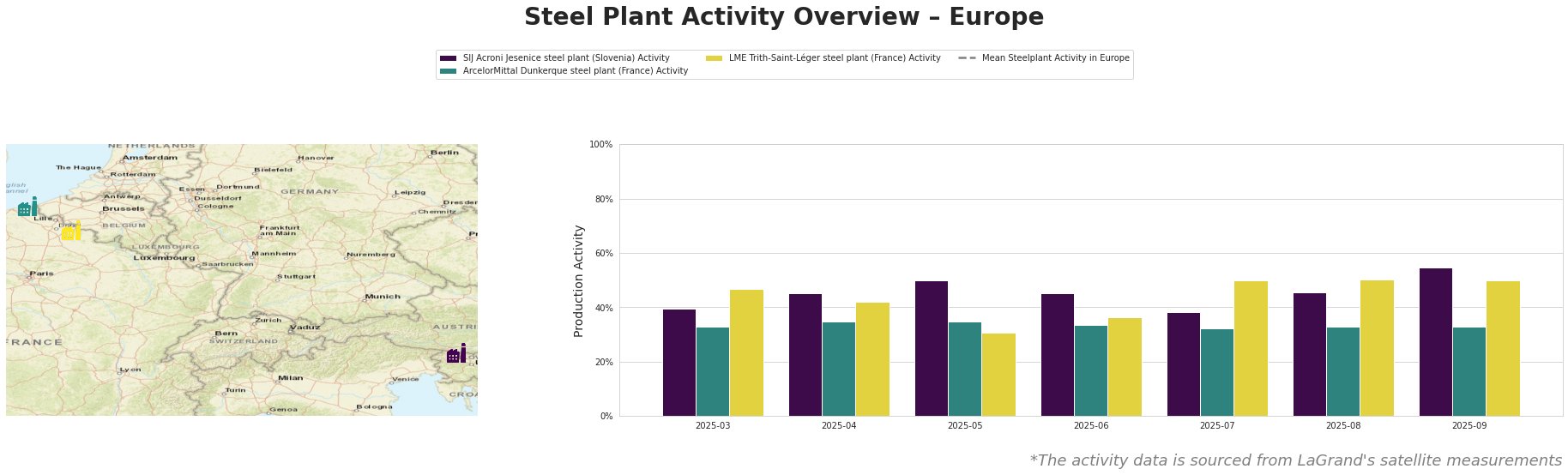

The average European steel plant activity experienced fluctuations, dropping in April and June, and then again in September to its lowest measured point.

- SIJ Acroni Jesenice steel plant (Slovenia): This EAF-based plant, producing mainly flat rolled steel, showed a peak activity in September (55%), rebounding from a low of 38% in July. This rise in activity does not appear to be directly correlated with any of the provided news articles on Ukrainian or Turkish trade flows.

- ArcelorMittal Dunkerque steel plant (France): This integrated BF-BOF plant, producing slabs and hot rolled products, exhibited a consistently low activity level, fluctuating narrowly between 32% and 35% over the observed period. No direct connection to the provided news articles can be established.

- LME Trith-Saint-Léger steel plant (France): This EAF-based plant, also producing slabs and hot rolled products, showed consistent activity levels, with a dip in May (31%) followed by increases to reach 50% in July, August and September. There is no direct connection can be established between the news articles and activity at this plant.

The shift in Ukraine’s steel trade landscape, as detailed in “The import of semi-finished products to Ukraine increased to almost 47 thousand tons” and “Turkish steel exports to Ukraine grew by 36.1% y/y in January-August,” has the potential to create procurement risks, but the plant activity data offers no immediate confirmation of the impact.

Evaluated Market Implications:

The increase in Turkish steel exports to Ukraine, coupled with a decrease in Ukrainian semi-finished product exports, may indicate a shift in supply dynamics within the region. However, satellite data shows no clear, direct impact on major steel plant activity levels in Europe.

Recommended Procurement Actions:

- Monitor Turkish Steel Prices: Given the increased Turkish steel exports to Ukraine as stated in “Turkish steel exports to Ukraine grew by 36.1% y/y in January-August,” procurement professionals should actively monitor Turkish steel prices to identify potential cost-saving opportunities. Focus on reinforcement bars and hot-rolled products, which lead Turkish exports.

- Diversify Ukrainian Supply Sources: Given the volatility in Ukrainian steel exports, especially in semi-finished products as outlined in “The import of semi-finished products to Ukraine increased to almost 47 thousand tons,” buyers reliant on Ukrainian steel should diversify their supply sources to mitigate potential disruptions. Consider Poland, Bulgaria, and Turkey, which are key destinations for Ukrainian exports according to the same article.