From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Faces Headwinds: Demand Slowdown and Production Adjustments Impacting Prices

Asia’s steel market is showing signs of contraction due to weakening demand and subsequent production adjustments. The observed decrease in steel plant activity correlates with economic concerns highlighted in “US consumer sentiment slips again in September, University of Michigan survey says“, which points to eroding purchasing power due to rising goods prices. While these are US-centric concerns, the interconnected nature of global markets may contribute to reduced demand for Asian steel exports. This introduction does not make a claim that the US consumer data is the cause of the decline in Asia; rather that is correlates with concerns which will impact overall global purchasing activity. The housing downturn reflected in “US single-family housing starts, building permits drop in August” further suggests weakened demand in key end-user sectors, however, no direct link can be explicitly established at this stage.

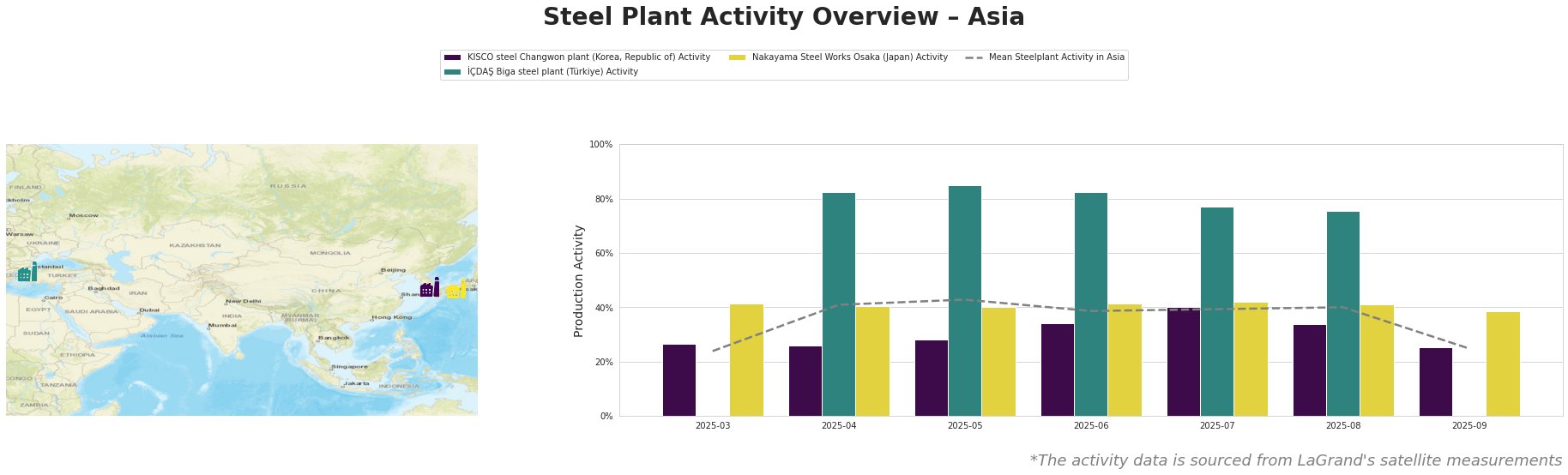

The mean steel plant activity in Asia shows a significant decline in September to 25.0%, down from approximately 40% in the preceding months. The KISCO steel Changwon plant shows relatively stable activity until September, when activity dipped to 25.0%. The İÇDAŞ Biga steel plant showed high activity from April to August, but no data is available for March or September. Nakayama Steel Works Osaka also exhibited relatively stable activity until September, experiencing a decrease to 38.0%.

KISCO steel Changwon plant, a South Korean EAF steel plant with a 3,000 ttpa crude steel capacity focused on rebar, forging, and billets for the building and energy sectors, has demonstrated a downward trend in activity. Peaking in July at 40%, its activity aligned with the average. However, the sharp drop to 25% in September coincides with the overall regional decline, potentially reflecting softening demand and correlating to the sentiment expressed in “US consumer sentiment slips again in September, University of Michigan survey says“.

İÇDAŞ Biga steel plant, a Turkish EAF steel plant with a 2,500 ttpa crude steel capacity producing various long products for construction, energy, and transportation, showed high activity levels between April and August, reaching 85% in May. However, the absence of data for September makes it impossible to determine if this plant also experienced a decline correlating with the mean or the sentiment echoed in “US consumer sentiment slips again in September, University of Michigan survey says“.

Nakayama Steel Works Osaka, a Japanese EAF steel plant with a 660 ttpa crude steel capacity focused on coil, plate, bars, and wire rods, experienced a slight but consistent decline in activity, dropping to 38% in September. This downturn may be indirectly linked to concerns around economic vulnerabilities as stated in “US consumer sentiment slips again in September, University of Michigan survey says“.

The observed drop in Asian steel plant activity, coupled with concerns around global economic conditions highlighted in “US consumer sentiment slips again in September, University of Michigan survey says” and the US housing market slowdown reported in “US single-family housing starts, building permits drop in August“, points to a potentially weakening demand environment.

Procurement Actions:

- Steel Buyers: Given the uncertainty and downward activity trend in Asia, buyers should negotiate shorter-term contracts and explore options for price hedging to mitigate risks associated with potential price volatility.

- Market Analysts: Closely monitor housing starts and building permits and consumer sentiment trends in regions that are export destinations for Asian steel. This may give advanced warning of future demand changes.