From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market Faces Production Cuts and Rising Inventories: Negative Outlook

China’s steel sector is experiencing a downturn, as indicated by recent news and satellite-observed activity. The core issue is declining steel production coupled with rising inventories. According to “China cut steel production to a 9-month low in August,” production limits in Tangshan and reduced output from electric arc furnaces are contributing factors. This aligns with satellite observations showing fluctuating activity levels across various steel plants. The article “Stocks of main finished steel products in China up 4.2 percent in early Sept 2025” further reinforces the negative sentiment, suggesting weakening demand. “China’s crude steel output below 80 million mt again in August, down 2.8% in Jan-Aug 2025” connects production cuts in specific regions (Tianjin and Tangshan) to an upcoming military parade, possibly impacting specific plant activities depending on their location.

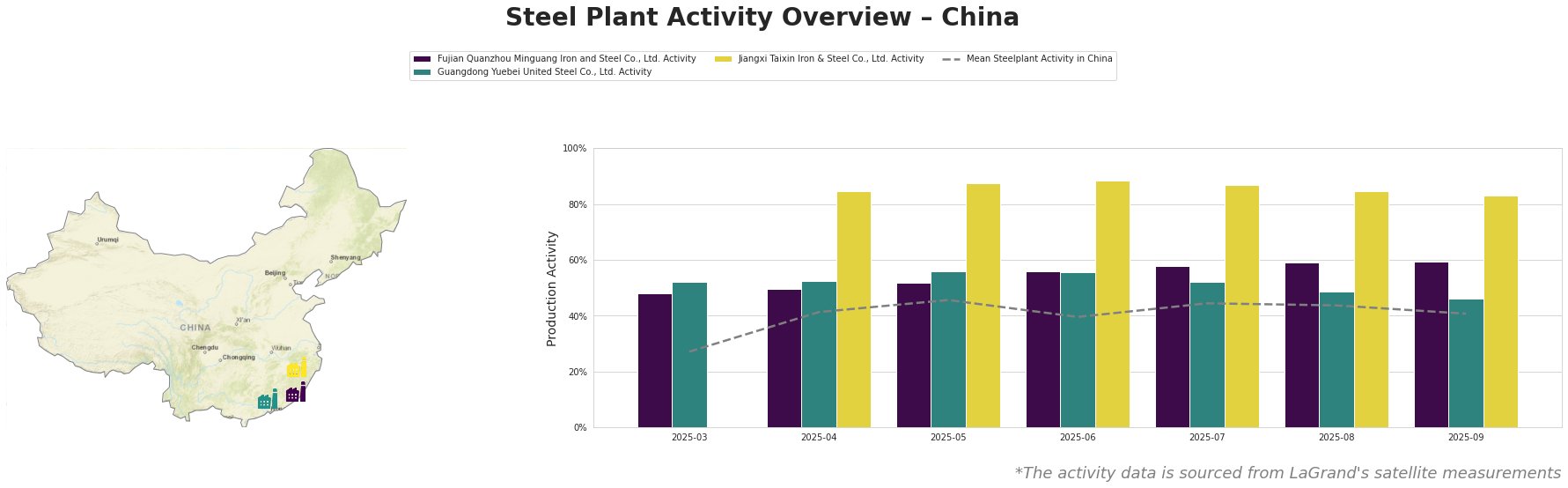

Overall, the average steel plant activity in China decreased from 44% in August to 41% in September.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF-based steel plant with a crude steel capacity of 2,550 thousand tonnes per annum (ttpa), showed consistently higher activity than the national average. The plant’s activity has steadily increased, reaching 60% in September, in contrast to the overall market decline, No direct connection to the provided news articles can be established.

Guangdong Yuebei United Steel Co., Ltd., another integrated BF-based plant with a crude steel capacity of 2,000 ttpa producing primarily Rebar for the building and infrastructure sector, experienced a drop in activity from 56% in June to 46% in September. This decline may reflect the weak demand from the struggling construction sector as mentioned in “China cut steel production to a 9-month low in August,” given the plant’s focus on rebar production.

Jiangxi Taixin Iron & Steel Co., Ltd., an EAF-based plant with a smaller crude steel capacity of 1,000 ttpa producing wire and rod, maintained a relatively high activity level, fluctuating between 88% and 83% from April to September. While there’s a slight decrease in September, its activity remains significantly above average. The news article “China cut steel production to a 9-month low in August” mentions reduced output from electric arc furnaces (EAF) due to falling steel prices and steady scrap metal costs, which potentially explains the slight decrease, even though the values stay relatively high compared to the other plants.

Given the increase in inventories and the decrease in production highlighted in “Stocks of main finished steel products in China up 4.2 percent in early Sept 2025” and “China cut steel production to a 9-month low in August,” steel buyers should anticipate potential price volatility. Steel buyers heavily reliant on Guangdong Yuebei United Steel Co., Ltd. for rebar should explore alternative suppliers due to the observed production decline. Buyers dependent on wire and rod should monitor Jiangxi Taixin Iron & Steel Co., Ltd., but for now the supply chain appears to be very stable.