From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineSouth America Steel Market Faces Downturn: Imports Surge, Production Dips, Investment Cuts

South America’s steel market is facing headwinds due to rising imports and declining production. Specifically, the article “Imports impact investment in Brazil’s steel industry” highlights a decline in investment driven by cheaper imports, particularly from China. This aligns with a general negative sentiment regarding steel output in the region. However, no direct connection can be established to observed activity changes at specific plants.

The article “Exports of heavy plates from Brazil decline sharply in August 2025” reports a significant drop in heavy plate exports, primarily due to decreased exports to the US. This decline coincides with a period of generally fluctuating activity levels across observed plants, but no specific, direct impact can be attributed to one plant. Furthermore, according to “Importers fill 60pc of Brazil’s steel quotas” the increasing levels of imports, up to the levels allowed by the quota, are impacting the regional steel market. “Brazil steel output, imports fall in August” highlights that in August, crude steel production decreased, while steel imports also decreased.

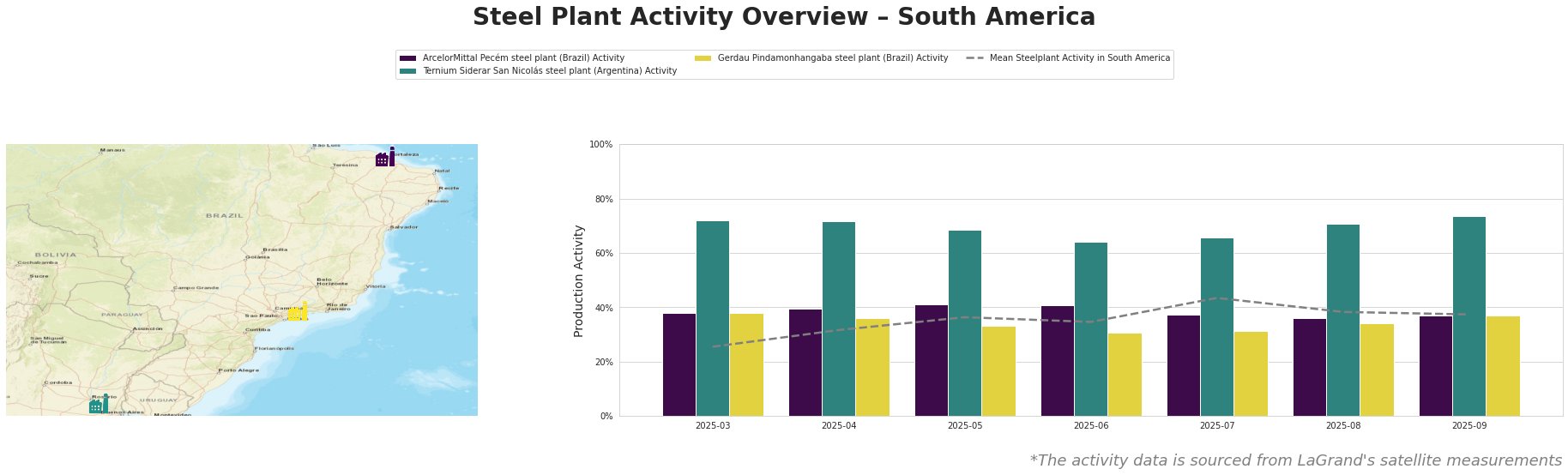

Overall, the average steel plant activity in South America has fluctuated, reaching a peak of 43.0% in July 2025, before decreasing to 37.0% in September 2025.

ArcelorMittal Pecém steel plant: This integrated steel plant in Ceará, Brazil, with a 3,000 ttpa crude steel capacity via BOF, shows relatively stable activity. Activity hovered around 40% between March and June 2025. A drop to 37% in July and August has continued through September. Given its reliance on the integrated BF/BOF process and production of slabs and plates for key sectors like automotive and infrastructure, it is likely that the plant is impacted by the issues raised in “Imports impact investment in Brazil’s steel industry,” but no direct evidence is available.

Ternium Siderar San Nicolás steel plant: Located in Buenos Aires, Argentina, this integrated plant with a 3,200 ttpa crude steel capacity (BOF) demonstrates consistently high activity levels. Activity remained relatively stable near 70% from March to August 2025 and rose to 74% in September. There is no information available in the provided articles that directly impact Ternium Siderar San Nicolás, but the high activity level suggests a degree of insulation from the issues affecting Brazilian steelmakers.

Gerdau Pindamonhangaba steel plant: This electric arc furnace (EAF) based plant in São Paulo, Brazil, has a 620 ttpa crude steel capacity. The plant has shown declining activity between March and July 2025, going from 38% to 31%. In August and September the activity rose to 34% and 37% respectively. Given that Gerdau is mentioned in “Imports impact investment in Brazil’s steel industry,” where the company is shifting investment away from Brazil, it’s plausible the Pindamonhangaba plant could be affected, but a direct connection cannot be established based on the available information.

Evaluated Market Implications

The reported decline in Brazilian heavy plate exports in “Exports of heavy plates from Brazil decline sharply in August 2025” and the overall increase in imports into Brazil, reported in “Importers fill 60pc of Brazil’s steel quotas” potentially impact local supply. Coupled with the news that imports are impacting investment in Brazil (“Imports impact investment in Brazil’s steel industry“), this could affect both price levels and the availability of domestically produced steel.

Procurement Action: Steel buyers sourcing heavy plates or rolled steel within South America should:

- Diversify Suppliers: Actively seek alternative suppliers outside of Brazil, particularly in Argentina, to mitigate potential supply disruptions. The Ternium Siderar San Nicolás plant’s high activity levels suggest a more stable supply source.

- Monitor Quota Impacts: Closely monitor the remaining quota availability for Brazilian steel imports and anticipate potential price increases once the quota is exhausted. Buyers should factor the 25% tariff into their cost projections if relying on imports exceeding the quota, as mentioned in “Importers fill 60pc of Brazil’s steel quotas.”

- Negotiate Long-Term Contracts: Given the uncertainty surrounding investment in the Brazilian steel industry, negotiate long-term contracts with suppliers where possible to secure pricing and supply.