From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EnginePolish Steel Market Optimistic: JSW Coal Expansion Fuels Stable Production Despite Localized Fluctuations

Poland’s steel market exhibits a very positive sentiment, underpinned by sustained coking coal production. The launch of new longwalls at JSW mines, as detailed in “Poland’s JSW launches a new longwall at Pniówek mine with 490 thousand tons of coal reserves” and “Poland’s JSW continues to expand coking coal resources with another longwall at Pniówek mine,” directly supports a stable raw material supply for domestic steel production. While “Poland’s JSW mined 1.01 million tons of coal in August” reports a slight production shortfall due to a mine fire, overall coal production targets remain on track, bolstering confidence in continued steel production. However, these JSW production figures do not show an immediate direct correlation with the satellite-observed activities of the selected steel plants.

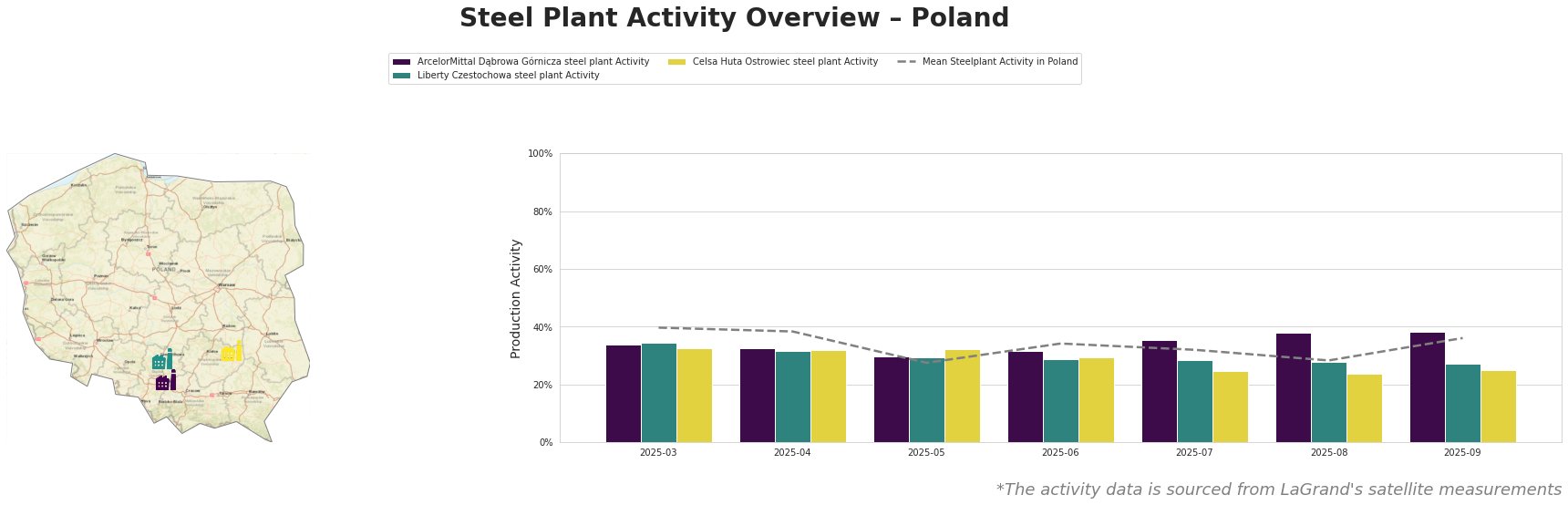

Monthly aggregated activities are as follows:

Overall, activity levels across the three plants have fluctuated. The mean steel plant activity in Poland shows a dip in May (28%) and August (28%) followed by a recovery in September (36%).

ArcelorMittal Dąbrowa Górnicza, an integrated steel plant with a 5 million tonne BOF capacity, has shown above-average activity since July, peaking at 38% in August and September. The trend does not appear to directly correlate with the news articles about JSW, as the steel plant uses coke from ArcelorMittal Kraków. However, stable coking coal from JSW could indirectly improve overall market confidence and operational security.

Liberty Czestochowa, an EAF-based plant focusing on plate production, has consistently operated below the average activity, with a slight decrease to 27% in September. No direct connection to the JSW news articles can be established.

Celsa Huta Ostrowiec, an EAF-based plant producing finished rolled products, including rebar for the construction sector, experienced a decline in activity, reaching a low of 24% in August, remaining at 25% in September. No direct correlation between its observed activity and the JSW-related news could be established.

The expansions in coking coal production by JSW, despite localized disruptions, mitigate potential supply disruptions for integrated steel producers like ArcelorMittal Dąbrowa Górnicza. Given the consistent above-average activity observed at ArcelorMittal Dąbrowa Górnicza, steel buyers can consider prioritizing procurement from this plant to ensure supply stability. For buyers relying on EAF-based plants like Celsa Huta Ostrowiec, which shows declining activity, it is recommended to diversify suppliers and monitor the coal prices. While no direct link between coal supply and EAF activity is found, it is crucial to closely monitor Liberty Czestochowa due to consistently below-average activity.