From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineBrazil Steel Market: Import Quotas & Declining Investment Impacting Production

Brazil’s steel market faces headwinds from rising imports and declining investment, impacting domestic production. This report analyzes recent news and plant activity data to provide actionable insights for steel buyers and analysts. “Brazil broadens steel import quota coverage” and “Imports impact investment in Brazil’s steel industry” directly correlate with observed activity changes, while the “Wire rod exports from Brazil decline in August 2025” and “Exports of heavy plates from Brazil decline sharply in August 2025” cannot be directly linked to plant activity.

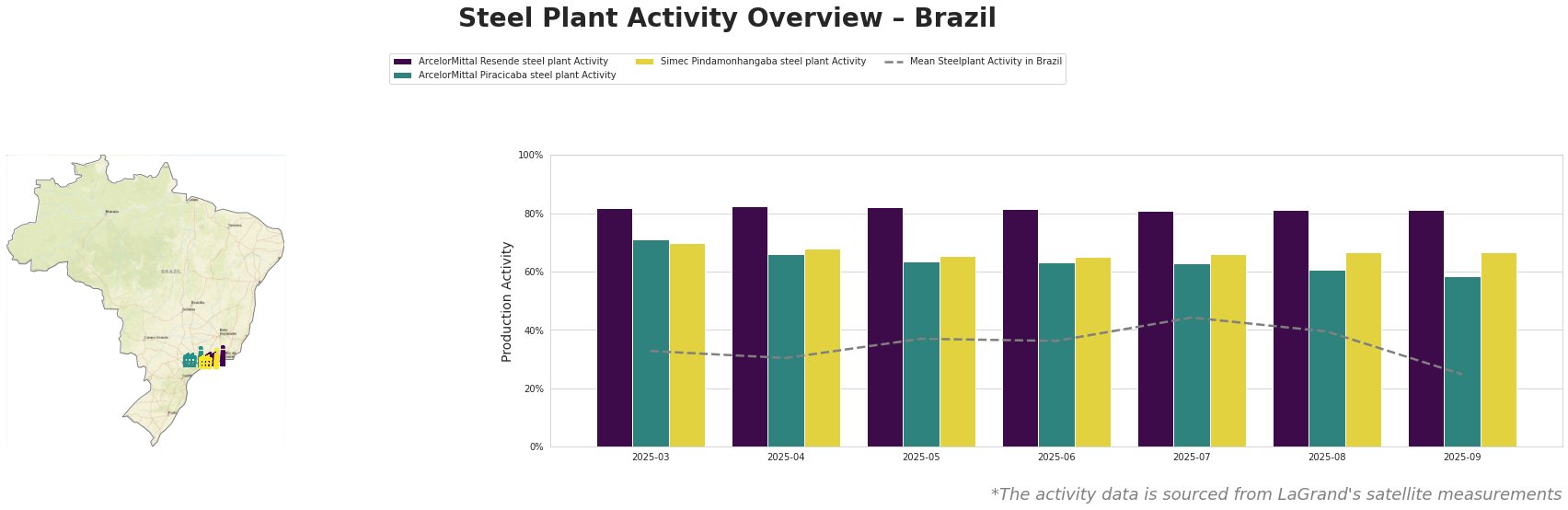

Overall, the mean steel plant activity in Brazil has seen a noticeable decline, dropping from 44% in July to 25% in September. ArcelorMittal Resende shows consistently high activity, while Piracicaba shows a slow decline.

ArcelorMittal Resende, a Rio de Janeiro based steel plant with a 1000 ttpa EAF capacity focused on rebar and wire rod for building and infrastructure, has maintained a consistently high activity level around 81-82% throughout the observed period, significantly above the Brazilian mean. There is no observed link to the news articles regarding import quotas, wire rod exports or heavy plate exports, though its continued output could suggest a degree of insulation from import pressures given its product mix.

ArcelorMittal Piracicaba, located in São Paulo with a slightly larger 1100 ttpa EAF capacity also producing rebar and wire rod, shows a gradual decline in activity from 71% in March to 59% in September. This decline, in conjunction with the news that “Imports impact investment in Brazil’s steel industry” and the government response of “Brazil broadens steel import quota coverage”, could indicate a reduction in domestic demand due to increased import competition.

Simec Pindamonhangaba, also in São Paulo, operates a 500 ttpa EAF and produces wire rod and rebar. Its activity levels have remained relatively stable between 65% and 70% throughout the period. No direct connection can be established between Simec Pindamonhangaba’s stable activity and the provided news articles.

The observed decline in overall steel plant activity in Brazil, particularly at ArcelorMittal Piracicaba, coupled with the news of declining investment (“Imports impact investment in Brazil’s steel industry”) and the government’s response via import quotas (“Brazil broadens steel import quota coverage”) indicates a challenging market environment. The decline in mean steel plant activity from 44% in July to 25% in September, and at ArcelorMittal Piracicaba from 63% to 59% over the same period, suggests a possible supply reduction. Therefore, steel buyers should:

- Closely monitor inventory levels: Be prepared for potential supply disruptions, especially in regions served by plants experiencing declining activity like ArcelorMittal Piracicaba.

- Diversify suppliers: Mitigate risk by sourcing from multiple suppliers, including those outside of Brazil, while considering the impact of import quotas.

- Factor in potential price increases: The combination of import restrictions and reduced domestic production may lead to price increases. Factor these into budgeting and procurement strategies.

- Evaluate long-term contracts: Secure long-term contracts with stable suppliers to ensure supply continuity, particularly with plants like ArcelorMittal Resende which maintain high activity levels.