From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkrainian Steel Sector Surges: Pig Iron Exports Soar Amidst Fluctuating Iron Ore and Steel Consumption

Ukraine’s steel sector displays strong growth in pig iron production and exports despite challenges in iron ore exports and fluctuating domestic steel consumption. “Ukraine reports eight percent rise in pig iron output for January-August 2025” and “Ukraine increased its pig iron exports by 65% y/y in January-August” directly correlate with observed increases in overall steel plant activity. However, “Ukraine reduced iron ore exports by 7% y/y in January-August” and “Consumption of steel products in Ukraine grew by 22.6% y/y in January-August” show counter trends highlighting complex dynamics within the sector.

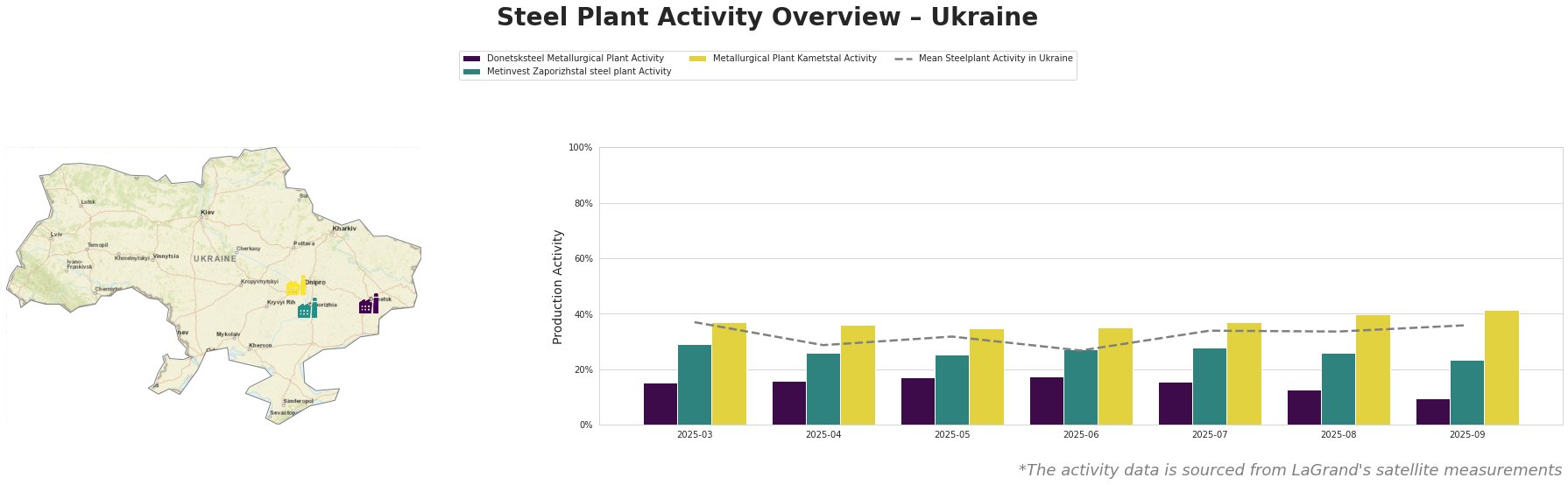

The mean steel plant activity in Ukraine fluctuated, ranging from a low of 27.0% in June to a peak of 37.0% in March. While there was a dip to 27.0% in June, activity has generally been trending upwards to 36% as of September. Donetsksteel Metallurgical Plant shows a concerning decline in activity, dropping from 18.0% in June to 9.0% in September. Metinvest Zaporizhstal steel plant’s activity also decreased from 29.0% in March to 24.0% in September. In contrast, Metallurgical Plant Kametstal has shown a consistent upward trend, increasing from 37.0% in March to a high of 42.0% in September, consistently exceeding the mean activity.

Donetsksteel Metallurgical Plant, an integrated plant (BF) with a capacity of 1,500 ttpa of iron and equipped with BF and EAF, has seen a sharp decrease in activity, from 18.0% in June to 9.0% in September. This decline could potentially impact pig iron supply, but no direct connection with the news articles can be established.

Metinvest Zaporizhstal steel plant, an integrated plant (BF) with a crude steel capacity of 4,100 ttpa and iron capacity of 4,359 ttpa, produces finished rolled products such as hot-rolled coil and cold-rolled sheets. Plant activity has gradually declined from 29.0% in March to 24.0% in September. Given its focus on finished rolled products, this decrease might reflect the “Consumption of steel products in Ukraine grew by 22.6% y/y in January-August,” where imports meet a large proportion of flat rolled product consumption as domestic supply for rolled products decreased by 1.4%.

Metallurgical Plant Kametstal, an integrated plant (BF) with a crude steel capacity of 4,200 ttpa and iron capacity of 4,350 ttpa, is the most active among the observed plants, with a consistent increase in activity from 37.0% in March to 42.0% in September. This plant focuses on semi-finished and finished rolled products like square billets and rails. This observed increase in activity aligns with “Ukraine reports eight percent rise in pig iron output for January-August 2025,” and is likely contributing to “Ukraine increased its pig iron exports by 65% y/y in January-August.”

Given the strong growth in pig iron exports reported in “Ukraine increased its pig iron exports by 65% y/y in January-August,” and the shift of the US as primary importer, steel buyers should monitor US pig iron prices closely and consider securing contracts with Ukrainian suppliers early to capitalize on competitive pricing. The observed activity decrease at Donetsksteel Metallurgical Plant, coupled with the lack of news explicitly addressing its current operations, creates uncertainty. Buyers dependent on this plant should diversify their supply sources as a precautionary measure. Considering the strong increase in ferroalloy exports detailed in “Ukraine’s ferroalloy industry exported 73.8 thousand tons of products in January-August,” steel producers should explore opportunities to integrate Ukrainian ferroalloys into their supply chain, particularly given the increase in exports to Poland.