From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Surges: NEV & Excavator Demand Drives Plant Activity Despite Inflation Concerns

Asia’s steel market exhibits strong positive sentiment, driven by increased demand in key sectors. “China’s excavator sales increase by 17.2 percent in January-August 2025” and “CAAM: Sales of new energy vehicles in China up 36.7 percent in Jan-Aug 2025” directly correlate with observed high activity at Bengang Steel Plates Co., Ltd., a major supplier to these industries, suggesting robust domestic demand. There is no direct relationship between these Asian market developments and “US inflation quickens to 2.9pc in August, core up.”

Measured Activity Overview:

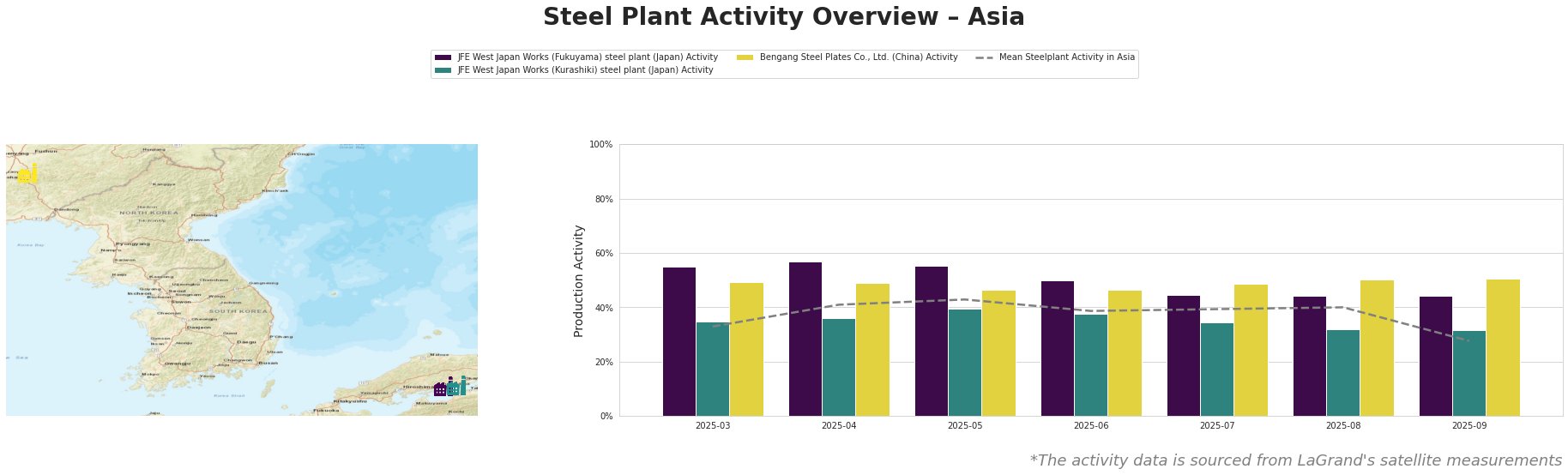

The average steel plant activity in Asia fluctuated between 33% and 43% from March to August 2025, then dropped to 28% in September. JFE West Japan Works (Fukuyama) consistently operated above the mean, with a high of 57% in April, declining to 44% by September. JFE West Japan Works (Kurashiki) operated near or slightly below the mean, peaking at 40% in May and falling to 32% in August and September. Bengang Steel Plates Co., Ltd. showed relatively stable activity, hovering around 46-51%, indicating consistent demand.

JFE West Japan Works (Fukuyama) steel plant, an integrated BF-BOF producer with a 13 million tonne crude steel capacity, primarily serving the automotive, building, and energy sectors, saw a gradual decline in activity from 57% in April to 44% in September. There is no direct relationship observed between the news articles provided and the observed activity.

JFE West Japan Works (Kurashiki) steel plant, another integrated BF-BOF producer, with a 10 million tonne crude steel capacity and similar end-user sectors as Fukuyama, experienced a similar declining trend, reaching 32% activity in August and September. No direct correlation to the provided news articles could be established.

Bengang Steel Plates Co., Ltd., a major Chinese steel plate producer with a 12.8 million tonne capacity, catering to the automotive and energy sectors, maintained relatively high and stable activity, ending at 51% in September. This aligns with the increased demand reported in “China’s excavator sales increase by 17.2 percent in January-August 2025” and “CAAM: Sales of new energy vehicles in China up 36.7 percent in Jan-Aug 2025”, where the demand for plates is likely increased due to booming excavator and NEV production.

Evaluated Market Implications:

The sustained high activity at Bengang Steel Plates Co., Ltd., coupled with the news of increased excavator and NEV sales in China, indicates a robust domestic demand for steel plates. Simultaneously, a reduction in measured activity at JFE’s Fukuyama and Kurashiki plants warrants careful monitoring.

Recommended Procurement Actions: Steel buyers should prioritize securing contracts with Bengang Steel Plates Co., Ltd. or other Chinese suppliers focused on plates to capitalize on strong domestic demand. Diversification across multiple suppliers remains crucial, especially given observed activity fluctuations in Japanese plants. Actively monitor capacity utilization rates to anticipate potential shifts in the supply and demand balance in Asia.