From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUK Defense Strategy & Rising Steel Plant Activity Signal European Market Strength

Europe’s steel market exhibits strong positive sentiment, particularly due to the UK’s strategic shift towards domestic steel. “The UK government is considering a plan for the development of domestic steel production,” coupled with “British defense strategy emphasizes priority for domestic steel” and “UK’s new defense industrial strategy puts UK steel at core of national security,” indicates potential shifts in procurement policies, supporting domestic producers. Satellite data suggests activity changes in specific plants, warranting close observation.

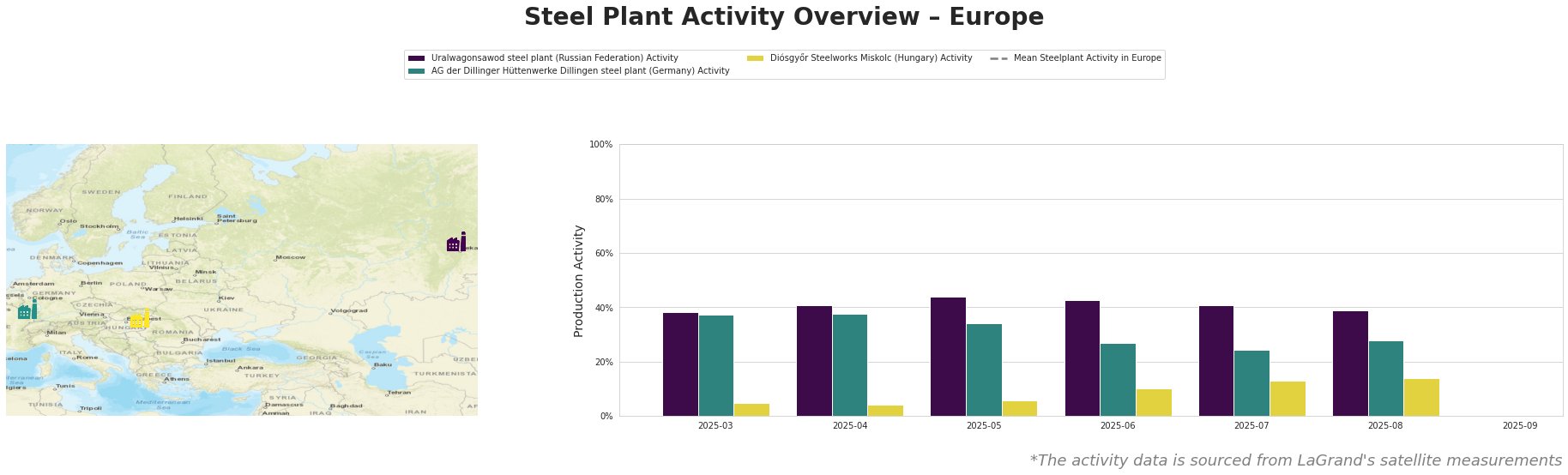

Mean Steelplant Activity in Europe is consistently negative across the entire measurement period.

Activity at Uralwagonsawod steel plant in Russia experienced a peak in May 2025 at 44%, before declining to 39% by August 2025. AG der Dillinger Hüttenwerke Dillingen steel plant in Germany showed a decline from 37% in March 2025 to 28% in August 2025. Diósgyőr Steelworks Miskolc in Hungary steadily increased activity from 5% in March 2025 to 14% in August 2025.

Uralwagonsawod is a Russian steel plant producing for the defense sector. Although satellite data reveals a peak activity in May 2025 (44%) followed by a slight decline, no explicit connection to the provided news articles can be established.

AG der Dillinger Hüttenwerke Dillingen steel plant, a German integrated steel producer with a 2.76 million tonne crude steel capacity, primarily utilizes BOF technology. Satellite data indicates a decline in activity from March (37%) to August (28%). No direct connection can be established between the observed activity decline and the provided news articles.

Diósgyőr Steelworks Miskolc, a Hungarian steel plant with a 550,000-tonne crude steel capacity using EAF technology for producing semi-finished and finished rolled products for the building and infrastructure sectors, exhibits a steady increase in activity, rising from 5% in March to 14% in August. No direct correlation can be established between this increased activity and the provided news articles.

The UK’s focus on domestic steel, driven by defense strategy, might lead to prioritization of local suppliers for military applications. Given the emphasis on domestic steel production in the UK, as highlighted in “British defense strategy emphasizes priority for domestic steel,” steel buyers should evaluate their supply chains and proactively engage with UK-based steel producers to secure long-term contracts, particularly for high-grade steel used in defense applications. Analysts should closely monitor procurement policy implementation and its impact on steel demand and pricing within the UK market. The increasing activity at Diósgyőr Steelworks in Hungary requires further investigation to understand the potential impact of their production on the wider European market, despite not being directly linked to the UK news articles.