From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineUkraine Steel Market Shows Mixed Signals: Pig Iron Exports Surge Amidst Construction Steel Price Hikes

Ukraine’s steel market presents a complex picture, marked by increased pig iron exports and rising construction steel prices against a backdrop of fluctuating production. Activity levels at key steel plants show some fluctuation over the recent period. “Ukraine increased its pig iron exports by 65% y/y in January-August” directly correlates with increased pig iron production reported in “Ukraine reports eight percent rise in pig iron output for January-August 2025“. These trends suggest shifting market dynamics as Ukraine navigates global steel market challenges. There are no satellite observations that directly explain these export and production changes.

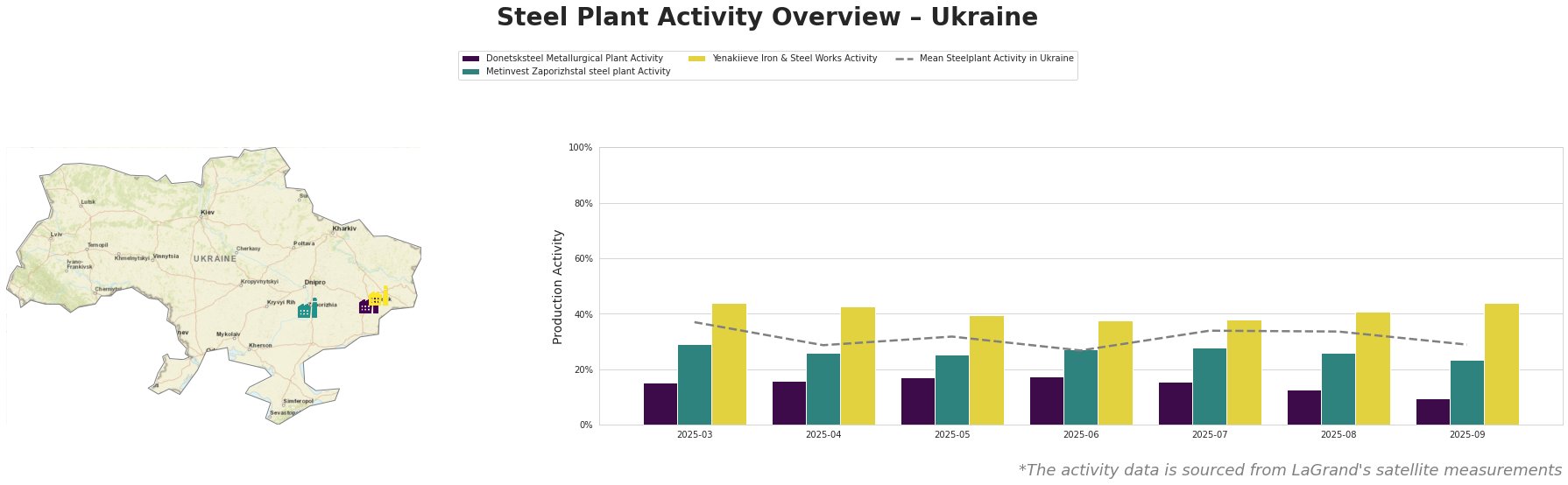

Overall, the mean steel plant activity in Ukraine has fluctuated, starting at 37% in March, dipping to 27% in June, and settling at 29% in September. Donetsksteel Metallurgical Plant consistently operates below the mean, showing a decline from 15% in March to 9% in September. Metinvest Zaporizhstal steel plant also operates below the mean, fluctuating between 24% and 29%. Yenakiieve Iron & Steel Works shows higher activity than the other two plants, exceeding the mean in all months except June and July, peaking at 44% in March and September. The monthly fluctuations in activity cannot be directly related to the provided news articles.

Donetsksteel Metallurgical Plant, with a focus on pig iron production using integrated BF technology, has consistently exhibited the lowest activity levels among the monitored plants. The plant’s activity decreased from 15% in March to 9% in September. The reported “Ukraine increased its pig iron exports by 65% y/y in January-August” does not seem to be reflected in the observed activity levels at this plant. No direct correlation can be established between the observed activity levels at Donetsksteel and the news articles.

Metinvest Zaporizhstal steel plant, a major producer of finished rolled products for automotive, packaging, and other sectors, shows activity below the national average. Its activity decreased from 29% in March to 24% in September. While “Consumption of steel products in Ukraine grew by 22.6% y/y in January-August” suggesting higher domestic demand for rolled products, this is not clearly reflected in the satellite-observed activity which showed a decrease. No direct connection between the plant’s activity and the provided news articles can be established.

Yenakiieve Iron & Steel Works, producing semi-finished and finished rolled products like rebar and beams, demonstrates the highest activity levels among the monitored plants, peaking at 44% in March and September. This contrasts with the overall decrease in steel production reported in “Ukraine produced 4.25 million tons of rolled steel in January-August“, which saw an increase in monthly rolled steel production in August. No direct correlation can be established between Yenakiieve’s activity and the news articles.

The increase in domestic prices for construction steel products, as noted in “Domestic prices for construction steel products rose slightly in August“, coupled with increased pig iron exports (“Ukraine increased its pig iron exports by 65% y/y in January-August”), suggests a possible shift in domestic steel supply. Given the increase in pig iron exports, potentially diverting material from domestic steel production, steel buyers should carefully monitor domestic supply chains for potential shortages and price volatility, particularly for construction-related steel products. Consider securing contracts with built-in price adjustment mechanisms to mitigate risks associated with fluctuating steel prices. The satellite data suggests no immediate production issues; however, the plant activity levels of Donetsksteel and Metinvest Zaporizhstal steel plant are below average compared to Yenakiieve Iron & Steel Works, suggesting possible production output variations for buyers.