From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMexico Steel Market: ArcelorMittal Activity Surge Offsets Industrial Output Concerns

Mexico’s steel market presents a mixed picture. While “Mexico’s industrial output extends declines in July” reports overall industrial contraction, activity at key steel plants suggests resilience, specifically at the ArcelorMittal plant. Conversely, the news of “Mexico auto exports up, output down in August” highlights potential downstream sector strain that might affect specific steel product demand, although no direct activity changes at the plants under review correlate directly with that news.

Recent activity data reveals the following trends:

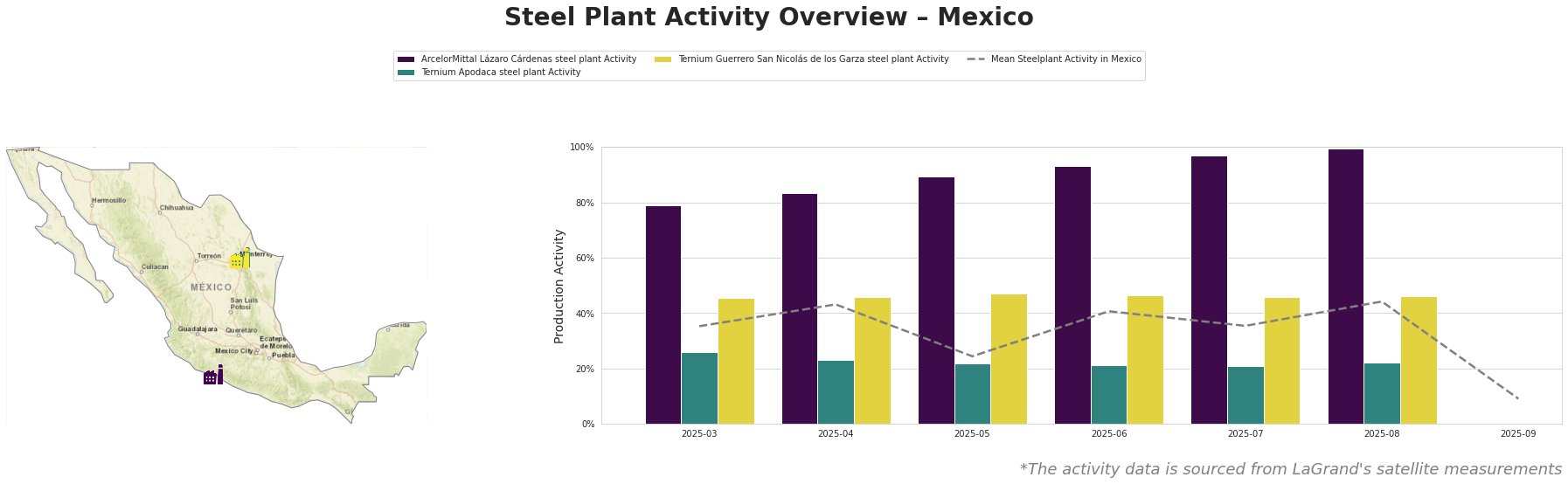

The mean steel plant activity in Mexico fluctuated between 24% and 44% from March to August 2025, before dropping significantly to 9% in September. The ArcelorMittal Lázaro Cárdenas plant consistently operated at very high activity levels (79% to 99%) during the same period. The Ternium Apodaca plant remained relatively stable at low activity levels (21% to 26%). Ternium Guerrero San Nicolás de los Garza also showed relatively stable activity (45% to 47%). The sharp drop in the mean activity in September is not directly linked to any of the provided news articles, nor is it reflected at the individual plants for which we have data.

ArcelorMittal Lázaro Cárdenas steel plant: This integrated plant (BF and DRI) in Michoacán, boasting a 5.7 million tonnes per annum (ttpa) crude steel capacity and 4 ttpa pelletizing capacity, exhibited a consistent rise in activity from March (79%) to August (99%). This high activity, focused on semi-finished products like billets and slabs and finished rolled products like rod and wire rod, suggests robust operation to cater the automotive, building and infrastructure, energy, steel packaging, tools and machinery and transport industries.

Ternium Apodaca steel plant: This Nuevo León-based EAF plant, with a 0.6 ttpa crude steel capacity, showed consistently low activity (21%-26%) between March and August. Its focus on billets and rebar for the building and infrastructure sector might indicate targeted production to meet specific regional demand. No link can be established between the reported decline in the industrial output and the activity of this plant.

Ternium Guerrero San Nicolás de los Garza steel plant: This integrated (DRI) plant in Nuevo León, with a 2.4 ttpa crude steel capacity and 1.73 ttpa DRI capacity, maintained stable activity levels (45%-47%) from March to August. Its production of hot- and cold-rolled coils, profiles, and tubes for the building and infrastructure and tools and machinery sectors suggests steady output to meet contractual obligations. No direct connection between its stable activity and the reported changes in the auto industry or inflation could be established.

Evaluated Market Implications:

The high and increasing activity observed at the ArcelorMittal Lázaro Cárdenas plant indicates strong production capacity, potentially offsetting some of the concerns raised by the overall industrial output decline reported in “Mexico’s industrial output extends declines in July”.

Recommended Procurement Actions: Steel buyers should closely monitor the ArcelorMittal Lázaro Cárdenas plant’s output for potential spot market opportunities, given its consistently high and growing activity. Buyers reliant on suppliers using Ternium Apodaca should maintain close communication to avoid supply disruptions, given its consistently low activity.