From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineOceania Steel Market Downturn: Activity Declines Amid Global Uncertainty

Oceania’s steel market faces headwinds, evidenced by declining plant activity. Concerns mirror the European market sluggishness detailed in “European heavy steel plate markets sluggish; imported material offered with CBAM premium,” although no direct connection can be established based on the provided information. The sentiment aligns with the declining dynamics in Europe reported in “Dynamics of the European HRC market is declining amid weak demand,” but no clear correlation in activity levels can be observed.

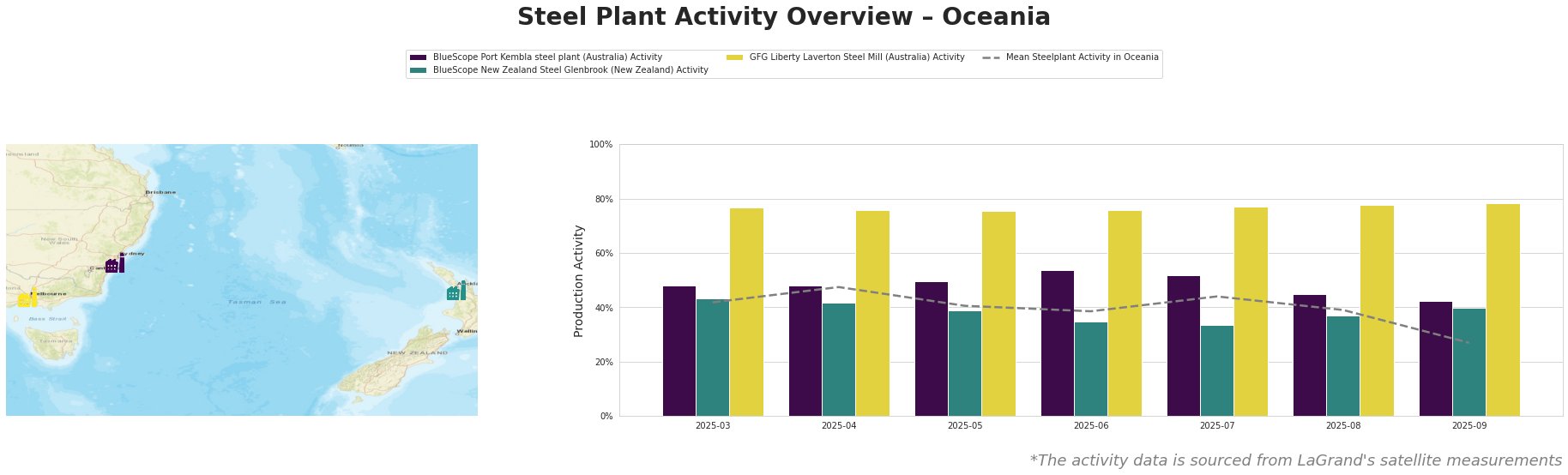

Overall, the mean steel plant activity in Oceania shows a declining trend, falling from 47.0% in April to 27.0% in September. The GFG Liberty Laverton Steel Mill demonstrates consistently high activity, around 76-78%, significantly above the Oceania mean. BlueScope Port Kembla’s activity has fluctuated but shows a decline to 42.0% in September. BlueScope New Zealand Steel Glenbrook shows the most significant decline, from 43.0% in March to 40.0% in September, with a low of 33.0% in July.

The BlueScope Port Kembla steel plant, an integrated BF-BOF operation with a 3.2 million tonne crude steel capacity, saw activity decline from a high of 54% in June to 42% in September. This decrease in activity does not have an explicit link to any of the provided news articles, meaning the cause for this change is not currently evident.

BlueScope New Zealand Steel Glenbrook, a DRI-BOF plant with a 650,000-tonne crude steel capacity, experienced a relatively stable activity level between 33% and 43%. However, it mirrors the overall market decline observed in September, reaching 40.0%. The impact of European market dynamics, highlighted in “The HRC market in the EU has stalled due to lower demand, imports are limited by CBAM risks,” on Glenbrook’s production isn’t directly verifiable with the provided data.

The GFG Liberty Laverton Steel Mill, an EAF-based plant with a 660,000-tonne crude steel capacity focusing on long products, maintained a consistently high activity level around 75-78% throughout the period. This suggests that demand for its products remains strong, contrasting with the weak demand reported in Europe, as per “Dynamics of the European HRC market is declining amid weak demand.” This could indicate a divergence in regional market dynamics or product-specific resilience.

Given the overall decline in Oceania steel plant activity, coupled with the uncertainty in European markets due to CBAM, as described in “European heavy steel plate markets sluggish; imported material offered with CBAM premium” and “The HRC market in the EU has stalled due to lower demand, imports are limited by CBAM risks,” steel buyers in Oceania should:

-

Prioritize securing supply agreements with GFG Liberty Laverton Steel Mill to mitigate potential supply disruptions, given its consistently high activity levels and focus on long products for building and infrastructure.

-

Closely monitor BlueScope Port Kembla’s production and publicly available announcements. The recent decline in activity, coupled with its significant plate production, could lead to supply constraints if the trend continues.