From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market: Activity Declines Amid Global Trade Concerns

In Asia, steel plant activity shows a recent decline, coinciding with growing concerns about global trade dynamics and their impact on regional steel markets. While a direct link between observed activity changes and the European trade concerns reported in “UNESID urges stronger European steel trade measures” and “EESC calls for stronger trade protection in face of deepening EU steel industry crisis” cannot be explicitly established from the data, the timing suggests potential indirect effects on Asian steel exports and market sentiment. However, the Turkish steel industry’s call for action against dumped imports, as detailed in “Turkish steel industry calls for urgent measures against dumped imports,” highlights challenges in a key Asian market, though a direct relationship to observed activity levels is also not determinable from available data.

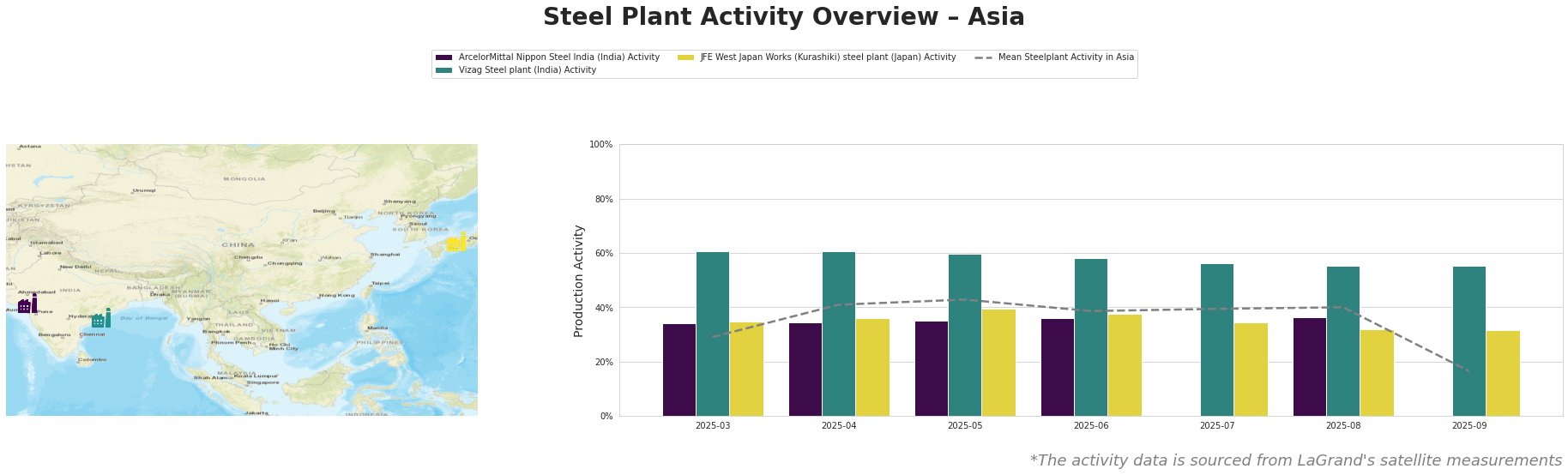

The mean steel plant activity in Asia shows a sharp decline in September 2025, falling to 17.0% after remaining relatively stable around 40% in the preceding months. ArcelorMittal Nippon Steel India, a plant in Gujarat with both integrated BF/DRI and EAF processes and a 9.6 MTPA crude steel capacity, exhibited stable activity at around 35% through August, but has missing data for the months of July and September.. Vizag Steel plant in Andhra Pradesh, India, an integrated BF/BOF producer with 7.3 MTPA crude steel capacity, showed a gradual decrease from 61.0% in March to 55.0% in September. JFE West Japan Works (Kurashiki), an integrated BF/BOF producer in the Chūgoku region of Japan with a 10 MTPA crude steel capacity, also experienced a decline from 35.0% in March to 32.0% in August and September. The sharp decline in mean activity in Asia is largely driven by missing activity values from ArcelorMittal Nippon Steel India and a relative stability in the activities of the other two plants, which are well above the Asia mean activity.

ArcelorMittal Nippon Steel India is an integrated steel plant in Gujarat with 9.6 MTPA crude steel capacity relying on both Blast Furnace/Direct Reduced Iron (BF/DRI) and Electric Arc Furnace (EAF) technologies. Activity levels remained around 35% until August, but data is missing for July and September. This prevents a direct assessment of recent trends. Since the plant utilizes both DRI and EAF, it could be sensitive to fluctuations in natural gas prices; however, without activity data, no connection to the cited news articles can be established.

Vizag Steel plant, located in Andhra Pradesh, India, uses integrated BF/BOF processes and has a crude steel capacity of 7.3 MTPA. Its activity decreased gradually from 61.0% in March to 55.0% in September. While this decline is relatively gradual, it does not correlate with any specific trade action reported in the provided news articles and does not represent a significant deviation from its production. No direct connection to the cited news articles can be established.

JFE West Japan Works (Kurashiki) in Japan, a 10 MTPA integrated BF/BOF steel plant, saw its activity decline from 35.0% in March to 32.0% by August and September. As an integrated BF/BOF producer, this plant is likely exposed to global iron ore and coal market dynamics. However, a direct relationship to the European trade concerns highlighted in “UNESID urges stronger European steel trade measures” and “EESC calls for stronger trade protection in face of deepening EU steel industry crisis” cannot be established based on the information provided.

The sharp decline in average Asian steel plant activity in September raises concerns, but is not reflected in the individual steel plant’s activities where data could be obtained. The provided data and news articles are insufficient to link plant activity to global trade issues directly; further data is needed for ArcelorMittal Nippon Steel India.

Given the current uncertainties and the potential for supply chain disruptions suggested by the general trade concerns, steel buyers should prioritize:

- Enhanced monitoring of supply chains: Closely track production data from key Asian suppliers and diversify sourcing strategies.

- Evaluate inventory levels: Consider increasing safety stock for critical steel products to mitigate potential short-term supply disruptions.

- Negotiate flexible contracts: Seek contracts with built-in flexibility to adjust order volumes and delivery schedules based on evolving market conditions.