From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market: Rebar Price Volatility Amidst Slowing Demand & CBAM Uncertainty

Italy’s steel market displays mixed signals as rebar prices experience volatility amidst slowing demand and uncertainty surrounding CBAM implementation, as reflected in the articles “Italy rebar prices widen amid fresh deals heard, lower offers; traders in wait-and-see mode,” “Italian roll market starts to slow down after August break,” “The European market for thick-rolled products is in decline; imported material is offered at a CBAM premium” and “European HRC prices have decreased slightly; the direction of market development is unclear“. Satellite-observed activity changes at Italian steel plants provide further insights into the current market situation, however, no direct links between news articles and plant activity could be explicitly established.

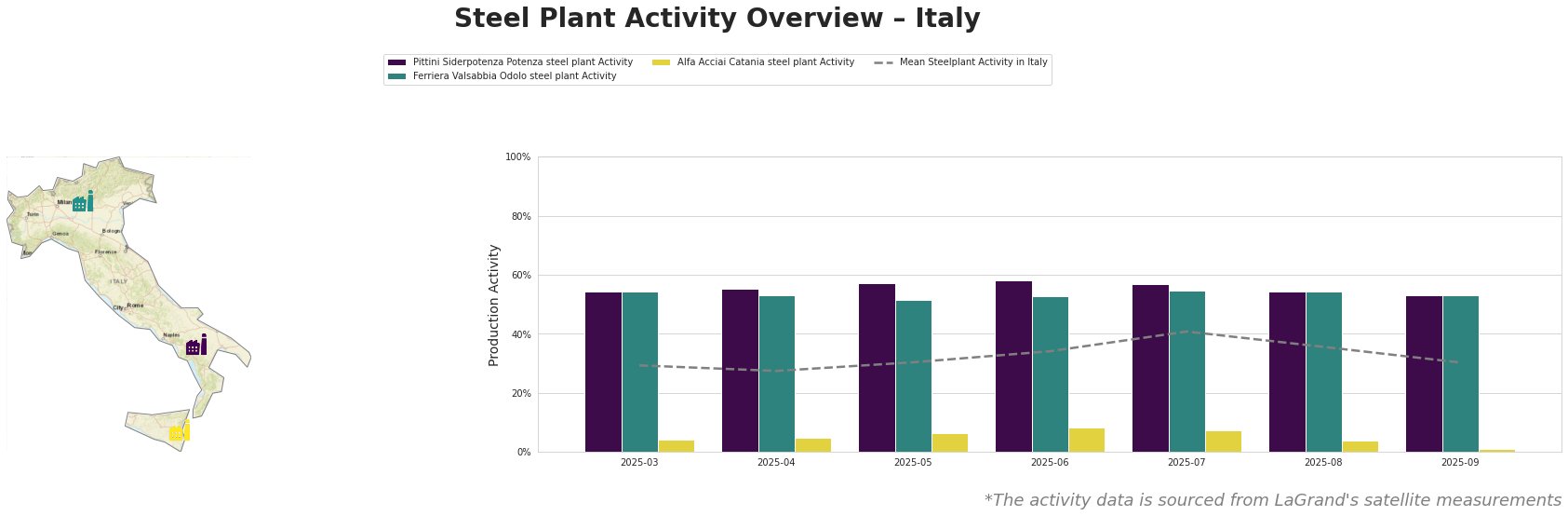

Recent monthly activity trends for selected Italian steel plants are shown below:

Overall, average steel plant activity in Italy shows a fluctuating trend, peaking in July at 41% and declining to 30% by September. Pittini Siderpotenza Potenza steel plant and Ferriera Valsabbia Odolo steel plant both exhibit relatively high and stable activity levels compared to the average, while Alfa Acciai Catania steel plant shows significantly lower activity.

Pittini Siderpotenza Potenza steel plant, located in the Province of Potenza, is an EAF-based (700ktpa capacity) rebar producer focused on the building and infrastructure sector. The plant maintains a Responsible Steel Certification and its activity, which consistently surpasses the Italian average, experienced a minor drop from 57% in July to 53% in September. While “Italy rebar prices widen amid fresh deals heard, lower offers; traders in wait-and-see mode” notes rebar price volatility, no direct connection to the plant’s slight activity reduction can be established.

Ferriera Valsabbia Odolo steel plant, situated in the Province of Brescia, operates an EAF with a 900ktpa capacity and produces billets and rebar. Like Pittini, it holds a Responsible Steel Certification. Its activity closely mirrors Pittini’s, remaining consistently above the national average. The plant’s activity decreased to 53% in September, coinciding with reduced activity in the Pittini plant. The article “Italian roll market starts to slow down after August break” indicates a market slowdown, but no direct link to this plant’s activity levels can be explicitly established.

Alfa Acciai Catania steel plant, located in the Province of Sicily, has a 500ktpa EAF capacity, producing billets and rebar. While it also possesses a Responsible Steel Certification, its activity levels are substantially lower than both the national average and the other two plants. September sees a drop to just 1% activity. No connection could be explicitly established between observed satellite activity and any of the provided news articles.

Given the overall market uncertainty and volatility in rebar prices reported in “Italy rebar prices widen amid fresh deals heard, lower offers; traders in wait-and-see mode“, steel buyers should:

- Closely monitor rebar price trends in Southern Italy, where deals are currently driving price increases.

- Consider diversifying suppliers to mitigate potential risks associated with regional price fluctuations.

- Evaluate forward purchasing strategies cautiously, considering the “wait-and-see” sentiment among traders and potential for both uptrends and downtrends.

Furthermore, the article “European HRC prices have decreased slightly; the direction of market development is unclear” highlights the uncertainty surrounding the implementation of CBAM and other regulatory changes. While “The European market for thick-rolled products is in decline; imported material is offered at a CBAM premium” suggests that some importers are already factoring in CBAM costs, the potential for delays or changes to the regulations creates volatility.

To mitigate risks associated with these factors, steel buyers should:

- Closely monitor policy updates and seek clarification from industry associations or consultants regarding the implementation timeline and specific requirements of CBAM.

- Consider negotiating flexible contract terms with suppliers to account for potential CBAM-related cost increases.

- Assess the carbon footprint of their steel purchases and explore opportunities to source lower-carbon steel options to minimize future CBAM liabilities.