From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEuropean Steel Market Faces Headwinds: Sluggish Demand and Regulatory Uncertainty Impact Prices

The European steel market is facing headwinds as demand weakens following the summer break. According to “Italian roll market starts to slow down after August break” and “The European market for thick-rolled products is in decline; imported material is offered at a CBAM premium“, trade activity has declined significantly and market direction is unclear as per “European HRC prices have decreased slightly; the direction of market development is unclear“. These developments are reflected in observed steel plant activity levels across Europe.

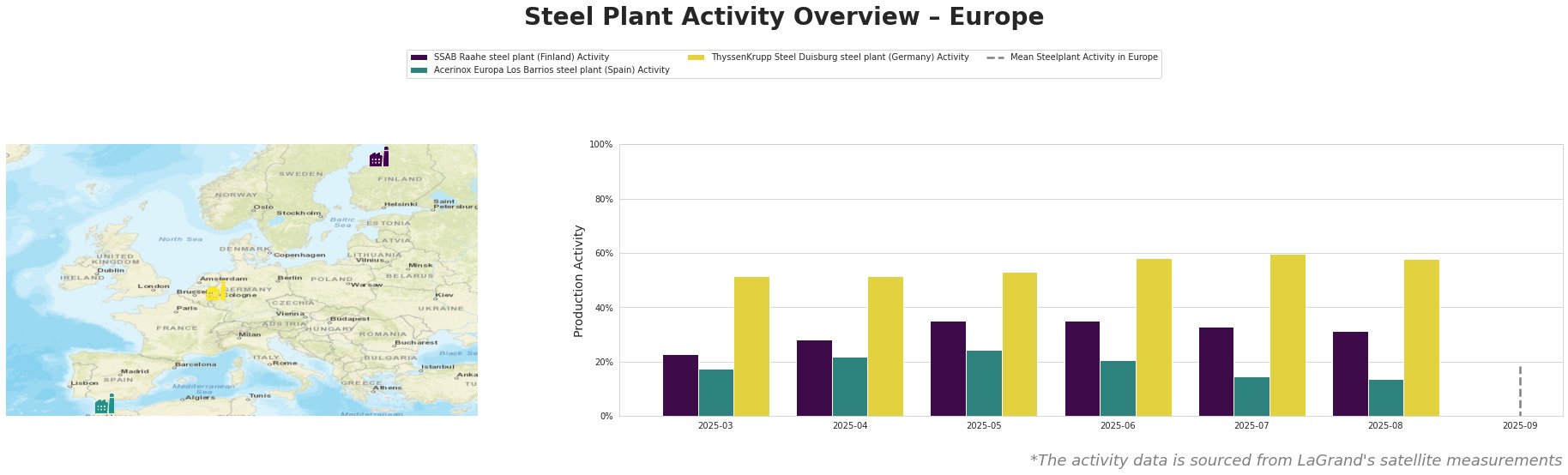

Measured Activity Overview

SSAB Raahe exhibited a steady decline in activity from May (35%) to August (31%). Acerinox Europa Los Barrios also experienced a decrease in activity, falling from 24% in May to 14% in August. ThyssenKrupp Steel Duisburg showed a peak activity level in July (60%) but then dropped to 58% in August, still remaining the highest among the observed plants. The September aggregated mean activity for all plants in Europe stands at 18%.

Steel Plant Information

SSAB Raahe, located in North Ostrobothnia, Finland, is an integrated steel plant with a crude steel capacity of 2.6 million tonnes per annum (ttpa), relying on blast furnace (BF) and basic oxygen furnace (BOF) technology. The plant produces semi-finished and finished rolled products, including hot-rolled coils and billets. The satellite-observed activity at SSAB Raahe has gradually decreased from 35% in May to 31% in August. This decline could be linked to the general slowdown in the rolled products market as described in “Italian roll market starts to slow down after August break”, but a direct relationship cannot be explicitly established based on the provided information.

Acerinox Europa Los Barrios, located in Cádiz, Spain, is an electric arc furnace (EAF)-based stainless steel producer with a crude steel capacity of 1.2 million ttpa. Its product range includes slabs, billets, hot-rolled coils, cold-rolled products, and plates. The plant’s activity decreased from 24% in May to 14% in August. This reduction in activity could be linked to the sourcing of significant volumes from Asia, Turkey, and North Africa by Italian and Spanish buyers, as mentioned in “Italian roll market starts to slow down after August break,” but a direct relationship cannot be explicitly established based on the provided information.

ThyssenKrupp Steel Duisburg, situated in North Rhine-Westphalia, Germany, is an integrated steel plant with a significant crude steel capacity of 13 million ttpa. Utilizing BF and BOF processes, it produces a diverse range of products, including hot strip, heavy plate, and coated products, serving various sectors like automotive and construction. The plant’s activity decreased from a peak of 60% in July to 58% in August. This slight decline in activity could be related to the overall sluggish trade in Europe, as noted in “The European market for thick-rolled products is in decline; imported material is offered at a CBAM premium,” but a direct relationship cannot be explicitly established based on the provided information.

Evaluated Market Implications

The combination of decreasing steel plant activity and negative market sentiment suggests potential supply disruptions, particularly in Southern Europe.

Recommended procurement actions:

- For Buyers in Italy and Spain: Given the “Italian roll market starts to slow down after August break” article that indicates that buyers sourced steel from Asia, Turkey and North Africa, monitor import dynamics closely, especially Turkish HRC availability post-Q3 quota exhaustion. If reliance on imports remains, factor in potential CBAM adjustments (as alluded to in “The European market for thick-rolled products is in decline; imported material is offered at a CBAM premium”) despite regulatory uncertainty.

- For buyers in Northern Europe: While “The European market for thick-rolled products is in decline; imported material is offered at a CBAM premium” notes some expectation of increased activity, maintain caution as overall demand and prices are softening as per “European HRC prices have decreased slightly; the direction of market development is unclear”. Prioritize short-term contracts and closely monitor mill pricing strategies for October deliveries.