From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineItalian Steel Market Slowdown: Weak Demand and CBAM Uncertainty Weigh on Production

The Italian steel market is facing headwinds due to weak demand and uncertainty surrounding the Carbon Border Adjustment Mechanism (CBAM). The slowdown is reflected in the satellite observed activity and is consistent with the news article “Italian roll market starts to slow down after August break,” which highlights minimal contract signings post-summer and increased sourcing from Asia, Turkey, and North Africa. The article “The European market for thick-rolled products is in decline; imported material is offered at a CBAM premium” further corroborates the market’s sluggishness and the impact of CBAM-related uncertainty, despite stable import prices for heavy plates since June. The market sentiment is further weakened as reported in the article “European HRC prices have decreased slightly; the direction of market development is unclear“.

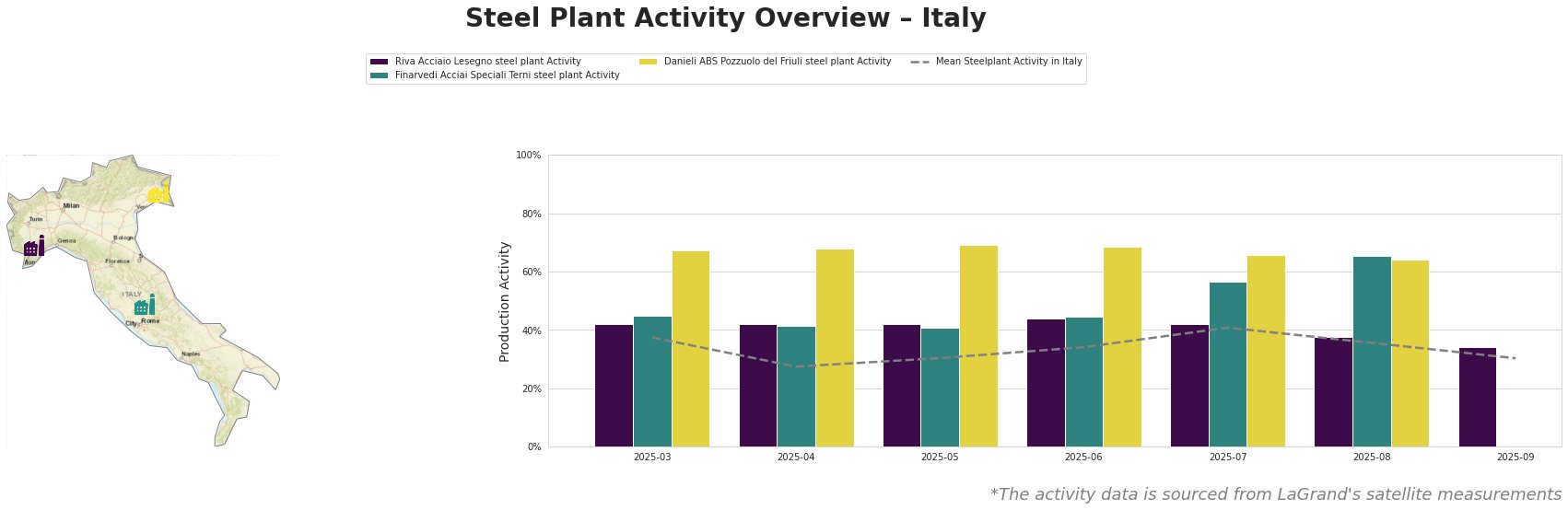

Overall, the mean steel plant activity in Italy has shown a decreasing trend from July (41%) to September (30%). The most significant month-on-month decrease was observed between August and September.

Riva Acciaio Lesegno steel plant, an EAF-based producer in the Province of Cuneo with a 600 ttpa crude steel capacity, saw its activity decrease from 38% in August to 34% in September. This decline aligns with the overall market slowdown reported in “Italian roll market starts to slow down after August break,” suggesting reduced demand for its semi-finished and finished rolled products used in building, infrastructure, tools, and machinery.

Finarvedi Acciai Speciali Terni steel plant, a major EAF-based producer in the Province of Terni with a 1450 ttpa crude steel capacity, exhibited a notable increase in activity between July (56%) and August (66%). September’s figures are not available. This surge could potentially be related to fulfilling previously signed contracts or strategic inventory buildup in anticipation of CBAM, though no explicit link can be confirmed with the provided news. The plant produces hot- and cold-rolled coils, strips, sheets, stainless steels, and forged products for automotive, building, infrastructure, and transport sectors.

Danieli ABS Pozzuolo del Friuli steel plant, an EAF-based producer in the Province of Udine with an 1100 ttpa crude steel capacity, experienced a slight decrease in activity from 66% in July to 64% in August, followed by an unavailable September figure. While the activity remains above the national average, the decrease coincides with the weakening demand reported in “Italian roll market starts to slow down after August break,” potentially affecting the plant’s output of blooms, billets, ingots, rolled products, and forged products destined for the automotive, building, energy, and transport sectors.

The observed decrease in activity at Riva Acciaio Lesegno, coupled with the overall market sentiment reflected in “Italian roll market starts to slow down after August break,” suggests potential supply disruptions for rolled steel products, particularly those used in building and infrastructure. Given the uncertainty surrounding CBAM and the anticipation of higher prices, steel buyers should:

- Prioritize securing supply contracts for Q4 2025 with Riva Acciaio Lesegno if they rely on their products, but carefully negotiate prices considering the plant’s reduced activity.

- Closely monitor CBAM developments and factor potential premium costs into procurement strategies, as highlighted in “The European market for thick-rolled products is in decline; imported material is offered at a CBAM premium.”

- Evaluate alternative sourcing options from regions less affected by CBAM if cost becomes a significant factor, keeping in mind potential supply chain disruptions.

- Closely follow the steel prices developments given the market uncertainty reported in “European HRC prices have decreased slightly; the direction of market development is unclear.” and adjust procurment strategies accordingly.