From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineEurope Steel Market: Weak Demand Drives Price Declines & Production Cuts

In Europe, weak demand is driving down rebar prices, particularly in Poland and Romania, as reflected in the news articles “Polish rebar prices drop further on muted demand” and “Prices for Polish rebar continue to decline due to weak demand“. These declines may lead to further price fluctuations. While domestic prices remain stable in Romania according to “Romanian longs prices stable, import negotiations with Turkey continue“, import negotiations are ongoing, suggesting potential price adjustments.

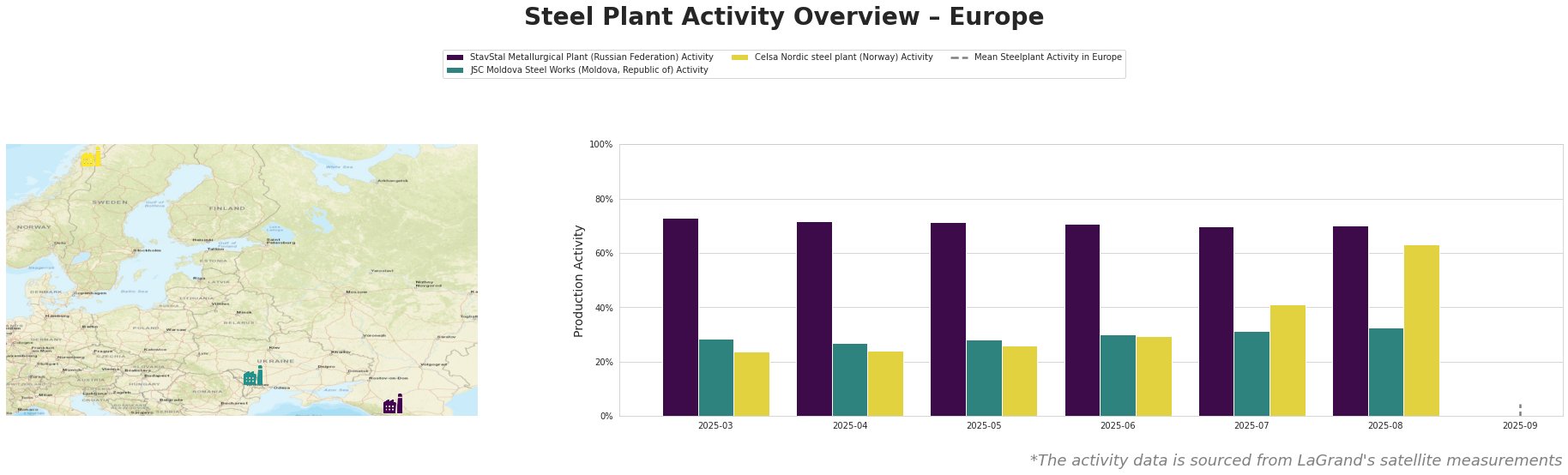

Satellite data reveals varying activity trends across European steel plants. StavStal Metallurgical Plant, a Russian EAF-based producer focusing on rebar and wire rod, shows a gradual activity decline from 73% in March to 70% in August. No explicit connection to the provided news articles could be established.

JSC Moldova Steel Works, a Moldovan EAF-based producer of wire rod, rebar, and billet, exhibited a steady increase in activity from 29% in March to 33% in August. No explicit connection to the provided news articles could be established.

Celsa Nordic steel plant, a Norwegian EAF-based producer focused on rebar and wire rod for the building and infrastructure sectors, has significantly increased activity from 24% in March to 63% in August. No explicit connection to the provided news articles could be established.

The Mean Steelplant Activity in Europe demonstrates high fluctuation from March to August, with an abrupt and sharp spike in September. No correlation could be made to any provided news sources.

The Polish market’s weak demand, as highlighted in “Polish rebar prices drop further on muted demand” and “Prices for Polish rebar continue to decline due to weak demand“, has prompted mills to cut production. This localized supply constraint, coupled with stable Romanian prices (Romanian longs prices stable, import negotiations with Turkey continue), suggests potential regional price volatility.

Evaluated Market Implications:

Given the Polish market conditions and the production cuts by mills, steel buyers focusing on rebar in Poland should closely monitor scrap prices in September, as mentioned in “Prices for Polish rebar continue to decline due to weak demand“. Increased scrap prices might provide upward pressure, though any benefit may only be short-lived if overall demand remains muted. Furthermore, with imports from Germany and Ukraine available at competitive prices, Polish buyers could explore these alternatives to mitigate potential domestic supply shortages. Buyers negotiating with Romanian mills should factor in the stable domestic prices but remain aware of ongoing import negotiations, particularly with Turkish mills. Successfully negotiating import deals at prices close to Turkish offers ($530-545/mt FOB) would represent a significant cost advantage.