From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel Market: Production Cuts Loom, Exports Strong Amidst Price Fluctuations

China’s steel sector faces production cuts alongside fluctuating prices, with Baosteel anticipating strong export volumes. According to “China to cut steel production by at least 25 million tons in 2025,” production is set to decrease. The Ministry of Commerce reports price drops in “MOC: Average rebar prices in China down 1.1 percent in August 18-24 2025“, while “China’s steel exports will exceed 100 million tons in 2025 – Baosteel” forecasts robust export activity. Direct correlation of these factors with observed plant activity is not immediately evident from available data.

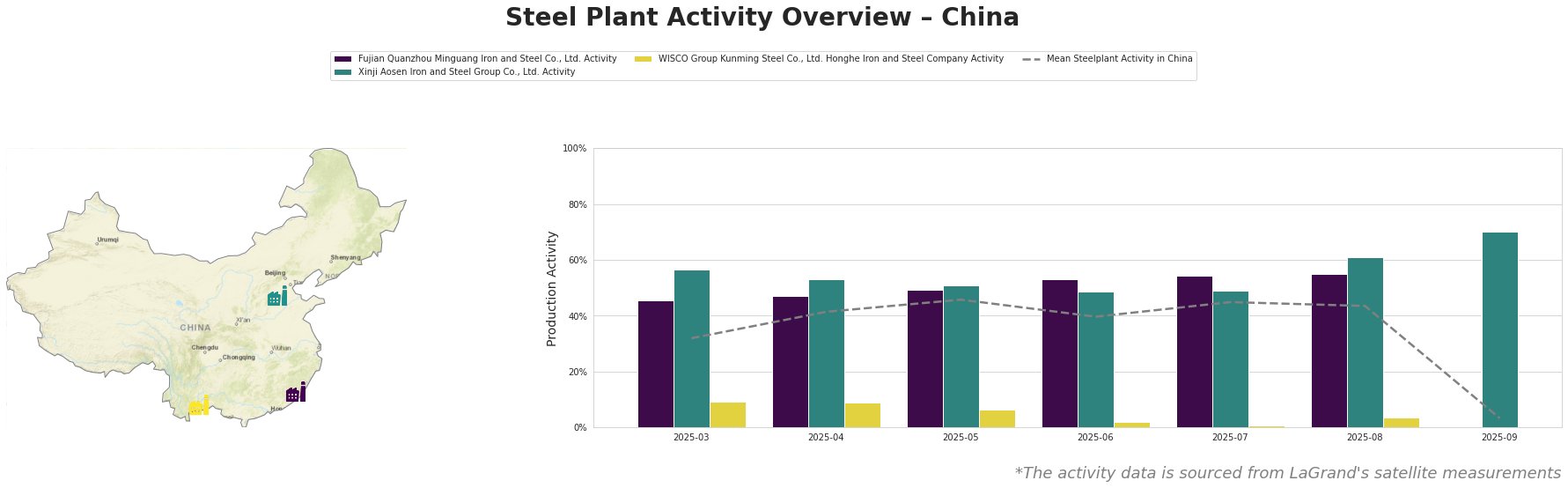

The mean steel plant activity in China has fluctuated throughout the observed period, with a peak in May (46%) and a drastic drop in September (3%). Fujian Quanzhou Minguang Iron and Steel Co., Ltd. consistently operated above the national average, peaking in August (55%) before activity levels are unavailable in September. Xinji Aosen Iron and Steel Group Co., Ltd. similarly shows high activity, reaching 70% in September, which is significantly above the average. WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company shows significantly lower activity than the mean, dropping to 1% in July and rising to 4% in August, and with data missing for September. The decline in the mean steel plant activity in China in September is significant.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., located in Fujian, utilizes integrated BF production with a crude steel capacity of 2550 thousand tonnes per annum (ttpa) and focuses on finished rolled products like rebar and wire rod. The satellite data shows a consistent operation above national average for the months where data is available, possibly indicating the plant is resistant to short-term dips in domestic pricing detailed in “MOC: Average rebar prices in China down 1.1 percent in August 18-24 2025.” The data is missing for September, thus no conclusion about alignment with the broader reduction from the article “China to cut steel production by at least 25 million tons in 2025” can be made.

Xinji Aosen Iron and Steel Group Co., Ltd., situated in Hebei, has an integrated BF production route and a higher crude steel capacity of 3600 ttpa. It produces both semi-finished (billets, slabs) and finished rolled products (wire rods, hot-rolled strip). While the observed data indicates high operational activity, with a noticeable increase to 70% in September, a connection to any specific news is not clearly established.

WISCO Group Kunming Steel Co., Ltd. Honghe Iron and Steel Company, based in Yunnan, also uses the integrated BF production method, but has a lower crude steel capacity of 1150 ttpa. Its product range is diverse, including bars, wire, and various sheet products. The observed consistently low activity, dropping as low as 1% in July, coupled with its comparatively low production volume makes it a possible candidate for reduction in line with “China to cut steel production by at least 25 million tons in 2025”, although a direct connection cannot be confirmed.

The announced production cuts outlined in “China to cut steel production by at least 25 million tons in 2025”, combined with the PMI contraction reported in “China’s steel sector PMI declines to 49.8 percent in August 2025,” suggest potential supply-side constraints despite Baosteel’s export optimism, as detailed in “China’s steel exports will exceed 100 million tons in 2025 – Baosteel”.

Given the scheduled production cuts, procurement professionals should:

- Prioritize securing long-term contracts with suppliers, particularly those like Fujian Quanzhou Minguang Iron and Steel Co., Ltd., currently operating at high capacity, to mitigate potential supply disruptions.

- Closely monitor export trends and inventory levels, especially for products produced by companies like Xinji Aosen Iron and Steel Group Co., Ltd, to anticipate availability for domestic consumption.

- Factor in rising raw material costs, as mentioned in “China’s steel sector PMI declines to 49.8 percent in August 2025,” when negotiating contracts, as this will likely impact finished steel prices.