From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsia Steel Market Optimism: Production Cuts Balanced by Export Growth, China’s PMI Declines

Asia’s steel market presents a complex but overall positive outlook. Production cuts in China, driven by government initiatives detailed in “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” and “China to cut steel production by at least 25 million tons in 2025,” aim to stabilize the sector. While these cuts are expected, the simultaneous forecast of strong exports, highlighted in “China’s steel exports will exceed 100 million tons in 2025 – Baosteel,” suggests continued availability on the global market. These developments, however, appear decoupled from short-term price fluctuations, with “MOC: Average rebar prices in China down 1.1 percent in August 18-24 2025,” indicating recent price softening, while “China’s steel sector PMI declines to 49.8 percent in August 2025,” highlighting sector contraction. The overall long-term picture suggests shifts in regional and global dominance, as “China faces 350 Mt of excess capacity by 2050, says Wood Mackenzie,” which also indicates a move towards India and Southeast Asia for consumption.

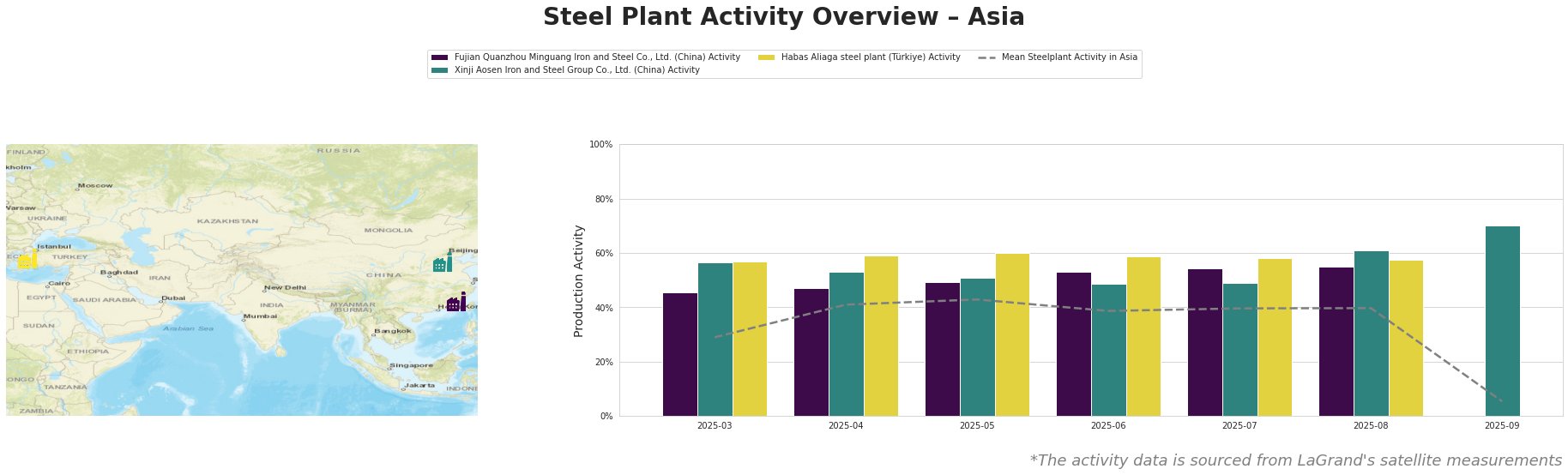

The mean steel plant activity in Asia shows a marked decline in September 2025, plummeting to 5.0% after a period of relative stability around 40% from June to August. Individual plant activities vary significantly. Fujian Quanzhou Minguang Iron and Steel Co., Ltd. demonstrates a consistent upward trend from March (46.0%) to August (55.0%). Xinji Aosen Iron and Steel Group Co., Ltd. fluctuates, reaching a high of 70.0% in September, while Habas Aliaga steel plant shows relative stability around 57-60% before data unavailability for September. The September decline in average activity cannot be directly linked to any of the provided news articles, but may be due to seasonality as suggested in “China’s steel sector PMI declines to 49.8 percent in August 2025“.

Fujian Quanzhou Minguang Iron and Steel Co., Ltd., an integrated BF-BOF producer in Fujian, China, has a crude steel capacity of 2.55 million tonnes annually, producing finished rolled products like rebar and wire rod. Its observed activity steadily increased from 46% in March to 55% in August. While this activity trend does not directly contradict the broader production cuts discussed in “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” and “China to cut steel production by at least 25 million tons in 2025“, it suggests this specific plant may not yet be affected, or is ramping up production before potential future cuts.

Xinji Aosen Iron and Steel Group Co., Ltd., another integrated BF-BOF producer located in Hebei, China, boasts a higher crude steel capacity of 3.6 million tonnes per year, specializing in semi-finished and finished rolled products. Satellite data reveals a fluctuating activity pattern, culminating in a high of 70.0% in September. This increase seems to contradict the anticipated production cuts outlined in “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” and “China to cut steel production by at least 25 million tons in 2025“. There is no direct evidence to say this plant will be affected by the production cuts.

Habas Aliaga steel plant, an EAF-based steel producer in İzmir, Türkiye, has a crude steel capacity of 4.5 million tonnes per year, focusing on billets, slabs, and long products. The plant maintained a relatively stable activity level between 57% and 60% from March to August. Given its location outside of China and its EAF production route, there’s no direct connection between the plant’s activity and the Chinese production reduction measures outlined in “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” and “China to cut steel production by at least 25 million tons in 2025.”

The planned production cuts in China, detailed in “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” and “China to cut steel production by at least 25 million tons in 2025,” coupled with Baosteel’s projection of sustained high export volumes in “China’s steel exports will exceed 100 million tons in 2025 – Baosteel,” could lead to localized supply constraints within China but ample supply on the export market. Steel buyers should:

- Monitor Chinese domestic prices closely: The potential for localized shortages within China could create upward price pressure, even with the expected export volumes. Given the recent price decreases reported in “MOC: Average rebar prices in China down 1.1 percent in August 18-24 2025,” buyers have an opportunity to procure at potentially lower prices in the short term, but must be aware of potential price rises.

- Diversify sourcing: Given the shift in global demand highlighted in “China faces 350 Mt of excess capacity by 2050, says Wood Mackenzie,” procurement professionals need to expand towards India and Southeast Asia to secure better value.