From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineChina Steel: Production Cuts & Export Surge Drive Positive Outlook Despite PMI Dip

China’s steel market presents a mixed but overall positive picture driven by planned production cuts and strong export forecasts, tempered by a slight contraction in PMI.

The initiatives towards supply-side reform, evident in the planned reduction in crude steel output, are reflected in two news articles: “China issues work plan for steel industry, over 25 million mt output cut expected in 2025” and “China to cut steel production by at least 25 million tons in 2025“. These plans aim to reduce output to below 980 million tons in 2025. While the news articles indicate planned production cuts, a direct correlation to specific satellite-observed plant activity changes cannot be definitively established from the provided data alone.

Here’s a breakdown of recent activity:

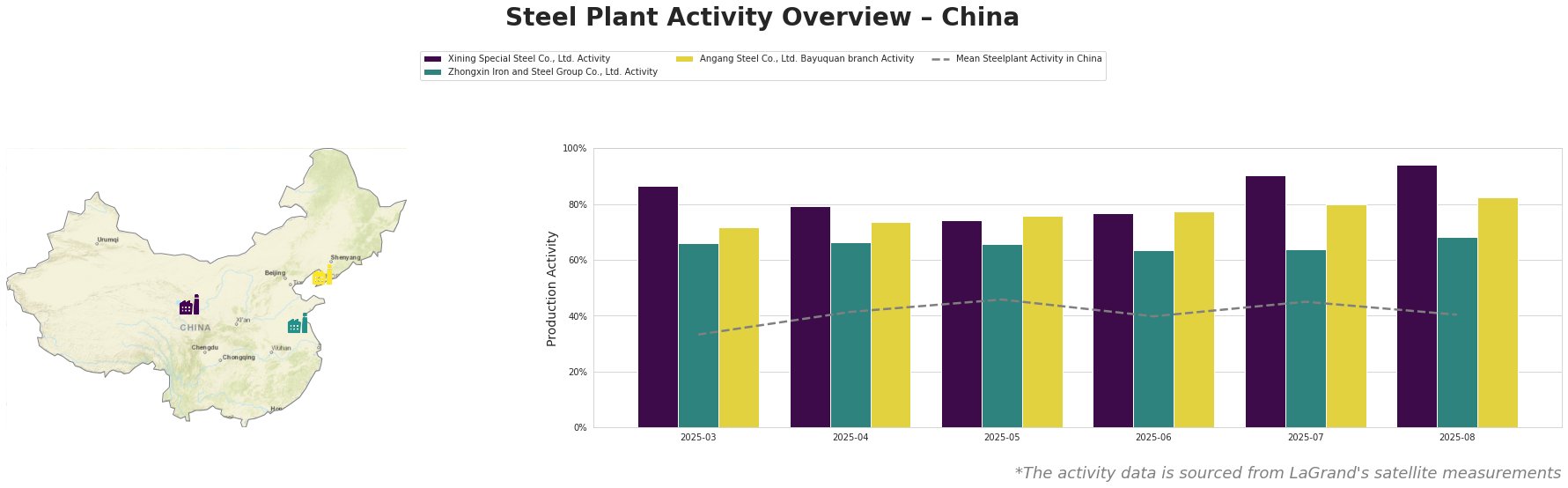

The mean steel plant activity in China shows fluctuating activity, peaking at 46% in May and dropping to 40% in August. Xining Special Steel Co., Ltd. consistently operates at significantly higher activity levels than the mean, reaching 94% in August. Zhongxin Iron and Steel Group Co., Ltd. exhibits relatively stable activity around the mid-60% range, with a slight increase to 68% in August. Angang Steel Co., Ltd. Bayuquan branch shows consistently high activity, reaching 82% in August.

Xining Special Steel Co., Ltd., an integrated steel plant in Qinghai with a crude steel capacity of 2000ktpa, produces specialized steel products including automotive, bearing, and stainless steel. Observed activity for Xining Special Steel Co., Ltd. is consistently elevated compared to the national average, peaking at 94% in August. No direct link between this increased activity and the production cut announcements could be established from the given news.

Zhongxin Iron and Steel Group Co., Ltd., located in Jiangsu, boasts a crude steel capacity of 5700ktpa utilizing BF-BOF processes. Its primary products include steel billets and hot-rolled steel. Activity at Zhongxin Iron and Steel Group Co., Ltd. is stable, hovering around 65%, and remains below the activity levels of both Xining and Angang. No direct relationship to any of the provided news articles could be established from observed activity.

Angang Steel Co., Ltd. Bayuquan branch, situated in Liaoning, features a 6500ktpa crude steel capacity focused on finished rolled products, including container steel and ship plate. This plant shows high activity levels, with a notable increase to 82% in August. No direct link between this increased activity and the production cut announcements could be established from the given news.

Despite the planned production cuts, “China’s steel exports will exceed 100 million tons in 2025 – Baosteel” highlights strong export expectations, with Baosteel aiming to increase its own exports significantly. However, “China’s steel sector PMI declines to 49.8 percent in August 2025” indicates a contraction, with declining new orders and production, but rising raw material prices.

Evaluated Market Implications:

While planned production cuts could potentially lead to supply constraints, particularly if facilities like Xining Special Steel do not adjust their production levels, the expectation of strong exports suggests that domestic shortages might be mitigated. However, the PMI contraction and rising raw material prices could squeeze profit margins for producers.

Recommended Procurement Actions:

- Monitor export trends closely: Given Baosteel’s bullish export forecast, buyers should monitor actual export volumes to assess the impact on domestic availability.

- Negotiate contracts proactively: With rising raw material prices and potential supply-side constraints, buyers should secure contracts early, focusing on price hedging strategies.

- Evaluate alternative suppliers: If specific regions or plants experience significant production cuts, buyers should diversify their supplier base to mitigate risks.