From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineMarcegaglia’s Expansion Drives Optimistic European Steel Outlook Despite Ukrainian Production Challenges

Europe’s steel market shows a very positive outlook driven by significant investments in new production capacity. The news articles “Danieli to Deliver Hot-Rolled Coil Mini-Mill Project for Marcegaglia“, “Marcegaglia moves to the engineering phase of construction of its plant in Fos-sur-Mer“, “Marcegaglia awards Danieli contract for new Fos-sur-Mer mill“, “Marcegaglia signs a contract with Danieli for the construction of a new mill in Foz-sur-Mer“, “Marcegaglia selects Danieli for new project” and “Italy’s Marcegaglia partners with Danieli to build mini-mill in France” detail Marcegaglia’s ambitious plans for a new mini-mill in Fos-sur-Mer, France. These investments suggest increased future supply and a strong commitment to the European steel market. However, while no direct relationship can be explicitly established with the news articles provided, activity at the Metinvest Zaporizhstal steel plant in Ukraine remained significantly below average.

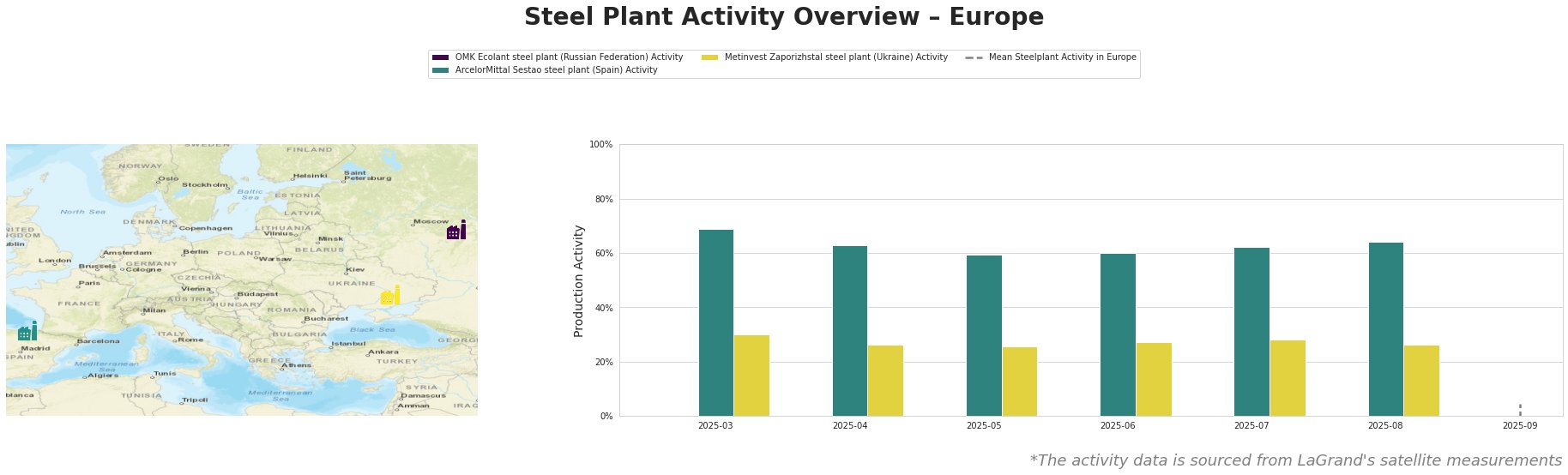

Measured Activity Overview

The mean steel plant activity in Europe is highly erratic. Activity at ArcelorMittal Sestao gradually decreased from 69% in March to 59% in May, followed by a recovery to 64% in August. Activity at the Metinvest Zaporizhstal steel plant in Ukraine remained consistently low, fluctuating between 25% and 30% throughout the observed period. The activity level of the OMK Ecolant steel plant remained constant at a very low level.

Plant Information:

OMK Ecolant steel plant: Located in Nizhny Novgorod, Russia, this plant has a crude steel capacity of 1.8 million tonnes per annum (mtpa) via EAF and an iron capacity of 2.5 mtpa via DRI. It focuses on semi-finished products like slabs and round billets for the building, energy, and transport sectors. The plant employs DRI and EAF technologies, including a Danieli DRI unit based on ENERGIRON technology. The activity level of OMK Ecolant remained extremely low, but no direct connection to the provided news articles can be established.

ArcelorMittal Sestao steel plant: Situated in Biscay, Spain, this electric arc furnace (EAF) plant boasts a crude steel capacity of 2 mtpa. It produces hot-rolled coils for the automotive and construction industries, utilizing 100% renewable energy and sourcing DRI from ArcelorMittal Asturias. The plant’s activity fluctuated, declining from 69% in March 2025 to 59% in May 2025 before recovering to 64% in August 2025. The fluctuation does not appear to be directly related to the news articles provided.

Metinvest Zaporizhstal steel plant: Based in Zaporizhzhia, Ukraine, this integrated BF-OHF plant has a crude steel capacity of 4.1 mtpa and an iron capacity of 4.359 mtpa. Its product range includes hot-rolled and cold-rolled sheets and coils for the automotive, steel packaging, and transport sectors. The plant uses BF and OHF technologies. The plant’s activity remained very low, consistently ranging from 25% to 30%. No explicit connection to the news articles provided can be established for this low activity.

Evaluated Market Implications:

Marcegaglia’s investment in the new Fos-sur-Mer mill, as reported in “Danieli to Deliver Hot-Rolled Coil Mini-Mill Project for Marcegaglia“, “Marcegaglia moves to the engineering phase of construction of its plant in Fos-sur-Mer“, “Marcegaglia awards Danieli contract for new Fos-sur-Mer mill“, “Marcegaglia signs a contract with Danieli for the construction of a new mill in Foz-sur-Mer“, “Marcegaglia selects Danieli for new project” and “Italy’s Marcegaglia partners with Danieli to build mini-mill in France“, signals increased future HRC supply in Europe, particularly for stainless and carbon steel. The expected start of production in mid-2028 provides a long-term positive outlook.

However, persistently low activity at the Metinvest Zaporizhstal plant in Ukraine suggests a potential ongoing disruption in supply from this region.

Recommended Procurement Actions:

-

For steel buyers focused on long-term procurement (2028 onwards): Consider establishing relationships with Marcegaglia to secure future HRC supply from the Fos-sur-Mer mill, leveraging its planned capacity of 2.1 million tons annually.

-

For steel buyers currently sourcing from Eastern Europe, particularly Ukraine: Diversify supply chains to mitigate risks associated with the consistently low activity at the Metinvest Zaporizhstal plant. Explore alternative suppliers within Europe to ensure a stable supply of hot-rolled and cold-rolled sheets and coils.