From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Navigates Trade Uncertainty: Activity Varies Amidst Global Pressures

In Asia, steel production faces a complex landscape of fluctuating activity amidst global trade pressures. The news article “VDMA calls on Commission to secure relief from US Tariffs on Steel and Aluminum,” while focused on Europe, highlights the broader impact of tariffs on global steel markets, creating uncertainty that indirectly affects Asian producers. The impact is complex as there may be less demand overall. While the news articles do not explicitly discuss the Asian steel market, they point to protectionist tensions that could create headwinds for steel producers in Asia. There is no observable evidence in the provided satellite data of a direct and imediate impact of this.

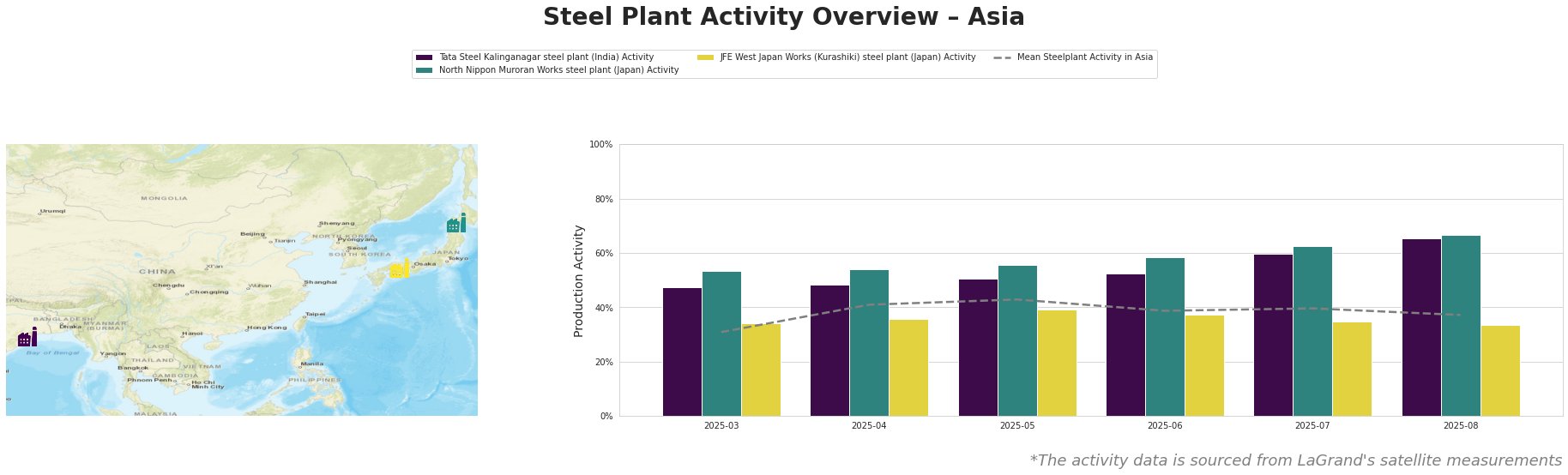

Observed steel plant activity across Asia shows diverse trends.

The mean steel plant activity in Asia fluctuated, peaking in May at 43% and then declining to 37% in August. Tata Steel Kalinganagar in India showed a consistent upward trend, reaching 65% activity in August, significantly above the Asian average. North Nippon Muroran Works in Japan also demonstrated increasing activity, reaching 67% in August, exceeding the regional mean. Conversely, JFE West Japan Works (Kurashiki) exhibited lower activity levels, peaking at 39% in May and falling to 33% in August, below the Asian average. There is no direct connection to be established between the individual plant development based on the provided news articles.

Tata Steel Kalinganagar is an integrated steel plant in Odisha, India, with a crude steel capacity of 3000 thousand tonnes per annum (ttpa) using blast furnace-basic oxygen furnace (BF-BOF) technology. The observed increase in activity to 65% by August suggests robust domestic demand or successful export strategies. No connection between the news articles and the plant´s activity could be established.

North Nippon Muroran Works in Hokkaidō, Japan, has a crude steel capacity of 2598 ttpa, utilizing both BF-BOF and electric arc furnace (EAF) processes. The rise in activity to 67% in August indicates strong performance. The plant’s ability to generate its own power may provide some resilience against fluctuating energy costs, but no direct causal link to the European news articles can be inferred.

JFE West Japan Works (Kurashiki) in Chūgoku, Japan, a major integrated steel plant with 10000 ttpa crude steel capacity, experienced a decrease in activity, settling at 33% in August. This plant produces a wide range of products, including sheets, plates, and pipes, serving diverse sectors like automotive and construction. There is no direct connection to be established between the JFE West Japan Works´ development and the provided news articles.

The provided news articles do not establish a direct connection to the activity levels of specific Asian steel plants. However, the general uncertainty surrounding global steel trade highlighted in “VDMA calls on Commission to secure relief from US Tariffs on Steel and Aluminum” could indirectly impact market sentiment and procurement strategies.

Evaluated Market Implications:

- While specific supply disruptions in Asia cannot be directly tied to the news articles or plant activities, buyers should be aware of potential indirect effects of global trade tensions on the Asian steel market.

-

Recommended Procurement Actions:

- Monitor Price Volatility: Closely track price fluctuations for steel products, particularly those affected by potential tariffs or trade restrictions.

- Diversify Supply Sources: Explore alternative suppliers within Asia to mitigate risks associated with potential disruptions at any single plant.

- Strengthen Supplier Relationships: Communicate closely with key suppliers to understand their production plans and potential challenges in the current market environment. This is especially relevant for buyers relying on JFE West Japan Works, given its lower activity levels, to ensure continuity of supply.

- Review Inventory Levels: Evaluate current inventory levels and adjust as needed based on risk tolerance and anticipated market conditions.