From the Field to the Dashboard – Built by Experts, for Experts.

Discover What's Really Happening in the Steel Industry

Use the AI-powered search engine to analyze production activity, market trends, and news faster than ever before.

Try the Free AI Search EngineAsian Steel Market Soars on DRI Production; India Leads the Charge

Asia’s steel market demonstrates strong growth driven by increasing Direct Reduced Iron (DRI) production, particularly in India. This trend is supported by the news articles “Report: Worldwide DRI Production Sets New Record” and “Global DRI output up nine percent in July 2025,” which highlight India’s significant contribution to global DRI production. The satellite-observed data, detailed below, provides further insights into the activity levels of key steel plants in the region.

Measured Activity Overview

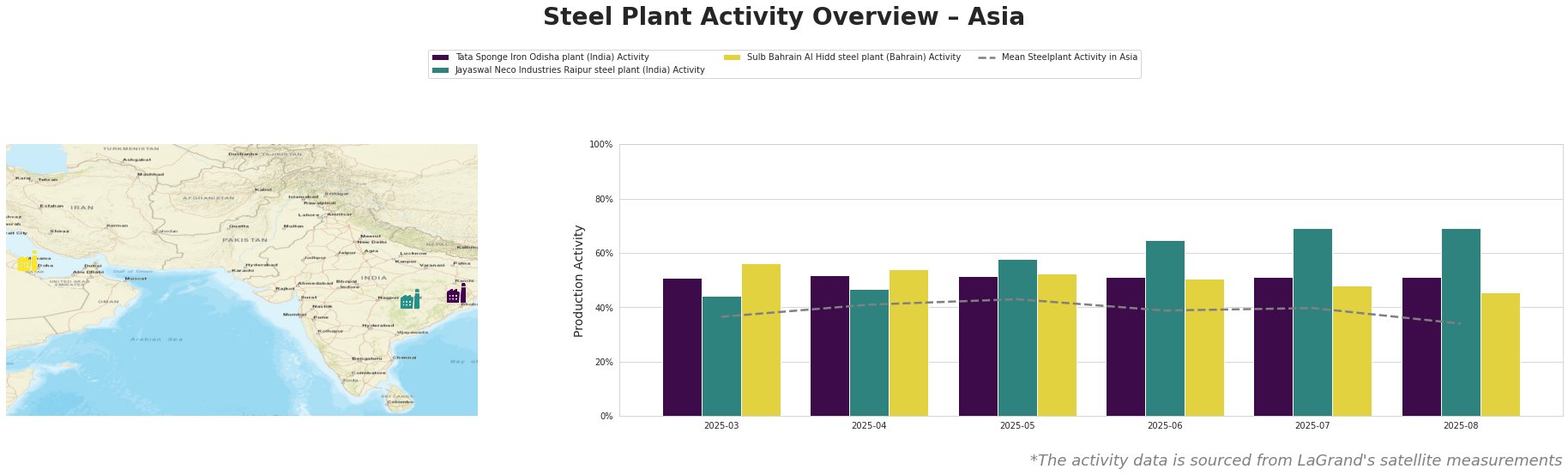

The mean steel plant activity in Asia fluctuated between 34.0% and 43.0% during the observed period, ending at 34.0% in August. The Jayaswal Neco Industries Raipur steel plant shows a consistent increase in activity, peaking at 69.0% in July and August, significantly above the Asian average. The Tata Sponge Iron Odisha plant maintains a stable activity level around 51.0%. The Sulb Bahrain Al Hidd steel plant shows a gradual decline from 56.0% in March to 46.0% in August.

Tata Sponge Iron Odisha plant, located in Odisha, India, operates a 400,000 metric ton per annum (TPA) DRI plant. Activity at this plant has remained stable at approximately 51.0% throughout the observed period. Given the news article “Report: Worldwide DRI Production Sets New Record” reports India’s increasing DRI production capacity, it would be expected to see increased activity levels for this plant. No direct connection can be established between the stable activity level of 51% and reported market dynamics.

Jayaswal Neco Industries Raipur steel plant, situated in Chhattisgarh, India, is an integrated steel plant with a DRI capacity of 270,000 TPA alongside BF and EAF production. Its activity level increased significantly from 44.0% in March to a high of 69.0% in July and August. This aligns with the “Report: Worldwide DRI Production Sets New Record” and “Global DRI output up nine percent in July 2025” articles emphasizing India’s rapidly expanding DRI production.

Sulb Bahrain Al Hidd steel plant in Bahrain, equipped with a 1.6 million TPA Midrex DRI plant and EAF steelmaking, experienced a decrease in activity from 56.0% in March to 46.0% in August. While no explicit news articles directly address factors affecting Bahrain’s DRI output, the overall stable global DRI trade flows mentioned in “Global DRI trade to remain stable in 2025 despite tariffs and sanctions” suggest that this activity decrease may be related to regional market dynamics or plant-specific maintenance, for which no direct connection to reported news can be established.

Evaluated Market Implications:

Based on the news articles and satellite data, the following supply chain implications and recommendations are made:

- Supply Disruptions: The overall market sentiment is very positive, but the observed decline in activity at Sulb Bahrain Al Hidd plant (Bahrain) from 56.0% to 46.0% could suggest potential localized supply constraints in the Middle East.

- Procurement Actions:

- Steel buyers sourcing DRI or DRI-derived steel products in the Middle East should monitor Sulb Bahrain Al Hidd’s production trends closely. Consider diversifying suppliers to mitigate potential disruptions linked to the plant’s decreased activity.

- Given the strong growth in Indian DRI production, as highlighted in the “Report: Worldwide DRI Production Sets New Record” and corroborated by the increasing activity at Jayaswal Neco Industries Raipur steel plant (India), explore opportunities to secure DRI supply from Indian producers.

- Market analysts should further investigate the factors influencing the activity decline at the Sulb Bahrain Al Hidd plant, to determine the root cause of this anomaly. This could be related to changes in input costs, market demand, or plant-specific operational challenges.